Safeway 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

22

Operating and administrative expense increased 128 basis points in 2003. Higher Dominick’s impairment charges increased

operating and administrative expense 30 basis points. Reduced sales from the Southern California strike increased operating

and administrative expense by an estimated 29 basis points. Higher pension expense added 28 basis points, and higher

workers’ compensation expense added 15 basis points. The remaining 26-basis-point increase was primarily due to higher

employee benefit costs, soft sales and settlement income from the termination of an in-store banking agreement recorded in

2002 operating and administrative expense.

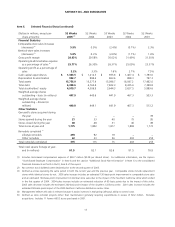

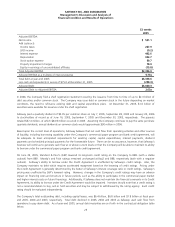

Interest Expense Interest expense was $402.6 million in 2005, compared to $411.2 million in 2004 and $442.4 million in

2003. Interest expense decreased in 2005 primarily due to lower average borrowings in 2005 compared to 2004, partially

offset by a higher average interest rate. Interest expense also decreased in 2004, primarily due to lower average borrowings

in 2004 compared to 2003. Interest expense increased in 2003, primarily due to higher average borrowings in 2003

compared to 2002.

Other Income (Loss) Other income consists of interest income, minority interest in a consolidated affiliate and equity in

earnings from Safeway’s unconsolidated affiliates. Interest income was $12.7 million in 2005, $9.7 million in 2004 and $5.4

million in 2003. Equity in earnings (losses) of unconsolidated affiliates was income of $15.8 million in 2005, income of $12.6

million in 2004 and a loss of $7.1 million in 2003.

Income Taxes The Company’s effective tax rates for 2005, 2004 and 2003 were 33.9%, 29.4% and 220.3%, respectively.

The effective tax rate for 2005 includes a tax benefit from the repatriation of foreign earnings under the American Jobs

Creation Act of 2004, and a benefit from the favorable resolution of certain tax issues. In 2004, the effective tax rate

included benefits related to tax law changes and the resolution of certain tax issues. The higher effective tax rate in 2003

reflects the tax effect of a charge for nondeductible goodwill impairment.

Critical Accounting Policies and Estimates

Critical accounting policies are those accounting policies that management believes are important to the portrayal of

Safeway’s financial condition and results of operations and require management’s most difficult, subjective or complex

judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Workers’ Compensation The Company is primarily self-insured for workers’ compensation, automobile and general liability

costs. It is the Company’s policy to record its self-insurance liability, as determined actuarially, based on claims filed and an

estimate of claims incurred but not yet reported, discounted at a risk-free interest rate. Any actuarial projection of losses

concerning workers’ compensation and general liability is subject to a high degree of variability. Among the causes of this

variability are unpredictable external factors affecting future inflation rates, discount rates, litigation trends, legal

interpretations, benefit level changes and claim settlement patterns. A 25-basis-point increase in the Company’s discount

rate would reduce its liability by approximately $4.7 million.

The majority of the Company’s workers’ compensation liability is from claims occurring in California. California workers’

compensation has received intense scrutiny from the state’s politicians, insurers, employers and providers, as well as the

public in general. Recent years have seen escalation in the number of legislative reforms, judicial rulings and social

phenomena affecting this business. Some of the many sources of uncertainty in the Company’s reserve estimates include

changes in benefit levels, medical fee schedules, medical utilization guidelines, vocation rehabilitation and apportionment.

Store Closures Safeway’s policy is to recognize losses relating to the impairment of long-lived assets when expected net

future cash flows are less than the assets’ carrying values. When stores that are under long-term leases close, Safeway

records a liability for the future minimum lease payments and related ancillary costs, net of estimated cost recoveries. In both

cases, fair value is determined by estimating net future cash flows and discounting them using a risk-adjusted rate of interest.

The Company estimates future cash flows based on its experience and knowledge of the market in which the closed store is

located and, when necessary, uses real estate brokers. However, these estimates project future cash flows several years into

the future and are affected by factors such as inflation, real estate markets and economic conditions.

Employee Benefit Plans The determination of Safeway’s obligation and expense for pension benefits is dependent, in part,