Porsche 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

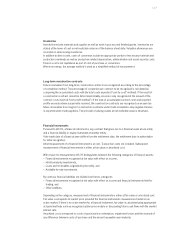

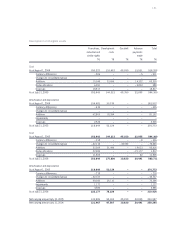

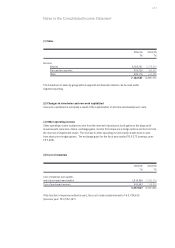

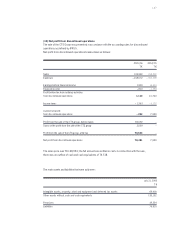

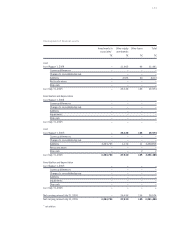

125

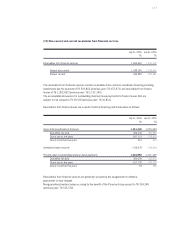

2005/06 2004/05

T€ T€

Income from equity investments – 401

Other interest and similar income 181,098 171,906

Other interest and similar expenses – 158,448 – 125,554

Interest expenses from compounding of provisions – 40,468 – 31,590

Interest and similar expenses – 198,916 – 157,144

Other financial result 10,955 4,886

– 6,863 20,049

(8) Other financial income

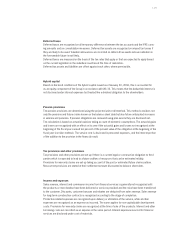

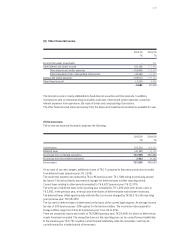

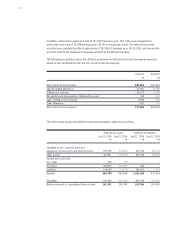

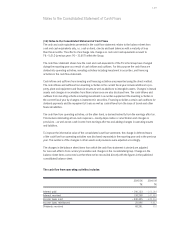

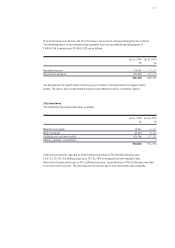

On account of tax rate changes, additional income of T€ 17 compared to the previous year was recorded

from deferred taxes (previous year: T€ 1,009).

The current tax expense was reduced by T€ 2,196 (previous year: T€ 1,548) owing to previously unused

tax losses. This did not lead to any material changes for deferred taxes in either reporting period.

Current taxes relating to other periods amounted to T€ 4,632 (previous year: T€ 12,079).

The write-ups of deferred taxes in the reporting year amounted to T€ 1,690 while write-downs came to

T€ 2,893. In the previous year, write-ups and write-downs of deferred taxes had not been necessary.

The deferred taxes offset against equity without effect on income changed by T€ 38,375 in the reporting

year (previous year: T€ 128,325).

The tax rate for deferred taxes is determined on the basis of the current legal situation. An average income

tax rate of 39% (previous year: 39%) applies for the German entities. The income tax rates applied for

foreign entities range from 0% to 41% (previous year: from 0% to 41%).

There are unused tax losses and credits of T€ 8,848 (previous year: T€ 29,469), for which no deferred tax

assets have been recorded. The unused tax losses in the reporting year can be carried forward indefinitely.

In the previous year T€ 2,793 could be carried forward indefinitely, while the remainder could only be

carried forward for a limited period of three years.

The interest income is mainly attributable to fixed-interest securities and time deposits. In addition,

it includes income on interest-bearing receivables and loans. Interest and similar expenses comprises

interest expenses from operations, the issue of bonds and compounding of provisions.

The other financial result stems exclusively from the disposal of investments classified as available for sale.

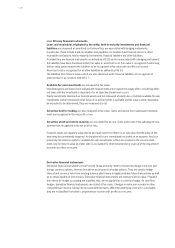

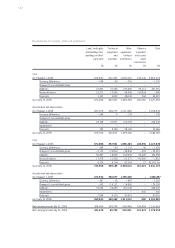

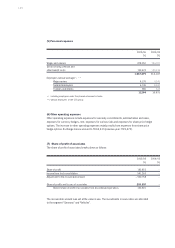

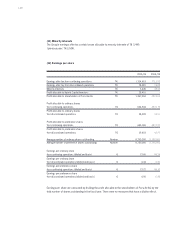

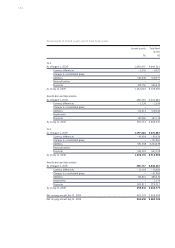

(9) Income taxes

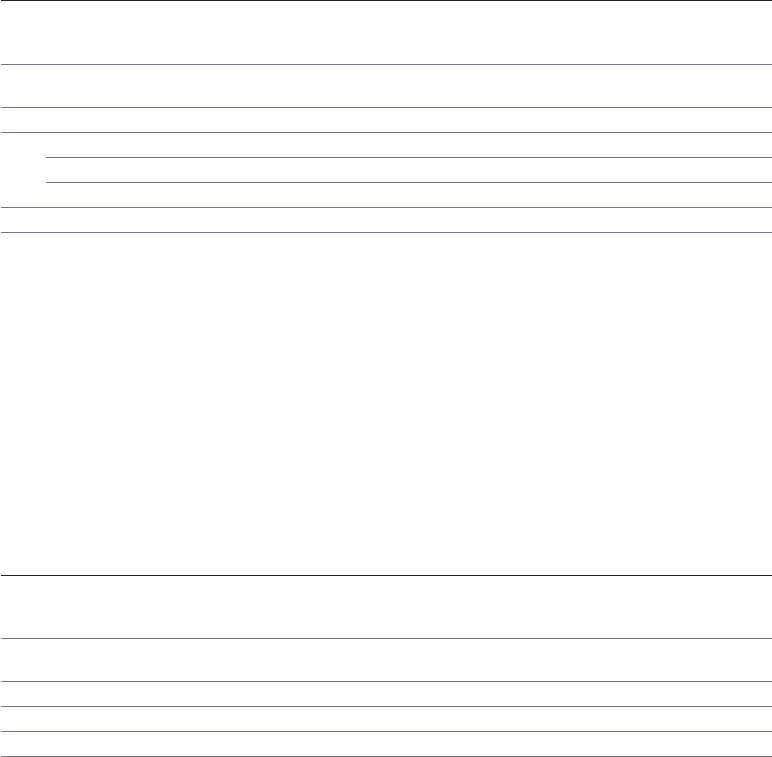

The income tax expense disclosed comprises the following:

2005/06 2004/05

T€ T€

Current taxes 572,230 463,027

Deferred taxes 141,348 – 10,129

Income tax from continuing operations 713,578 452,898

Income tax from discontinued operations 3,422 6,102

Income taxes 717,000 459,000