Safeway 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 SAFEWAY INC. 2005 ANNUAL REPORT

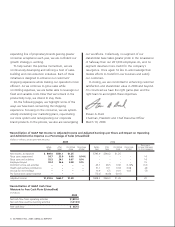

expanding line of proprietary brands gaining greater

consumer acceptance each year, we are confident our

growth strategy is working.

To help sustain this positive momentum, we are

continuously developing and refining a host of sales-

building and cost-reduction initiatives. Each of these

initiatives is designed to enhance our customers’

shopping experience while making our operations more

efficient. As we continue to grow sales while

controlling expenses, we are better able to leverage our

fixed and variable costs. Now that we’re back in the

productivity loop, we intend to stay there.

On the following pages, we highlight some of the

ways we have been reinventing the shopping

experience. Focusing on the consumer, we are system-

atically revitalizing our marketing plans, rejuvenating

our store system and reinvigorating our corporate

brand products. In the process, we also are reenergizing

our workforce. Collectively, no segment of our

stakeholder base takes greater pride in the renaissance

of Safeway than our 201,000 employees do, and no

segment deserves more credit for the company’s

resurgence. Once again I‘d like to acknowledge their

tireless efforts to transform our business and satisfy

our customers.

In closing, we are committed to enhancing customer

satisfaction and shareholder value in 2006 and beyond.

I’m convinced we have the right game plan and the

right team to accomplish these objectives.

Steven A. Burd

Chairman, President and Chief Executive Officer

March 10, 2006

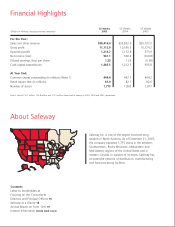

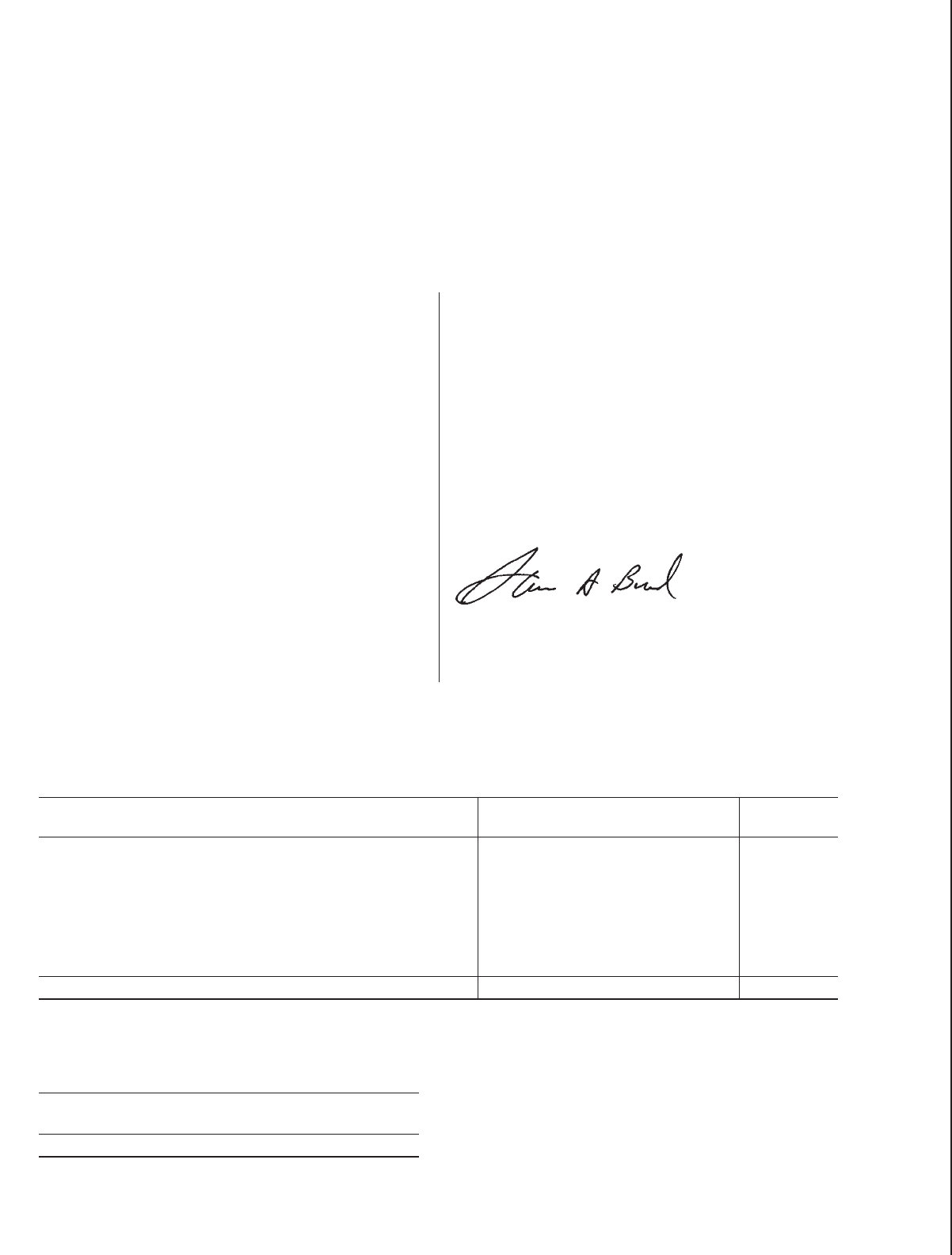

Reconciliation of GAAP Net Income to Adjusted Income and Adjusted Earnings per Share and Impact on Operating

and Administrative Expense as a Percentage of Sales (Unaudited)

(Dollars in millions, except per-share amounts)

2005 2004

Basis point

Before After Per diluted Percentage Before After Per diluted Percentage increase (decrease)

taxes taxes share of sales taxes taxes share of sales in O & A expense

Net income, as reported $ 849.0 $561.1 $1.25 $793.9 $560.2 $1.25

Texas store impairment 54.7 33.9 0.08 0.14% –––– 14

Texas store exit activities 55.5 34.1 0.07 0.14 – – – – 14

Employee buyout 59.4 36.6 0.08 0.15 – – – – 15

Dominick’s store exit activities –––– 45.7 28.5 0.06 0.12% (12)

Health and welfare contribution –––– 31.1 19.1 0.04 0.08 (8)

Accrual for rent holidays – – – – 10.6 6.5 0.01 0.03 (3)

Pro forma stock option expense ––– (73.0) (44.8) (0.10)

Adjusted income $1,018.6 $665.7 $1.48 $808.3 $569.5 $1.26 20

1

Reconciliation of GAAP Cash Flow

Measure to Free Cash Flow (Unaudited)

(In millions)

2005

Net cash flow from operating activities $1,881.0

Net cash flow used by investing activities (1,313.5)

Free cash flow $ 567.5

2