Salesforce.com 2016 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2016 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

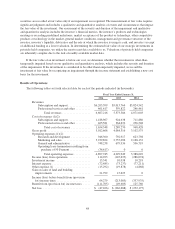

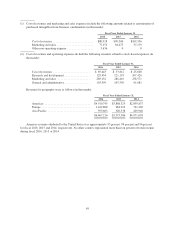

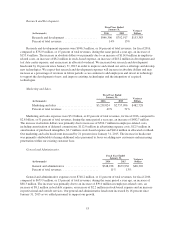

Other expense.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2016 2015

Other expense .................................. $(15,292) $(19,878) $4,586

Other expense primarily consists of non-operating costs such as strategic investments fair market

adjustments, foreign exchange rate fluctuations, real estate transactions and losses on derecognition of debt. The

decrease in other expense for fiscal 2016 was primarily due to losses totaling $ 10.3 million related to the

extinguishment of the 0.75% Senior Notes converted by noteholders in fiscal 2015.

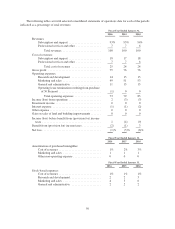

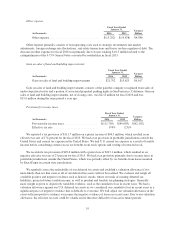

Gain on sales of land and building improvements.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2016 2015

Gain on sales of land and building improvements ....... $21,792 $15,625 $6,167

Gain on sales of land and building improvements consists of the gain the company recognized from sales of

undeveloped real estate and a portion of associated perpetual parking rights in San Francisco, California. Gain on

sales of land and building improvements, net of closing costs, was $21.8 million for fiscal 2016 and was

$15.6 million during the same period a year ago.

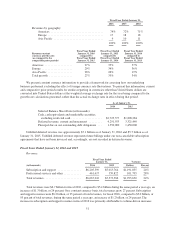

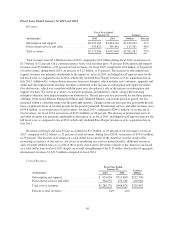

Provision for income taxes.

Fiscal Year Ended

January 31, Variance

Dollars(in thousands) 2016 2015

Provision for income taxes ...................... $(111,705) $(49,603) $(62,102)

Effective tax rate ............................. 174% (23)%

We reported a tax provision of $111.7 million on a pretax income of $64.3 million, which resulted in an

effective tax rate of 174 percent for the fiscal 2016. We had a tax provision in profitable jurisdictions outside the

United States and current tax expense in the United States. We had U.S. current tax expense as a result of taxable

income before considering certain excess tax benefits from stock options and vesting of restricted stock.

We recorded a tax provision of $49.6 million with a pretax loss of $213.1 million, which resulted in an

negative effective tax rate of 23 percent for fiscal 2015. We had a tax provision primarily due to income taxes in

profitable jurisdictions outside the United States, which was partially offset by tax benefits from losses incurred

by ExactTarget in certain state jurisdictions.

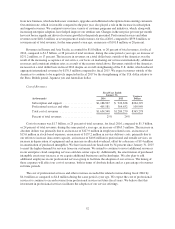

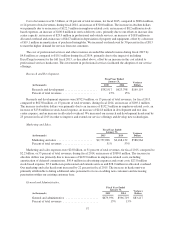

We regularly assess the realizability of our deferred tax assets and establish a valuation allowance if it is

more-likely-than-not that some or all of our deferred tax assets will not be realized. We evaluate and weigh all

available positive and negative evidence such as historic results, future reversals of existing deferred tax

liabilities, projected future taxable income, as well as prudent and feasible tax-planning strategies. Generally,

more weight is given to objectively verifiable evidence, such as the cumulative loss in recent years. We had a

valuation allowance against our U.S. deferred tax assets as we considered our cumulative loss in recent years as a

significant piece of negative evidence that is difficult to overcome. We will adjust our valuation allowance in the

event sufficient positive evidence overcomes the negative evidence of losses in recent years. Due to our valuation

allowance, the effective tax rate could be volatile and is therefore difficult to forecast in future periods.

55