Safeway 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

48

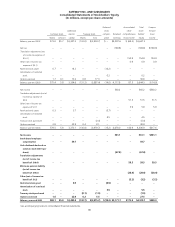

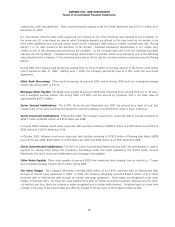

(1) In general, contingent rentals are based on individual store sales.

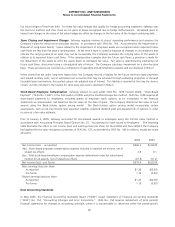

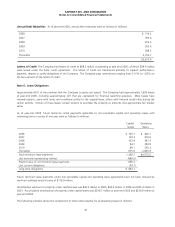

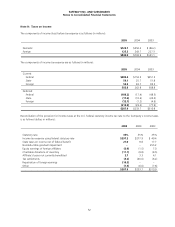

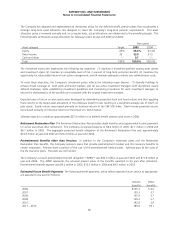

Note F: Interest Expense

Interest expense consisted of the following (in millions):

2005 2004 2003

Property leases:

Minimum rentals $422.4 $406.9 $411.4

Contingent rentals (1) 10.8 9.4 11.5

Less rentals from subleases (30.2) (28.1) (31.4)

403.0 388.2 391.5

Equipment leases 25.7 24.1 25.2

$428.7 $412.3 $416.7

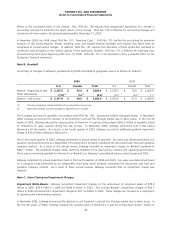

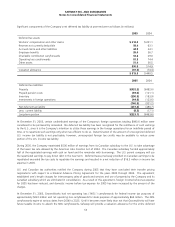

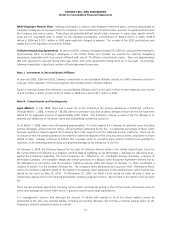

2005 2004 2003

Commercial paper $ 1.5 $ 7.8 $ 16.4

Bank credit agreement 3.3 4.0 3.5

Other bank borrowings 0.2 0.4 0.4

Mortgage notes payable 2.1 2.4 3.3

9.30% Senior Secured Debentures 2.3 2.3 2.3

3.625% Senior Notes -- 12.3

6.05% Senior Notes -- 18.3

6.85% Senior Notes -9.8 13.7

7.25% Senior Notes -20.3 29.0

2.50% Senior Notes 4.1 5.0 0.9

Floating Rate Senior Notes 4.5 2.9 0.4

3.80% Senior Notes 5.3 8.6 8.6

6.15% Senior Notes 43.1 43.1 43.1

4.80% Senior Notes 23.0 23.0 23.0

7.00% Senior Notes 17.5 17.5 17.5

4.125% Senior Notes 12.4 12.4 2.3

4.45% Senior Notes 1.5 --

6.50% Senior Notes 16.3 16.3 16.3

7.50% Senior Notes 37.5 37.5 37.5

4.95% Senior Notes 24.8 9.7 -

6.50% Senior Notes 32.5 32.5 32.5

5.80% Senior Notes 46.4 46.4 46.4

5.625% Senior Notes 14.1 5.5 -

7.45% Senior Debentures 11.2 11.2 11.2

7.25% Senior Debentures 43.5 43.5 43.5

9.65% Senior Subordinated Debentures -0.2 7.8

9.875% Senior Subordinated Debentures 2.4 2.4 2.4

Other notes payable 1.1 0.7 0.7

Medium-term notes --0.4

Obligations under capital leases 64.8 66.0 63.1

Amortization of deferred finance costs 7.5 7.8 8.0

Interest rate swap agreements (4.3) (8.3) (0.5)

Capitalized interest (16.0) (19.7) (21.9)

$402.6 $411.2 $442.4