Safeway 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

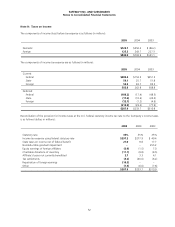

Notes to Consolidated Financial Statements

49

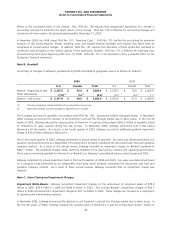

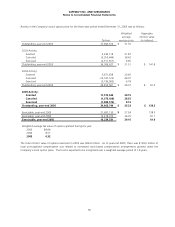

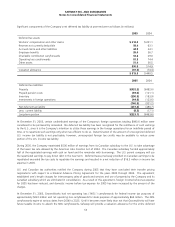

Note G: Capital Stock

Shares Authorized and Issued Authorized preferred stock consists of 25 million shares of which none was outstanding

during 2005, 2004 or 2003. Authorized common stock consists of 1.5 billion shares at $0.01 par value. Common stock

outstanding at year-end 2005 was 449.4 million shares (net of 130.7 million shares of treasury stock) and 447.7 million

shares at year-end 2004 (net of 130.8 million shares of treasury stock).

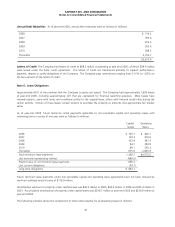

Stock Option Plans Under Safeway’s stock option plans, the Company may grant incentive and non-qualified options to

purchase common stock at an exercise price equal to or greater than the fair market value at the grant date, as determined

by the Executive Compensation Committee of the Board of Directors. Options generally vest over five or seven years. Vested

options are exercisable in part or in full at any time prior to the expiration date of six to 15 years from the date of the grant.

Options to purchase 14.4 million shares were available for grant at December 31, 2005 under the 1999 Amended and

Restated Equity Participation Plan. Shares issued, as a result of stock option exercises, will be funded with the issuance of

new shares. Converted options from the acquisitions of Randall’s and Vons will be funded out of treasury shares except to

the extent there are insufficient treasury shares in which case new shares will be issued.

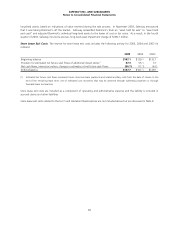

On July 31, 2002, the Board of Directors adopted the 2002 Equity Incentive Plan of Safeway Inc. (the “2002 Plan”), under

which awards of non-qualified stock options and stock-based awards may be made. There are 2.0 million shares of common

stock authorized for issuance pursuant to grants under the 2002 Plan. As of December 31, 2005, no options have been

granted under this plan.

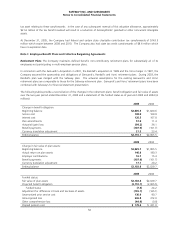

In September 2004, Safeway initiated a voluntary exchange program for stock options and stock rights having an exercise

price greater than $35.00 to eligible employees. The Company’s executive officers, members of the Board of Directors and

former employees were not eligible to participate. The exchange program ended on October 5, 2004 and approximately 9.7

million stock options and rights were surrendered and cancelled. Replacement stock options and replacement stock rights

totaling approximately 4.5 million were issued on April 7, 2005 at an exercise price of $20.75. These replacement stock

options have a six-year term and vest over five years.

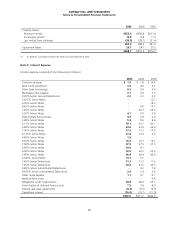

Restricted Stock The Company awarded 21,187 shares of restricted stock in 2005, 263,135 shares of restricted stock in

2004 and 706,236 shares of restricted stock in 2003 to certain officers and key employees. These shares vest over a period

of between three to four years and are subject to certain transfer restrictions and forfeiture prior to vesting. Deferred stock

compensation, representing the fair value of the stock at the measurement date of the award, is amortized to compensation

expense over the vesting period. The amortization of this restricted stock resulted in compensation expense of $5.5 million in

2005, $4.5 million in 2004 and $0.2 million in 2003. As of December 31, 2005, 428,108 restricted shares were vested,

562,450 were unvested and 87,676 shares have been returned to Safeway to satisfy tax-withholding obligations of

employees.