Porsche 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

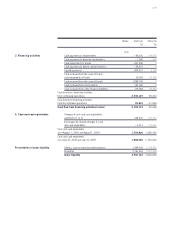

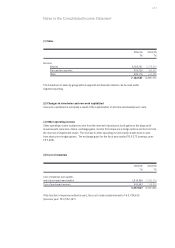

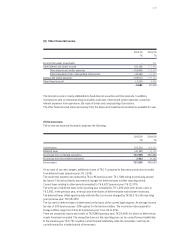

Deferred taxes

Deferred taxes are recognized on all temporary differences between the tax accounts and the IFRS carry-

ing amounts and on consolidation measures. Deferred tax assets are recognized on unused tax losses if

they are likely to be used. Valuation allowances are recorded on deferred tax assets whose realization in

the foreseeable future is not likely.

Deferred taxes are measured on the basis of the tax rates that apply or that are expected to apply based

on the current legislation in the individual countries at the time of realization.

Deferred tax assets and liabilities are offset against each other, where permissible.

Hybrid capital

Based on the bond conditions of the hybrid capital issued as of January 30, 2006, this is accounted for

as an equity component of the Group in accordance with IAS 32. This means that the deductible interest is

not disclosed under interest expenses but treated like a dividend obligation to the shareholders.

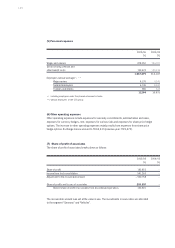

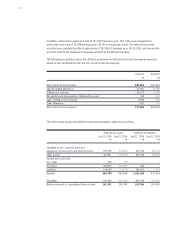

Pension provisions

The pension provisions are determined using the projected unit credit method. This method considers not

only the pensions and future claims known on the balance sheet date but also future anticipated increases

in salaries and pensions. If pension obligations are reinsured using plan assets they are disclosed net.

The calculation is based on actuarial opinions taking account of biometric assumptions. The actuarial gains

and losses are recognized with an effect on income if the actuarial gains and losses not recognized at the

beginning of the fiscal year exceed ten percent of the present value of the obligation at the beginning of the

fiscal year (corridor method). The service cost is disclosed in personnel expenses, and the interest portion

of the addition to the provision in the financial result.

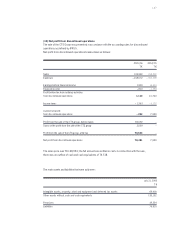

Tax provisions and other provisions

Tax provisions and other provisions are set up if there is a current legal or constructive obligation to third

parties which is expected to lead to a future outflow of resources that can be estimated reliably.

Provisions for warranty claims are set up taking account of the past or estimated future claims pattern.

Non-current provisions are stated at their settlement amount discounted to balance sheet date.

Income and expenses

Sales revenue, interest and commission income from financial services is generally not recognized until

the products or merchandise have been delivered or services provided and the risks have been transferred

to the customer. Discounts, customer bonuses and rebates are deducted from sales revenue. Sales revenue

for long-term construction contracts is recognized according to the stage of completion.

Production-related expenses are recognized upon delivery or utilization of the service, while all other

expenses are recognized as an expense as incurred. The same applies for non-capitalizable development

costs. Provisions for warranty claims are recognized at the time of sale of the products. Interest and other

borrowing costs are recorded as an expense in the same period. Interest expenses incurred for financial

services are disclosed under cost of materials.