Safeway 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

42

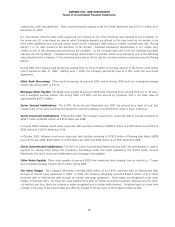

fair value hedges of fixed-rate debt. For these fair value hedges that qualify for hedge accounting treatment, Safeway uses

the short-cut method, and thus, there are no gains or losses recognized due to hedge ineffectiveness. Unrealized gains or

losses from changes in the value of fair value hedges are offset by changes in the fair value of the hedged underlying debt.

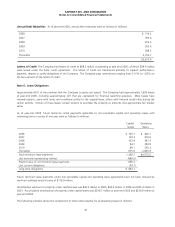

Store Closing and Impairment Charges Safeway regularly reviews its stores’ operating performance and assesses the

Company’s plans for certain store and plant closures. In accordance with SFAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets,” losses related to the impairment of long-lived assets are recognized when expected future

cash flows are less than the asset's carrying value. At the time a store is closed or because of changes in circumstances that

indicate the carrying value of an asset may not be recoverable, the Company evaluates the carrying value of the assets in

relation to its expected future cash flows. If the carrying value is greater than the future cash flows, a provision is made for

the impairment of the assets to write the assets down to estimated fair value. Fair value is determined by estimating net

future cash flows, discounted using a risk-adjusted rate of return. The Company calculates impairment on a store-by-store

basis. These provisions are recorded as a component of operating and administrative expense and are disclosed in Note C.

When stores that are under long-term leases close, the Company records a liability for the future minimum lease payments

and related ancillary costs, net of estimated cost recoveries that may be achieved through subletting properties or through

favorable lease terminations, discounted using a risk-adjusted rate of interest. This liability is recorded at the time the store is

closed. Activity included in the reserve for store lease exit costs is disclosed in Note C.

Stock-Based Employee Compensation Safeway elected to early adopt SFAS No. 123R (revised 2004), “Share-Based

Payment” (“SFAS No. 123R”) in the first quarter of 2005 using the modified prospective method. SFAS No. 123R requires all

share-based payments to employees, including grants of employee stock options, to be recognized in the financial

statements as compensation cost based on the fair value on the date of grant. The Company determines fair value of such

awards using the Black-Scholes option pricing model. The Black-Scholes option pricing model incorporates certain

assumptions, such as risk-free interest rate, expected volatility, expected dividend yield and expected life of options, in order

to arrive at a fair value estimate.

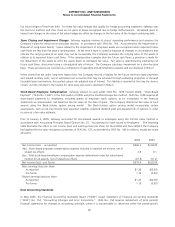

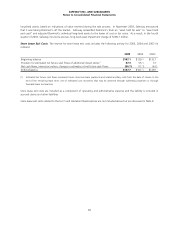

Prior to January 2, 2005, Safeway accounted for stock-based awards to employees using the intrinsic value method in

accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees.” The following

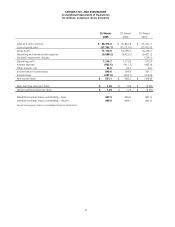

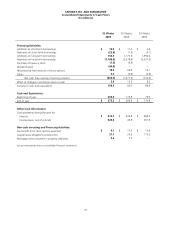

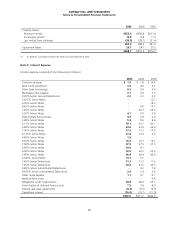

table illustrates the effect on net income (loss) and earnings (loss) per share for fiscal 2004 and fiscal 2003 if the Company

had applied the fair value recognition provisions of SFAS No. 123, as amended by SFAS No. 148 (in millions, except per-share

amounts):

2004 2003

Net income (loss) – as reported $560.2 $(169.8)

Add: Stock-based employee compensation expense included in reported net income, net of

related tax effects 2.8 0.1

Less: Total stock-based employee compensation expense determined under fair value based

method for all awards, net of related tax effects (47.6) (51.2)

Net income (loss) – pro forma $515.4 $(220.9)

Basic earnings (loss) per share:

As reported

Pro forma

$1.26

1.16

$(0.38)

(0.50)

Diluted earnings (loss) per share:

As reported

Pro forma

$1.25

1.15

$(0.38)

(0.50)

New Accounting Standards

In May 2005, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 154, “Accounting Changes and Error Corrections.” SFAS No. 154 requires restatement of prior periods’

financial statements for changes in accounting principle, unless it is impracticable to determine either the period-specific