Safeway 2005 Annual Report Download - page 66

Download and view the complete annual report

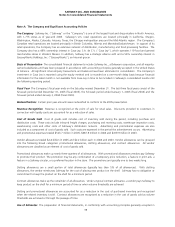

Please find page 66 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

46

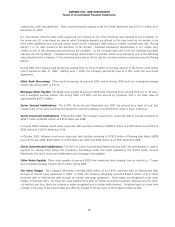

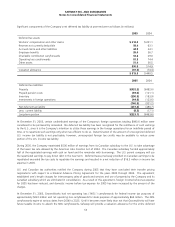

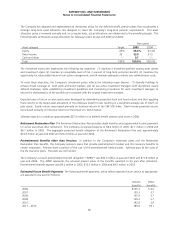

respectively, under this agreement. Total unused borrowing capacity under the Credit Agreement was $1,514.1 million as of

December 31, 2005.

U.S. borrowings under the bank credit agreement carry interest at one of the following rates selected by the Company: (1)

the prime rate; (2) a rate based on rates at which Eurodollar deposits are offered to first-class banks by the lenders in the

bank credit agreement plus a pricing margin based on the Company's debt rating or interest coverage ratio (the “Pricing

Margin”); or (3) rates quoted at the discretion of the lenders. Canadian borrowings denominated in U.S. dollars carry

interest at one of the following rates selected by the Company: (a) the Canadian base rate; or (b) the Canadian Eurodollar

rate plus the Pricing Margin. Canadian borrowings denominated in Canadian dollars carry interest at one of the following

rates selected by the Company: (1) the Canadian prime rate or (2) the rate for Canadian bankers acceptances plus the Pricing

Margin.

During 2005, the Company paid facility fees ranging from 0.11% to 0.145% on the total amount of the former credit facility

until it expired on May 31, 2005. Starting June 1, 2005, the Company paid facility fees of 0.10% under the new Credit

Agreement.

Other Bank Borrowings Other bank borrowings at year-end 2005 mature during 2006 and had a weighted average

interest rate during 2005 of 5.91%.

Mortgage Notes Payable Mortgage notes payable at year-end 2005 have remaining terms ranging from one to 18 years,

had a weighted average interest rate during 2005 of 8.59% and are secured by properties with a net book value of

approximately $167.5 million.

Senior Secured Indebtedness The 9.30% Senior Secured Debentures due 2007 are secured by a deed of trust that

created a lien on the land, buildings and equipment owned by Safeway at its distribution center in Tracy, California.

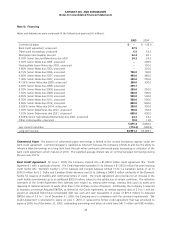

Senior Unsecured Indebtedness In November 2005, the Company issued senior unsecured debt in Canada consisting of

$259.7 million (CAD300 million) of 4.45% Notes due 2008.

In August 2004, Safeway issued senior unsecured debt securities consisting of $500.0 million of 4.95% Notes due 2010 and

$250 million of 5.625% Notes due 2014.

In October 2003, Safeway issued senior unsecured debt facilities consisting of $150.0 million of Floating Rate Notes (LIBOR

plus 0.47%) due 2005, $200 million of 2.50% Notes due 2005 and $300 million of 4.125% Notes due 2008.

Senior Subordinated Indebtedness The 9.875% Senior Subordinated Debentures due 2007 are subordinated in right of

payment to, among other things, the Company's borrowings under the Credit Agreement, the 9.30% Senior Secured

Debentures, the senior unsecured indebtedness and mortgage notes payable.

Other Notes Payable Other notes payable at year-end 2005 have remaining terms ranging from six months to 17 years

and a weighted average interest rate of 2.62% during 2005.

Fair Value Hedges The Company effectively converted $500 million of its 4.95% fixed-rate debt to floating-rate debt

through an interest swap agreement in 2004. In 2003, the Company effectively converted $300.0 million of its 4.125%

fixed-rate debt to floating-rate debt through an interest rate swap agreement. These swaps are designated as fair value

hedges of fixed-rate debt. For these fair value hedges that qualify for hedge accounting treatment, Safeway uses the short-

cut method, and thus, there are no gains or losses recognized due to hedge ineffectiveness. Unrealized gains or losses from

changes in the value of fair value hedges are offset by changes in the fair value of the hedged underlying debt.