Safeway 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

50

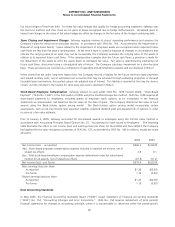

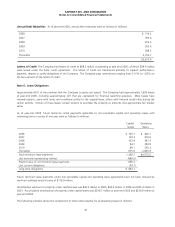

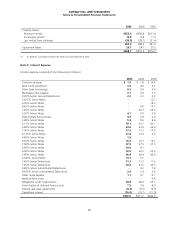

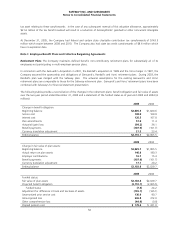

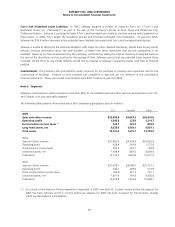

Activity in the Company’s stock option plans for the three-year period ended December 31, 2005 was as follows:

Options

Weighted

average

exercise price

Aggregate

intrinsic value

(in millions)

Outstandin

g

,

y

ear-end 2002 37,943,510 $ 31.70

2003 Activity:

Granted 4,230,118 21.87

Canceled (3,355,444) 38.42

Exercised (2,511,557) 6.85

Outstandin

g

,

y

ear-end 2003 36,306,627 $ 31.51 $ 141.8

2004 Activity:

Granted 5,871,639 20.60

Canceled (12,167,123) 44.07

Exercised (3,196,582) 6.78

Outstandin

g

,

y

ear-end 2004 26,814,561 $ 26.37 $ 81.4

2005 Activity:

Granted 11,515,944 20.19

Canceled (1,575,189) 28.55

Exercised (1,889,572) 8.12

Outstandin

g

,

y

ear-end 2005 34,865,744 $ 25.23 $ 139.3

Exercisable, year-end 2003 21,697,133 $27.24 138.5

Exercisable

,

y

ear-end 2004 15

,

218

,

373 26.35 81.1

Exercisable

,

y

ear-end 2005 16

,

239

,

331 29.16 81.9

Weighted average fair value of options granted during the year:

2003 $9.64

2004 8.57

2005 6.32

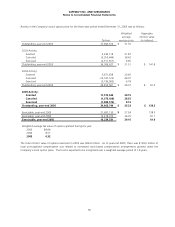

The total intrinsic value of options exercised in 2005 was $26.6 million. As of year-end 2005, there was $139.0 million of

total unrecognized compensation cost related to nonvested stock-based compensation arrangements granted under the

Company’s stock option plans. That cost is expected to be recognized over a weighted average period of 1.8 years.