Safeway 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC.

2005 ANNUAL REPORT

Reinventing the

Shopping Experience

Table of contents

-

Page 1

SAFEWAY INC. 2005 ANNUAL REPORT Reinventing the Shopping Experience -

Page 2

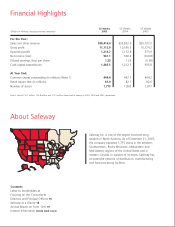

... Weeks 2005 52 Weeks 2004 53 Weeks 2003 For the Year: Sales and other revenue Gross profit Operating profit Net income (loss) Diluted earnings (loss) per share Cash capital expenditures At Year End: Common shares outstanding (in millions) (Note 1) Retail square feet (in millions) Number of stores... -

Page 3

..., expanding our line of high-quality proprietary brands, revitalizing the center of the store, developing solutions for our customers, and responding to health and wellness concerns. Lowered Our Cost Structure By restructuring labor contracts, improving our marketing and supply chain organization... -

Page 4

... market share in the U.S. supermarket channel 51 of 52 weeks, and we continued to roll out our highly successful Lifestyle stores through an aggressive remodeling program. We also finished restructuring our labor contracts and have begun to experience solid operating and administrative expense... -

Page 5

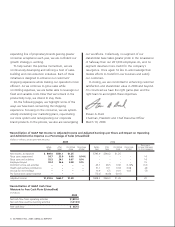

...basis points. Stock option expense, labor costs associated with Lifestyle grand openings and higher energy costs also increased our O&A expense-tosales ratio. However, these items were more than offset by the restructured labor agreements, increased fuel sales and reduced workers' compensation costs... -

Page 6

...Per diluted share Percentage of sales Basis point increase (decrease) in O & A expense Net income, as reported Texas store impairment Texas store exit activities Employee buyout Dominick's store exit activities Health and welfare contribution Accrual for rent holidays Pro forma stock option expense... -

Page 7

...a supermarket. For example, we realize that because consumers lead busier, more demanding lives today, choice and balance are more important than ever before. With such insights, we are able to target offerings geared to our customers' specific shopping patterns and preferences. At the same time, we... -

Page 8

... to sell extremely well and play a leading role in strengthening our brand identity. Our exclusive Rancher's Reserve beef is naturally aged to ensure exceptional tenderness and flavor. Building on that success, in 2005 we launched an online Rancher's Reserve gift delivery service featuring premium... -

Page 9

75% GROWTH IN SIGNATURE SOUP SALES Superior quality is the defining characteristic of our proprietary brands. They continue to sell extremely well and play a leading role in strengthening our brand identity. -

Page 10

..., easy recipe enabled them to spend more time with their family and friends at Thanksgiving. We continue to expand and refine our assortment of time-saving products and services such as ready-toserve meals, gasoline, online home shopping, in-store banking and photo processing. 8 SAFEWAY INC. 2005... -

Page 11

150+ O ORGANICS PRODUCTS TM -

Page 12

...additional product categories. And our corporate brands packaging will soon include nutritional icons to help our customers make informed choices. In addition, we have added a Wellness Center to our web site, where Dean Ornish, M.D. viewers can search articles on important health issues. We also are... -

Page 13

.... And orchids. At Safeway, we think you should be able to get them all in one place. The stuff you need to live life. And the stuff that makes life worth living. Not just ingredients for meals. Ingredients for life. Safeway. 80% OF TARGET AUDIENCE SAW MESSAGE SEVEN TIMES IN FIRST TWO WEEKS -

Page 14

...to improve our capital structure, by using cash flow from the business to reduce debt and thereby increase our financial flexibility. To rein in sharply rising energy costs, we have secured long-term, fixed-rate contracts and tolling agreements that are yielding significant annual savings. Thanks to... -

Page 15

Our highly successful Lifestyle store format is the ultimate expression of Ingredients for life, where all elements of our brand repositioning efforts come together. 314 MORE LIFESTYLE STORES IN 2005 -

Page 16

... a balanced work force that reflects the diversity of its customers and the communities in which they live. In 2005, for the third consecutive year, a leading business magazine recognized our enterprise-wide Diversity Initiative by including Safeway on its list of America's 50 Best Companies for... -

Page 17

SAFEWAY NAMED ONE OF THE 50 Best COMPANIES FOR MINORITIES By actively embracing diversity, we believe we gain a competitive advantage in serving our customers and attracting capable new employees to our work force. -

Page 18

... and Chief Executive Officer Safeway Inc. Paul Hazen Lead Independent Director Former Chairman and Chief Executive Officer Wells Fargo & Co. Deputy Chairman Vodafone Group PLC Janet E. Grove Chair and Chief Executive Officer Federated Merchandising Group Vice Chair Federated Department Stores, Inc... -

Page 19

... Vice President and Chief Information Officer Dick W. Gonzales Senior Vice President Human Resources Robert A. Gordon Senior Vice President, Secretary and General Counsel Chief Governance Officer Melissa C. Plaisance Senior Vice President Finance and Investor Relations Kenneth M. Shachmut Senior... -

Page 20

... Northern California Division Gregory A. Sparks Seattle Division Daniel J. Valenzuela Phoenix Division Thomas C. Keller The Vons Companies, Inc. FOREIGN SUBSIDIARY Canada Safeway Limited Chuck Mulvenna President and Chief Operating Officer EQUITY AFFILIATE Donald Keprta Dominick's Finer Foods, LLC... -

Page 21

... transition period from to Commission file number 1-00041 SAFEWAY INC. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 5918 Stoneridge Mall Road Pleasanton, California (Address of principal executive offices) Registrant... -

Page 22

... in Rule 12b-2 of the Act). Yes State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day... -

Page 23

... Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accounting Fees and Services 62 62 62 62 63 PART IV Item 15. SIGNATURES Exhibits, Financial Statement Schedules... -

Page 24

... centers; changes in state or federal legislation or regulation; the cost and stability of power sources; opportunities, acquisitions or dispositions that we pursue; performance in new business ventures; the rate of return on our pension assets; and the availability and terms of financing... -

Page 25

.... Merchandising Safeway's operating strategy is to provide value to its customers by maintaining high store standards and a wide selection of high quality products at competitive prices. To provide one-stop shopping for today's busy shoppers, the Company emphasizes high quality produce and meat, and... -

Page 26

...'s long-term growth strategy is its capital expenditure program. The Company's capital expenditure program funds, among other things, new stores, remodels, manufacturing plants, distribution facilities and information technology advances. Over the last several years, Safeway management has continued... -

Page 27

...former ABCO stores purchased in 2001. During 2005, Safeway invested $1.4 billion in cash capital expenditures. The Company opened 21 new Lifestyle stores, remodeled 293 stores to the Lifestyle format and closed 48 stores. The Company also completed 22 other remodels. In 2006, the Company expects to... -

Page 28

...process in Southern California. Financial Information about Geographic Areas Note L to the consolidated financial statements set forth in Part II, Item 8 of this report provides financial information by geographic area. Available Information Safeway's corporate web site is located at www.safeway.com... -

Page 29

... sales, lower gross profits and/or greater operating costs such as marketing. Our ability to attract customers is dependent, in large part, upon a combination of price, quality, product mix, brand recognition, store location, in-store marketing and design, promotional strategies and continued growth... -

Page 30

... operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, development efforts and other general corporate purposes; limit our flexibility in planning for, or reacting to, changes in our business; place... -

Page 31

.... California workers' compensation has received intense scrutiny from the state's politicians, insurers, employers and providers, as well as the public in general. Recent years have seen escalation in the number of legislative reforms, judicial rulings and social phenomena affecting this business... -

Page 32

...President Finance and Control David T. Ching Senior Vice President and Chief Information Officer Dick W. Gonzales (5) Senior Vice President Human Resources Robert A. Gordon (6) Senior Vice President Secretary and General Counsel Chief Governance Officer Year first elected Officer Present office 1992... -

Page 33

...Manager, Northern California Division of Safeway Inc. from 1998 to 2001, and President, Phoenix Division, from 1995 to 1998. (4) David F. Bond has been Senior Vice President, Finance and Control, of Safeway since July 1997. In this capacity, he also serves as the Company's Chief Accounting Officer... -

Page 34

... Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities The Company's common stock, $0.01 par value, is listed on the New York Stock Exchange. The following table presents quarterly high and low sales prices, as well as dividends declared per common share, for the Company... -

Page 35

... of 2005. Total number of shares purchased (1) Total number of shares Approximate dollar value of purchased as part of shares that may yet be publicly announced purchased under the plans or plans or programs programs (in millions) (2) $ 565.1 565.1 565.1 565.1 $ 565.1 Fiscal period September 11... -

Page 36

SAFEWAY INC. AND SUBSIDIARIES Item 6. Selected Financial Data 52 Weeks 2005(1) 52 Weeks 2004 53 Weeks 2003 52 Weeks 2002 52 Weeks 2001 (Dollars in millions, except pershare amounts) Results of Operations Sales and other revenue Gross profit Operating and administrative expense Goodwill ... -

Page 37

...estimated 50-basis-point impact of the 2000 Northern California distribution center strike. (4) (5) Management believes this ratio is relevant because it assists investors in evaluating Safeway's ability to control costs. Defined as store remodel projects (other than maintenance) generally requiring... -

Page 38

..., Safeway closed 12 under-performing Dominick's stores, which resulted in a store-lease exit charge of $45.7 million ($0.06 per diluted share). Dominick's incurred operating losses and declining sales in each of the last three fiscal years. The Company has negotiated a new labor contract at Dominick... -

Page 39

...additional $31.1 million before tax ($0.04 per diluted share) during the year to two Northern California multi-employer health and welfare plans for its share of funding deficits. On February 7, 2005, the Office of the Chief Accountant of the Securities and Exchange Commission issued a letter to the... -

Page 40

...to the restructuring of the Company's administrative offices. Sales Total sales increased 7.2% to $38.4 billion in 2005 from $35.8 billion in 2004, primarily because of Safeway's marketing strategy, Lifestyle store execution and increased fuel sales. Portions of 2005 Sales Dollar Cost of Goods Sold... -

Page 41

... Lifestyle stores, investment in price, increased advertising expense and higher energy costs. Gross profit declined 44 basis points in 2004. The strike in Southern California reduced gross profit by an estimated 41 basis points, and higher fuel sales (which have a lower gross margin) reduced gross... -

Page 42

.... California workers' compensation has received intense scrutiny from the state's politicians, insurers, employers and providers, as well as the public in general. Recent years have seen escalation in the number of legislative reforms, judicial rulings and social phenomena affecting this business... -

Page 43

... to fund future contributions to the Company's pension plans with cash flow from operations. Stock-Based Employee Compensation Safeway elected to early adopt SFAS No. 123R in the first quarter of 2005 using the modified prospective method. SFAS No. 123R requires all share-based payments to employees... -

Page 44

...resolved. The Company currently anticipates that it will use excess cash flows, if any, to repay debt and/or repurchase common stock. On June 1, 2005, the Company entered into a $1,600.0 million credit agreement (the "Credit Agreement") with a syndicate of banks. The Credit Agreement provides (1) to... -

Page 45

... Credit Agreement would be impaired. Investors should note that a credit rating is not a recommendation to buy, sell or hold securities and may be subject to withdrawal by the rating agency. Each credit rating should be evaluated independently. The Company's total outstanding debt, including capital... -

Page 46

... (1) Interest on capital leases Self-insurance liability Interest on self-insurance liability Operating leases Contracts for purchase of property, equipment and construction of buildings Contracts for purchase of inventory Fixed price energy contracts (1) Required principal payments only. (1) 201... -

Page 47

... INC. AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations recognized as current-period charges. In addition, SFAS No. 151 requires that allocation of fixed production overhead to conversion costs be based on the normal capacity of the production... -

Page 48

..., fair values and cash flows from reasonably possible near-term changes in interest rates and exchange rates to be material. The table below presents principal amounts and related weighted average rates by year of maturity for the Company's debt obligations at year-end 2005 (dollars in millions... -

Page 49

SAFEWAY INC. AND SUBSIDIARIES Item 8. Financial Statements and Supplementary Data Page Management's Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Statements of Operations for fiscal 2005, 2004 and 2003 Consolidated ... -

Page 50

... Management's Annual Report on Internal Control over Financial Reporting Management of the Company, including the Chief Executive Officer and the Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules... -

Page 51

... cash flows for each of the three years in the period ended December 31, 2005, in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, management's assessment that the Company maintained effective internal control over financial reporting... -

Page 52

... discussed in Note A to the consolidated financial statements, in fiscal 2005, the Company changed its method of accounting for share-based payment arrangements to conform to Statement of Financial Accounting Standards No. 123(R), "Share-Based Payment." San Francisco, California March 10, 2006 32 -

Page 53

... Statements of Operations (In millions, except per-share amounts) 52 Weeks 2005 Sales and other revenue Cost of goods sold Gross profit Operating and administrative expense Goodwill impairment charges Operating profit Interest expense Other income, net Income before income taxes Income taxes... -

Page 54

...-end 2005 Assets Current assets: Cash and equivalents Receivables Merchandise inventories, net of LIFO reserve of $48.4 and $48.6 Prepaid expenses and other current assets Total current assets Property: Land Buildings Leasehold improvements Fixtures and equipment Property under capital leases Less... -

Page 55

... Additional paid-in capital Treasury stock at cost: 130.7 and 130.8 shares Deferred stock compensation Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. Year... -

Page 56

... to pension plans Employee stock option expense Other Long-term accrued claims and other liabilities Loss (gain) on property retirements Changes in working capital items: Receivables Inventories at FIFO cost Prepaid expenses and other current assets Income taxes Payables and accruals Net cash flow... -

Page 57

... payments during the year for: Interest Income taxes, net of refunds Non-cash Investing and Financing Activities: Tax benefit from stock options exercised Capital lease obligations entered into Mortgage notes assumed in property additions See accompanying notes to consolidated financial statements... -

Page 58

...income Stock-based employee compensation Cash dividends declared on common stock ($0.15 per share) Translation adjustments (net of income tax benefit of $16.4) Minimum pension liability (net of income tax benefit of $15.6) Other (net of income tax benefit of $1.5) Restricted stock grant Amortization... -

Page 59

... The Company's investment in Casa Ley is reported using the equity method and is recorded on a one-month delay basis because financial information for the latest month is not available from Casa Ley in time to be included in Safeway's consolidated results until the following reporting period. Fiscal... -

Page 60

... to Safeway's financial statements. Self-Insurance The Company is primarily self-insured for workers' compensation, automobile and general liability costs. The self-insurance liability is determined actuarially, based on claims filed and an estimate of claims incurred but not yet reported, and... -

Page 61

...The Company has, from time to time, entered into interest rate swap agreements to change its portfolio mix of fixed- and floating-rate debt to more desirable levels. Interest rate swap agreements involve the exchange with a counterparty of fixed- and floating-rate interest payments periodically over... -

Page 62

... underlying debt. Store Closing and Impairment Charges Safeway regularly reviews its stores' operating performance and assesses the Company's plans for certain store and plant closures. In accordance with SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets," losses related... -

Page 63

... adjustments in Canada. The Company accounts for goodwill in accordance with SFAS No. 142, "Goodwill and Other Intangible Assets." In November 2002, Safeway announced the decision to sell Dominick's and exit the Chicago market due to labor issues. In the first 36 weeks of 2003, Safeway reduced the... -

Page 64

... Notes to Consolidated Financial Statements long-lived assets, based on indications of value received during the sale process. In November 2003, Safeway announced that it was taking Dominick's off the market. Safeway reclassified Dominick's from an "asset held for sale" to "asset held and used... -

Page 65

... of assets other than in the ordinary course of business. Additionally, the Company is required to maintain a minimum Adjusted EBITDA, as defined in the Credit Agreement, to interest expense ratio of 2.0 to 1 and not exceed an Adjusted Debt (total consolidated debt less cash and cash equivalents... -

Page 66

... in the bank credit agreement plus a pricing margin based on the Company's debt rating or interest coverage ratio (the "Pricing Margin"); or (3) rates quoted at the discretion of the lenders. Canadian borrowings denominated in U.S. dollars carry interest at one of the following rates selected by the... -

Page 67

... at year-end 2005, of which $38.4 million were issued under the bank credit agreement. The letters of credit are maintained primarily to support performance, payment, deposit or surety obligations of the Company. The Company pays commissions ranging from 0.15% to 1.00% on the face amount of the... -

Page 68

...63.1 8.0 (0.5) (21.9) $442.4 Commercial paper Bank credit agreement Other bank borrowings Mortgage notes payable 9.30% Senior Secured Debentures 3.625% Senior Notes 6.05% Senior Notes 6.85% Senior Notes 7.25% Senior Notes 2.50% Senior Notes Floating Rate Senior Notes 3.80% Senior Notes 6.15% Senior... -

Page 69

... shares of treasury stock). Stock Option Plans Under Safeway's stock option plans, the Company may grant incentive and non-qualified options to purchase common stock at an exercise price equal to or greater than the fair market value at the grant date, as determined by the Executive Compensation... -

Page 70

SAFEWAY INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements Activity in the Company's stock option plans for the three-year period ended December 31, 2005 was as follows: Weighted average exercise price $ 31.70 Aggregate intrinsic value (in millions) Outstanding, year-end 2002 2003 ... -

Page 71

... Company's dividend policy at the time the options were granted. The Company recognized stock-based compensation expense of $59.7 million ($0.08 per diluted share) during fiscal 2005 as a component of operating and administrative expense. Had compensation cost for Safeway's stock option plans been... -

Page 72

...as follows (dollars in millions): 2005 Statutory rate Income tax expense using federal statutory rate State taxes on income net of federal benefit Nondeductible goodwill impairment Equity earnings of foreign affiliates Charitable donations of inventory Affiliate's losses not currently benefitted Tax... -

Page 73

... Consolidated Financial Statements Significant components of the Company's net deferred tax liability at year-end were as follows (in millions): 2005 Deferred tax assets: Workers' compensation and other claims Reserves not currently deductible Accrued claims and other liabilities Employee benefits... -

Page 74

... the Safeway retirement plan. Genuardi's and Vons' retirement plans have been combined with Safeway's for financial statement presentation. The following tables provide a reconciliation of the changes in the retirement plans' benefit obligation and fair value of assets over the two-year period ended... -

Page 75

... used to determine net periodic benefit cost were as follows: 2005 Discount rate: United States plans Canadian plans Combined weighted average rate Expected return on plan assets: United States plans Canadian plans Rate of compensation increase: United States plans Canadian plans 5.8% 5.8 5.8 2004... -

Page 76

...Pensions In addition to the Company's retirement plans and the Retirement Restoration Plan benefits, the Company sponsors plans that provide postretirement medical and life insurance benefits to certain employees. Retirees share a portion of the cost of the postretirement medical plans. Safeway pays... -

Page 77

... the Company filed in the Superior Court for Alameda County, California. There can be no assurance that the pending claims will be settled or otherwise disposed of for amounts and on terms comparable to those settled to date. Safeway continues to believe that coverage under its insurance policy will... -

Page 78

...about the total numbers of leases from these divestitures that are still outstanding is not available. Based on an internal assessment by the Company, performed by taking the original inventory of assigned leases at the time of the divestitures and accounting for the passage of time, Safeway expects... -

Page 79

... proceeds from exercise of options to purchase common shares $ Common stock price used under the treasury stock method $ Common shares assumed purchased with potential proceeds average shares outstanding. 65.4 22.09 $ 192.8 $ 21.26 3.0 9.1 Anti-dilutive shares totaling 28.4 million in 2005... -

Page 80

... related to closing 26 under-performing Texas stores and a $23.0 million after-tax charge for an employee buyout in Dominick's and Northern California. Net income for the third 12 weeks of 2005 includes a $33.9 million after-tax impairment charge relating to 26 under-performing Texas stores closed... -

Page 81

... Act reports is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to the Company's management, including its President and Chief Executive Officer and Chief Financial Officer, as... -

Page 82

... www.safeway.com/investor_relations. The Code of Ethics applies to the Company's principal executive officer, principal financial officer, principal accounting officer, controller and other persons who perform similar functions for the Company, in addition to the corporate directors and employees of... -

Page 83

SAFEWAY INC. AND SUBSIDIARIES Item 14. Principal Accounting Fees and Services The information called for by Item 14 is incorporated by reference from the Company's definitive proxy statement for the 2006 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A under the Exchange Act ... -

Page 84

... 8 of this report. 2. Consolidated Financial Statement Schedules: None required. 3. The following exhibits are filed as part of this report: Agreement and Plan of Merger, dated as of July 22, 1999, among Safeway Inc., SI Merger Sub, Inc. and Randall's Food Markets Inc. (incorporated by reference to... -

Page 85

...Item 15. Exhibits, Financial Statement Schedules (continued) Exhibit 4(i).3 Form of Officers' Certificate relating to the Company's Fixed Rate Medium-Term Notes and the Company's Floating Rate Medium-Term Notes, form of Fixed Rate Note and form of Floating Rate Note (incorporated by reference to... -

Page 86

... Restated Stock Option Plan of Dominick's Supermarkets, Inc. (incorporated by reference to Exhibit 4.5 to registrant's Registration on Form S-8 No. 333-67575 dated November 19, 1998). The 2001 Amended and Restated Operating Performance Bonus Plan for Executive Officers of Safeway Inc. (incorporated... -

Page 87

...dated February 17, 1993, to The Vons Companies, Inc. 1990 Stock Option and Restricted Stock Plan (incorporated by reference to Exhibit 10.13.1 to The Vons Companies, Inc. Form 10-Q for the quarterly period ended March 28, 1993). Safeway Executive Deferred Compensation Plan and Deferral Election Form... -

Page 88

... Agreement dated as of June 1, 2005 by and among Safeway Inc., Canada Safeway Limited, Banc of America Securities LLC and J.P. Morgan Securities Inc., as joint lead arrangers, Deutsche Bank AG New York Branch, as administrative agent, Bank of America, N.A., JPMorgan Chase Bank, National Association... -

Page 89

... Stock Agreement (incorporated by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K filed on February 28, 2006). Computation of Earnings per Share (set forth in Part II, Item 8 of this report). Computation of Ratio of Earnings to Fixed Charges. Safeway Inc. Code of Business... -

Page 90

... 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SAFEWAY INC. By: /s/ Steven A. Burd Steven A. Burd Chairman, President and Chief Executive Officer KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears... -

Page 91

SAFEWAY INC. AND SUBSIDIARIES Director /s/ Rebecca A. Stirn Rebecca A. Stirn /s/ William Y. Tauscher William Y. Tauscher /s/ Raymond G. Viault Raymond G. Viault Date: March 10, 2006 March 10, 2006 March 10, 2006 71 -

Page 92

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: March 10, 2006 /s/ Steven A. Burd Steven A. Burd Chairman, President and Chief Executive Officer... -

Page 93

... presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and 3. 4. (d) Disclosed in this report any change in the registrant's internal control over financial reporting... -

Page 94

... hereof, regardless of any general incorporation language in such filing. A signed original of this written statement as required by Section 906 has been provided to Safeway Inc., and will be retained by Safeway Inc. and furnished to the Securities and Exchange Commission or its staff upon request... -

Page 95

... filed with the Securities and Exchange Commission can be accessed online at www.safeway. com/investor_relations. Alternately, a copy of the form may be obtained by writing to the Investor Relations Department at our executive offices or by calling 925-467-3790. Certifications The company submitted... -

Page 96

P.O. Box 99 Safeway Inc. Pleasanton, CA 94566-0009 www.safeway.com