Safeway 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

60

example ownership of assets, environmental or tax indemnifications) or personal injury matters. The terms of these

indemnifications range in duration and may not be explicitly defined. Historically, Safeway has not made significant

payments for these indemnifications. The Company believes that if it were to incur a loss in any of these matters, the loss

would not have a material effect on the Company’s financial condition or results of operations.

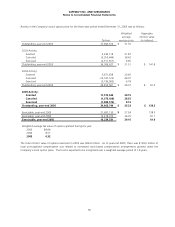

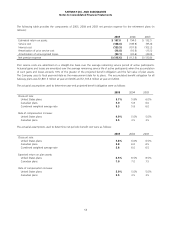

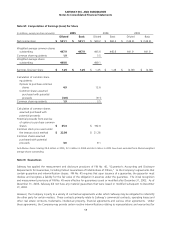

Note O: Quarterly Information (Unaudited)

The summarized quarterly financial data presented below reflect all adjustments, which in the opinion of management, are

of a normal and recurring nature necessary to present fairly the results of operations for the periods presented. (Rounding

affects some totals. In millions, except per-share amounts.)

52 Weeks

Last 16

Weeks (1)

Third 12

Weeks (2)

Second 12

Weeks

First 12

Weeks

2005

Sales and other revenue $ 38,416.0 $ 12,046.1 $ 8,945.5 $ 8,803.0 $ 8,621.4

Gross profit 11,112.9 3,506.9 2,556.6 2,529.9 2,519.5

Operating profit 1,214.7 377.2 239.7 302.4 295.4

Income before income taxes 849.0 268.1 151.9 216.4 212.8

Net income 561.1 173.5 122.5 134.0 131.3

Net income per share − basic $ 1.25 $ 0.39 $ 0.27 $ 0.30 $ 0.29

Net income per share − diluted 1.25 0.39 0.27 0.30 0.29

52 Weeks

Last 16

Weeks (3)

Third 12

Weeks (4)

Second 12

Weeks (5)

First 12

Weeks (6)

2004

Sales and other revenue $ 35,822.9 $ 11,390.4 $ 8,343.2 $ 8,406.5 $ 7,682.7

Gross profit 10,595.3 3,356.7 2,466.0 2,451.7 2,321.0

Operating profit 1,172.8 406.2 294.5 317.0 155.2

Income before income taxes 793.9 303.9 201.7 226.2 62.1

Net income 560.2 202.7 159.2 155.2 43.1

Net income per share − basic $ 1.26 $ 0.45 $ 0.36 $ 0.35 $ 0.10

Net income per share − diluted 1.25 0.45 0.35 0.35 0.10

(1) Net income for the last 16 weeks of 2005 includes an estimated $34.1 million after-tax charge related to closing 26 under-performing

Texas stores and a $23.0 million after-tax charge for an employee buyout in Dominick’s and Northern California.

(2) Net income for the third 12 weeks of 2005 includes a $33.9 million after-tax impairment charge relating to 26 under-performing Texas

stores closed in the fourth quarter of 2005, and a $13.6 million after-tax charge for an employee buyout in Northern California.

(3) Net income for the last 16 weeks of 2004 includes an estimated $37.0 million after-tax impact of the Southern California strike and

$6.5 million after-tax for an accrual for rent holidays.

(4) Net income for the third 12 weeks of 2004 includes an estimated $45.0 million after-tax impact of the Southern California strike,

partially offset by a tax benefit of $32.4 million arising from the resolution of certain tax issues.

(5) Net income for the second 12 weeks of 2004 includes an estimated $50.0 million after-tax impact of the Southern California strike.

(6) Net income for the first 12 weeks of 2004 includes an estimated $122.0 million after-tax impact of the Southern California strike and a

$28.5 million after-tax charge related to closing 12 under-performing Dominick’s stores.