Porsche 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

of 750 Euro. In the final days of the review year, the rate for

Porsche’s stock rose further to 767 Euro and then, at the

beginning of the new 2006/07 fiscal year, it reached more

than 800 Euro.

The stock also benefited from Porsche’s close contacts with

participants on the financial markets. The company’s develop-

ment was, for example, explained in detail to institutional in-

vestors and analysts at roadshows held at the most important

financial centers at home and abroad as well as during intensive

discussions at Porsche’s headquarters in Zuffenhausen. These

activities resulted repeatedly in a commitment to Porsche stock.

Investors and analysts were above all impressed by the sales

successes achieved in particular by the new sports cars. They

were no less enthusiastic about the prospects arising from

reinforced cooperation with Volkswagen. Consequently, the

overwhelming majority of financial market experts continued

to recommend the purchase of Porsche stock. Some invest-

ment banks increased their stock price forecasts for Porsche

shares to 900 through 1,000 Euro; one institution went as far

as to indicate a target of 911. Other analysts went even further,

with the highest target set in this accounting year running

1,100 Euro.

Outstanding Long-term Increase in Value

In the long term, an excellent performance can be expected

from Porsche stock. Looking at the quoted price for the past

ten fiscal years, i.e. the quoted price on the last day of each

annual period from July 31, 1996 to July 31, 2006, the price

has risen from 43.46 Euro to 767.00 Euro, an increase of

1,665 percent compared with the Dax’s increase of only 228

percent.

The increase in value of a shareholding with Porsche stock

over the same ten-year period was equally positive. If a sum

of 10,000 Euro had been invested in the sports car manu-

facturer’s shares on July 31, 1996, it would have increased to

176,484 Euro (including dividends) by July 31, 2006.

Increased Profit per Share

Porsche AG’s earnings situation improved yet again, as is

reflected in the increased profit per share. At 78.22 Euro, the

profit per share exceeds the prior-year value by 44.74 Euro.

Dividends are also set to swell: the shareholders’ general meet-

ing will be recommended to distribute a dividend of 8.94 Euro

for each common-stock share – 5.94 Euro plus a 3.00 Euro

special dividend – and 9.00 Euro for each preferred-stock share –

6.00 Euro plus a 3.00 Euro special dividend – for the fiscal year

2005/06. The previous year saw dividends of 4.94 Euro per

common-stock share and 5.00 Euro preferred-stock share. The

sum to be distributed as dividends to common- and preferred-

stock shareholders rose by 80.5 percent to 157 million Euro in

the previous fiscal year. The distribution quota stands at 10.6

percent (previous year: 11.2 percent).

Intensive Investor Relations

The high interest in Porsche has again grown significantly since

the company’s participation in Volkswagen AG. Porsche re-

sponded to the need for information and paid even greater at-

tention to investors and financial analysts in the 2005/06 fiscal

year. This communication often took the form of direct contact

with the financial market participants, in numerous individual

meetings, at roadshows, vehicle demos, trade fairs and events

for private investors. Equal emphasis was placed on compre-

hensive reporting in the media. In all its contacts, the company

attached great importance to “speaking with one voice”, in

other words to coordinated communication with both the ge-

neral public and the financial world.

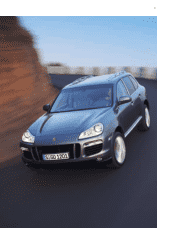

Current figures and the company’s strategy were explained

to analysts and investors at several special conferences,

including driving presentations of new models – for example,

the presentation of the Cayenne Turbo S in Dubai and the new

911 Turbo in Spain. There was also the analysts’ conference

in December 2005, at which the annual accounts were pre-

sented. In addition, personal meetings were held throughout

the review year with institutional investors at the company’s

headquarters in Zuffenhausen. On-site company presentations

played a special role in contacts with institutional investors.