Safeway 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

53

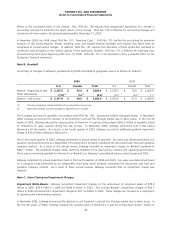

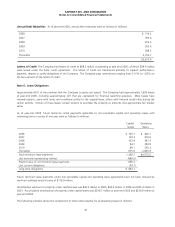

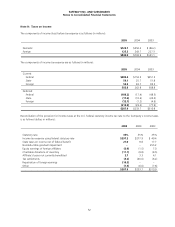

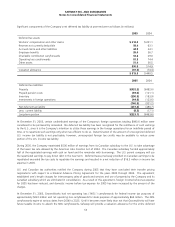

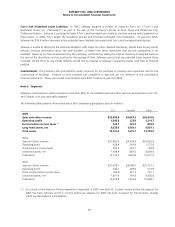

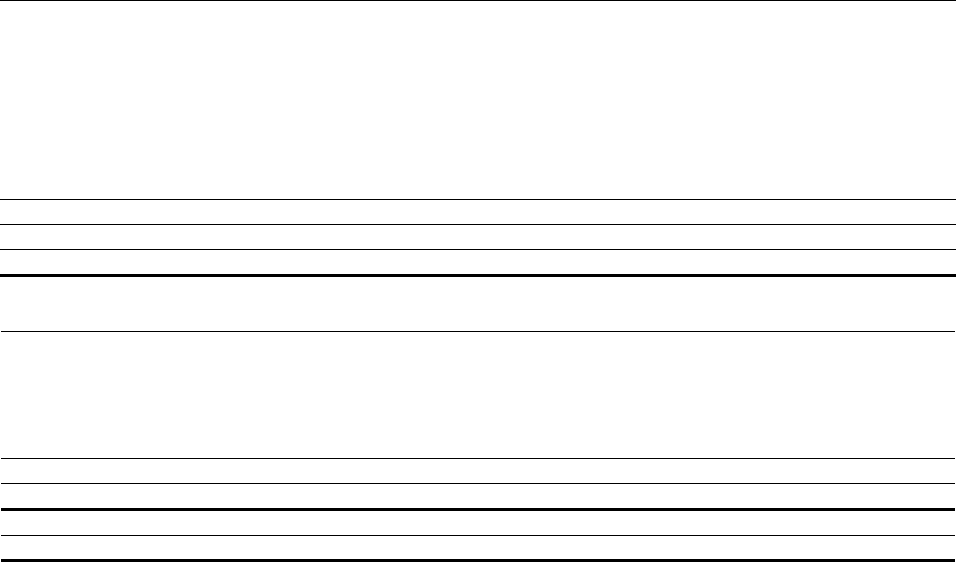

Significant components of the Company's net deferred tax liability at year-end were as follows (in millions):

2005 2004

Deferred tax assets:

Workers’ compensation and other claims $ 212.6 $ 201.1

Reserves not currently deductible 58.4 63.1

Accrued claims and other liabilities 44.9 34.1

Employee benefits 95.4 56.7

Charitable contribution carryforwards 52.8 29.0

Operating loss carryforwards 81.3 74.4

Other assets 51.4 56.5

596.8 514.9

Valuation allowance (81.3) (74.4)

$ 515.5 $ 440.5

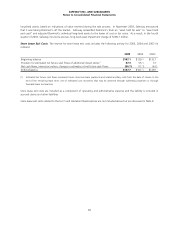

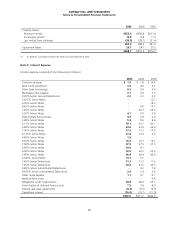

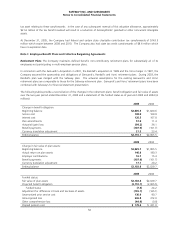

2005 2004

Deferred tax liabilities:

Property $(432.2) $(482.6)

Prepaid pension costs (69.0) (121.1)

Inventory (200.9) (193.9)

Investments in foreign operations (44.8) (123.6)

(746.9) (921.2)

Net deferred tax liability (231.4) (480.7)

Less: current liability (8.3) (17.1)

Long-term portion $(223.1) $(463.6)

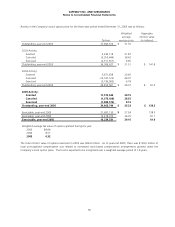

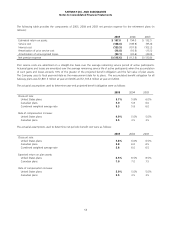

At December 31, 2005, certain undistributed earnings of the Company's foreign operations totaling $940.6 million were

considered to be permanently reinvested. No deferred tax liability has been recognized for the remittance of such earnings

to the U.S., since it is the Company's intention to utilize those earnings in the foreign operations for an indefinite period of

time, or to repatriate such earnings only when tax efficient to do so. Determination of the amount of unrecognized deferred

U.S. income tax liability is not practicable; however, unrecognized foreign tax credits may be available to reduce some

portion of the U.S. income tax liability.

During 2005, the Company repatriated $500 million of earnings from its Canadian subsidiary to the U.S. to take advantage

of the lower tax rate allowed by the American Jobs Creation Act of 2004. The Canadian subsidiary funded approximately

half of the repatriated earnings with cash on hand and the remainder with borrowings. The U.S. parent company will use

the repatriated earnings to pay down debt in the near term. Deferred taxes previously provided on Canadian earnings to be

repatriated exceeded the tax costs to repatriate the earnings and resulted in a net reduction of $16.5 million in income tax

expense in 2005.

U.S. and Canadian tax authorities notified the Company during 2005 that they have concluded their transfer pricing

negotiations with respect to a bilateral Advance Pricing Agreement for the years 2000 through 2006. The agreement

established arm’s length charges for intercompany sales of goods and services and use of property by the Company and its

Canadian subsidiary which are eliminated in consolidation. As a result of this agreement, foreign income before tax expense

for 2005 has been reduced, and domestic income before tax expense for 2005 has been increased by the amount of the

charges.

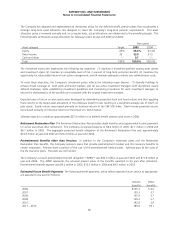

At December 31, 2005, GroceryWorks had net operating loss (“NOL”) carryforwards for federal income tax purposes of

approximately $222 million and net operating loss carryforwards for state purposes of approximately $64 million. The NOL

carryforwards expire at various dates from 2006 to 2025. Until it becomes more likely than not that GroceryWorks will have

future taxable income to absorb the NOL carryforwards, Safeway will provide a valuation allowance for the entire deferred