Safeway 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 SAFEWAY INC. 2005 ANNUAL REPORT

To Our Stockholders

During the year our same-store sales grew stronger each

quarter (when adjusting for the Easter calendar shift), we

increased market share in the U.S. supermarket channel

51 of 52 weeks, and we continued to roll out our

highly successful Lifestyle stores through an aggressive

remodeling program. We also finished restructuring our

labor contracts and have begun to experience solid

operating and administrative expense leverage.

Results From Operations

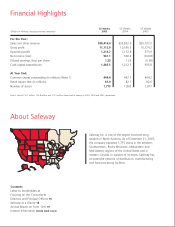

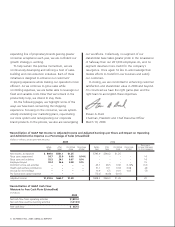

Net income was $561.1 million ($1.25 per diluted

share) in 2005 compared to $560.2 million ($1.25 per

diluted share) in 2004. As indicated in the table at the

bottom of page 4, earnings in 2005 were reduced by

$104.6 million ($0.23 per diluted share) as a result of

the following unusual, after-tax charges:

•Impairment of $33.9 million ($0.08 per diluted

share) for Randall’s, our Texas operation.

•Charges of $34.1 million ($0.07 per diluted share)

related to store exit activities in Texas, when we closed

26 underperforming stores in the Houston, Dallas/Fort

Worth and Austin markets.

•Employee buyouts – primarily in Northern

California and at Dominick’s, our Chicago-area

operation – amounting to $36.6 million ($0.08 per

diluted share).

Excluding these charges, adjusted income in 2005

was $665.7 million ($1.48 per diluted share).1

For 2004, the same table details after-tax charges

and pro forma expense for the following items:

•Charges of $28.5 million ($0.06 per diluted share)

for Dominick’s store exit activities.

•Contributions of $19.1 million ($0.04 per diluted

share) to a Northern California UFCW multi-employer

health and welfare plan.

•Accrual of $6.5 million ($0.01 per undiluted share)

for rent holidays.

•Pro forma stock option expense of $44.8 million

($0.10 per diluted share).

Excluding these items, adjusted income in 2004 was

$569.5 million ($1.26 per diluted share).1

Sales

Total sales rose 7.2% to $38.4 billion in 2005 from

$35.8 billion in 2004, primarily due to consistent

execution of our strategy, ongoing success of our

Lifestyle stores and increased fuel sales. Excluding

strike-affected stores in the first quarter of 2004,

comparable-store sales climbed 4.6%, while identical-

store sales (which do not include replacement stores)

were up 4.4%. Further excluding fuel, comparable-

store sales and identical-store sales increased 3.0% and

2.9%, respectively.

We are gratified by the strong, sequential improve-

ment in our top-line growth trend during 2005.

Excluding fuel and adjusting for the Easter holiday, we

have now posted identical-store sales gains in 10 of the

previous 12 quarters. The trend is broad-based as well;

nine of our 10 operating divisions recorded positive ID

sales in 2005.

Lifestyle Stores

With 458 Lifestyle stores in operation as of year-end

2005, they accounted for 26% of our total store base.

These stores contributed significantly to sales growth

throughout the year, and their operating performance

and return on invested capital continue to exceed

expectations.

To help ensure a successful launch and sustain

performance well beyond the opening, we provide

After weathering three difficult years and retooling our strategy, we

rebounded dramatically in 2005 and set the stage for further progress in

2006 and beyond.