Safeway 2005 Annual Report Download - page 61

Download and view the complete annual report

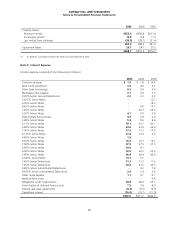

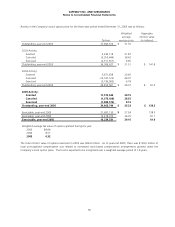

Please find page 61 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

41

The current portion of the self-insurance liability is included in other accrued liabilities, and the long-term portion is included

in accrued claims and other liabilities in the consolidated balance sheets. The total undiscounted liability was $634.3 million

at year-end 2005 and $558.8 million at year-end 2004.

Rent Holidays Certain of the Company’s operating leases contain rent holidays. For these leases, Safeway recognizes the

related rent expense on a straight-line basis at the earlier of the first rent payment or the date of possession of the leased

property. The difference between the amounts charged to expense and the rent paid is recorded as deferred lease incentives

and amortized over the lease term.

Construction Allowances As part of certain lease agreements, the Company receives construction allowances from

landlords. The construction allowances are deferred and amortized on a straight-line basis over the life of the lease as a

reduction to rent expense.

Income Taxes The Company provides income tax expense or benefit in accordance with Statement of Financial Accounting

Standards (“SFAS”) No. 109, “Accounting for Income Taxes.” Deferred income taxes represent future net tax effects

resulting from temporary differences between the financial statement and tax basis of assets and liabilities using enacted tax

rates in effect for the year in which the differences are expected to reverse.

Income Tax Contingencies The Company is subject to periodic audits by the Internal Revenue Service and other foreign,

state and local taxing authorities. These audits may challenge certain of the Company’s tax positions such as the timing and

amount of deductions and allocation of taxable income to the various tax jurisdictions. Loss and gain contingencies are

accounted for in accordance with SFAS No. 5, “Accounting for Contingencies,” and may require significant management

judgment in estimating final outcomes. Actual results could materially differ from these estimates and could significantly

affect the effective tax rate and cash flows in future years.

Off-Balance Sheet Financial Instruments The Company has, from time to time, entered into interest rate swap

agreements to change its portfolio mix of fixed- and floating-rate debt to more desirable levels. Interest rate swap

agreements involve the exchange with a counterparty of fixed- and floating-rate interest payments periodically over the life

of the agreements without exchange of the underlying notional principal amounts. The differential to be paid or received is

recognized over the life of the agreements as an adjustment to interest expense. The Company's counterparties have been

major financial institutions.

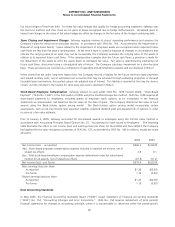

Fair Value of Financial Instruments Generally accepted accounting principles require the disclosure of the fair value of

certain financial instruments, whether or not recognized in the balance sheet, for which it is practicable to estimate fair

value. The Company estimated the fair values presented below using appropriate valuation methodologies and market

information available as of year-end. Considerable judgment is required to develop estimates of fair value, and the estimates

presented are not necessarily indicative of the amounts that the Company could realize in a current market exchange. The

use of different market assumptions or estimation methodologies could have a material effect on the estimated fair values.

Additionally, the fair values were estimated at year-end, and current estimates of fair value may differ significantly from the

amounts presented.

The following methods and assumptions were used to estimate the fair value of each class of financial instruments:

Cash and equivalents, accounts receivable, accounts payable and short-term debt. The carrying amount of these items

approximates fair value.

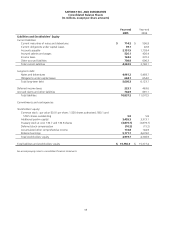

Long-term debt. Market values quoted on the New York Stock Exchange are used to estimate the fair value of publicly

traded debt. To estimate the fair value of debt issues that are not quoted on an exchange, the Company uses those interest

rates that are currently available to it for issuance of debt with similar terms and remaining maturities. At year-end 2005, the

estimated fair value of debt was $5.8 billion compared to a carrying value of $5.7 billion. At year-end 2004, the estimated

fair value of debt was $6.4 billion compared to a carrying value of $6.1 billion.

Interest rate swaps. Interest rate swaps, under which the Company agrees to pay variable rates of interest, are designated as