Safeway 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

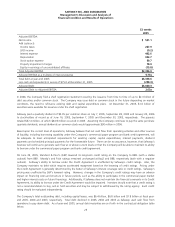

SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

19

In the third quarter of 2005, the Company announced a plan to revitalize the Texas market which included the closure of 26

under-performing stores, a focused Lifestyle remodel program and the introduction of proprietary products. This resulted in

a pre-tax, long-lived asset impairment charge of $54.7 million ($0.08 per diluted share). In the fourth quarter of 2005,

Safeway recorded $55.5 million pre-tax ($0.07 per diluted share) in store exit activities for these stores.

In the fourth quarter of 2003, Safeway performed its annual review of goodwill and wrote off $447.7 million ($1.00 per

diluted share) of goodwill at Randall’s.

As a result of an improving competitive environment, the closing of 26 under-performing stores and improved marketing

efforts, Randall’s identical-store sales grew in 2005 and, although profitability improved, Randall’s incurred an operating loss

in 2005. As previously mentioned, Safeway has announced a plan to revitalize Randall’s; however, there can be no

assurance that Randall’s will achieve satisfactory operating results in the future.

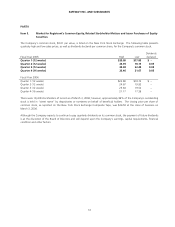

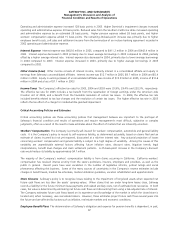

Other Charges Other significant pre-tax charges consist of the following (in millions):

2005 2004 2003

Northern California health and welfare contribution - $31.1 -

Accrual for rent holidays - 10.6 -

Inventory loss accrual -- $48.9

Inventory markdown change in estimate 22.1

Impairment of miscellaneous equity investments -- 10.6

Employee buyouts, severance costs and other related costs $59.4 - 25.5

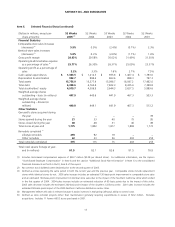

In 2005, the Company incurred $59.4 million before tax ($0.08 per diluted share) in employee buyout charges, severance

and related costs, relating primarily to Dominick’s and Northern California.

In 2004, Safeway was notified that it was required to contribute an additional $31.1 million before tax ($0.04 per diluted

share) during the year to two Northern California multi-employer health and welfare plans for its share of funding deficits.

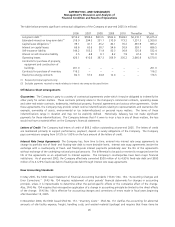

On February 7, 2005, the Office of the Chief Accountant of the Securities and Exchange Commission issued a letter to the

American Institute of Certified Public Accountants expressing its view regarding certain lease-related accounting issues and

their application under generally accepted accounting principles (“GAAP”). In light of this letter, Safeway determined that its

then-current method of accounting for rent holidays was not in accordance with GAAP. Historically, the Company

recognized rent expense on a straight-line basis beginning at the first rent payment. The Company now recognizes rent

expense on a straight-line basis when it takes possession and control of the property. Safeway recorded a $10.6 million

before tax charge ($0.01 per diluted share) in 2004 to correct this error. However, most of the adjustment was accumulated

over many years.

In 2003, Safeway changed its accounting policy to accrue estimated physical inventory losses that occur between the last

physical inventory count and the quarterly or year-end balance sheet date. Previously, Safeway recorded inventory losses

only in the period the physical count was performed.

Safeway takes a physical count of perishable inventory in stores every four weeks and nonperishable inventory in stores twice

a year on a cycle basis. Distribution centers are counted twice a year on a cycle basis. Safeway historically recorded

inventory losses only in the period the physical count was performed. In the fourth quarter of fiscal 2003, Safeway

determined that its then-current method of accounting for estimated physical inventory losses was not in accordance with

GAAP. In order to reflect inventory more accurately on the balance sheet, Safeway began to accrue an estimated physical

inventory loss for the period between the last physical inventory count and the quarterly or year-end balance sheet date.

Safeway recorded a charge of $48.9 million before tax ($0.07 per diluted share) in the fourth quarter of fiscal 2003 to

correct this error. However, most of the adjustment accumulated over many prior years. In addition, in the fourth quarter of

fiscal 2003, Safeway revised its physical inventory calculation methodology to reflect more precise data on inventory

markdowns from newly installed financial software. Safeway recorded a charge of $22.1 million before tax ($0.03 per

diluted share) in the fourth quarter of fiscal 2003 as a result of this change in accounting estimate.