Safeway 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

20

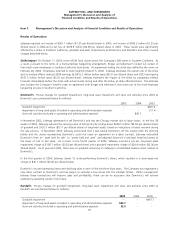

Safeway wrote off miscellaneous equity investments in 2003 totaling $10.6 million ($0.01 per diluted share), after

determining they were impaired. Safeway also incurred pre-tax charges totaling $25.5 million ($0.04 per diluted share) for

employee buyouts, severance costs and other costs related to the restructuring of the Company’s administrative offices.

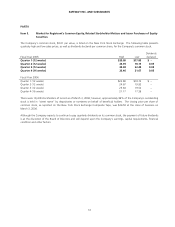

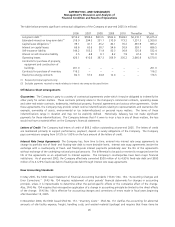

Sales Total sales increased 7.2% to $38.4 billion in 2005 from $35.8 billion in 2004, primarily because of Safeway’s

marketing strategy, Lifestyle store execution and increased fuel sales.

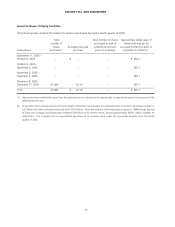

Same-store sales increases for 2005 were as follows:

Comparable-store sales

(includes replacement

stores)

Identical-store sales

(excludes replacement

stores)

Including fuel:

Excluding strike-affected stores 4.6% 4.4%

Including strike-affected stores 5.9% 5.8%

Excluding fuel:

Excluding strike-affected stores 3.0% 2.9%

Including strike-affected stores 4.4% 4.3%

In 2004, total sales increased only slightly to $35.8 billion from $35.7 billion in 2003, primarily because of the Southern

California strike and because fiscal 2004 had one fewer week than fiscal 2003.

Same-store sales increases (decreases) for 2004 were as follows:

Comparable-store sales

(includes replacement

stores)

Identical-store sales

(excludes replacement

stores)

Including fuel:

Excluding strike-affected stores 1.5% 0.9%

Including strike-affected stores 0.9% 0.3%

Excluding fuel:

Excluding strike-affected stores (0.2%) (0.8%)

Including strike-affected stores (0.7%) (1.3%)

In 2003, total sales increased 2.3% to $35.7 billion from $34.9 billion in 2002 primarily due to fiscal 2003 consisting of 53

weeks compared to 52 weeks in 2002, new store openings and additional fuel sales, partially offset by the estimated impact

of the strike in Southern California. Excluding the estimated effects of the strike in Southern California, comparable-store

sales were flat, while identical-store sales declined 0.4%. Further excluding the effects of fuel sales, 2003 comparable-store

sales decreased 1.6% and identical-store sales decreased 2.0%.

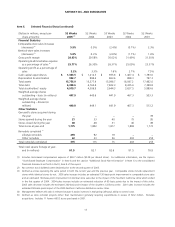

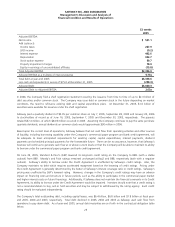

Gross Profit Gross profit represents the portion of sales revenue remaining after deducting the costs of goods sold during

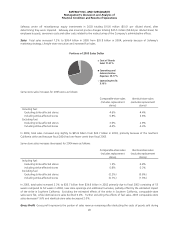

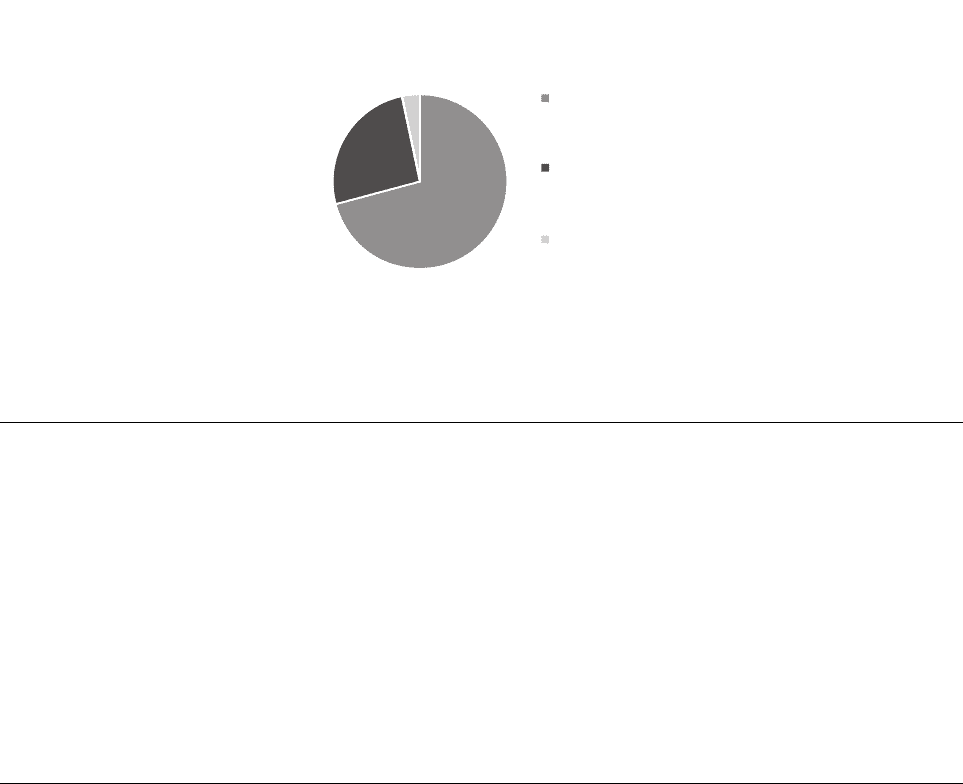

Portions of 2005 Sales Dollar

Cost of Goods

Sold: 71.07%

Operating and

Administrative

Expense: 25.77%

Operating Profit:

3.16%