Safeway 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

24

Liquidity and Financial Resources

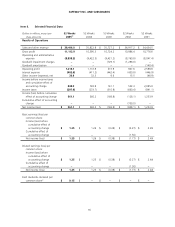

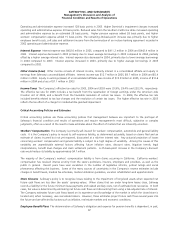

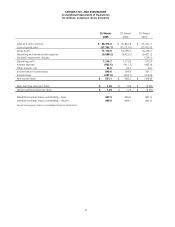

Net cash flow from operating activities was $1,881.0 million in 2005, $2,226.4 million in 2004 and $1,609.6 million in 2003.

Working capital contributed to cash flow in 2005, but at a lower level than in 2004. Net cash flow from operating activities

increased in 2004 largely due to increased net income and changes in working capital. Net cash flow from operating

activities decreased in 2003 primarily due to lower operating results and changes in working capital.

Cash flow used by investing activities was $1,313.5 million in 2005, $1,070.3 million in 2004 and $795.0 million in 2003.

Cash flow used by investing activities increased in 2005 compared to 2004 because of higher capital expenditures and lower

proceeds from the sale of property. Cash flow used by investing activities increased in 2004 compared to 2003 because of

higher capital expenditures.

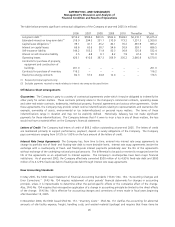

Capital expenditures were gradually scaled back in 2003 as the economy softened and as the Company was developing and

testing what is now the Lifestyle store concept. Capital expenditures increased in 2004 and 2005 as the Company focused

on remodeling its existing stores under its Lifestyle store format. In 2005, the Company opened 21 new Lifestyle stores and

completed 293 Lifestyle store remodels. The Company also completed 22 other remodels. In 2004, Safeway opened 32

new Lifestyle stores, completed 92 Lifestyle remodels and also completed another 23 remodels. In 2003, Safeway opened 40

new stores, one in the Lifestyle store format, and remodeled 75 stores, 19 in the Lifestyle store format. In 2006, Safeway

expects to spend approximately $1.6 billion in cash capital expenditures, open approximately 20 to 25 new Lifestyle stores

and complete approximately 280 Lifestyle remodels.

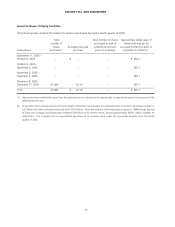

Cash used by financing activities, which consisted principally of cash used to pay down debt, was $466.9 million in 2005,

$1,077.6 million in 2004 and $724.0 million in 2003.

The Company has income tax-related contingencies that may result in significant cash inflows or outflows. Management is

uncertain as to when or in what amounts these matters may be resolved. The Company currently anticipates that it will use

excess cash flows, if any, to repay debt and/or repurchase common stock.

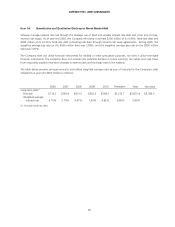

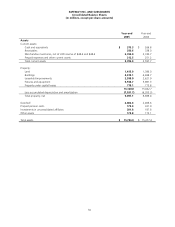

On June 1, 2005, the Company entered into a $1,600.0 million credit agreement (the “Credit Agreement”) with a syndicate

of banks. The Credit Agreement provides (1) to Safeway a $1,350.0 million, five-year, revolving credit facility (the “Domestic

Facility”), (2) to Safeway and Canada Safeway Limited (“CSL”) a Canadian facility of up to $250.0 million for U.S. Dollar and

Canadian Dollar advances and (3) to Safeway a $400.0 million sub-facility of the Domestic Facility for issuance of standby

and commercial letters of credit. The Credit Agreement also provides for an increase in the credit facility commitments up to

an additional $500.0 million, subject to the satisfaction of certain conditions. The restrictive covenants of the Credit

Agreement limit Safeway with respect to, among other things, creating liens upon its assets and disposing of material

amounts of assets other than in the ordinary course of business. The Credit Agreement is scheduled to expire on June 1,

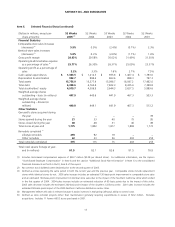

2010; it replaced the former credit agreement that was scheduled to expire in 2006. As of December 31, 2005, outstanding

borrowings and letters of credit were $47.5 million and $38.4 million, respectively, under this agreement. Total unused

borrowing capacity under the Credit Agreement was $1,514.1 million as of December 31, 2005. Additionally, the Company

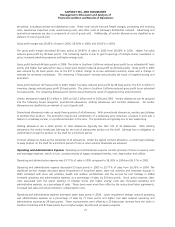

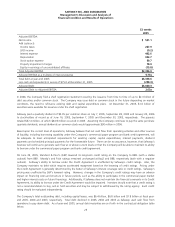

is required to maintain a minimum Adjusted EBITDA, as defined in the Credit Agreement, to interest expense ratio of 2.0 to 1

and not exceed an Adjusted Debt (total consolidated debt less cash and cash equivalents in excess of $75.0 million) to

Adjusted EBITDA ratio of 3.5 to 1. As of December 31, 2005, the Company was in compliance with the covenant

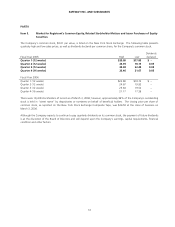

requirements. The computation of Adjusted EBITDA, as defined by the Credit Agreement, is provided below solely to provide

an understanding of the impact that Adjusted EBITDA has on Safeway’s ability to borrow under the bank credit agreement.

Adjusted EBITDA should not be considered as an alternative to net income or cash flow from operating activities (which are

determined in accordance with GAAP) as an indicator of operating performance or a measure of liquidity. Other companies

may define Adjusted EBITDA differently and, as a result, such measures may not be comparable to Safeway’s Adjusted

EBITDA (dollars in millions).