Porsche 2005 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

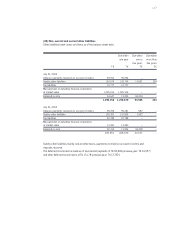

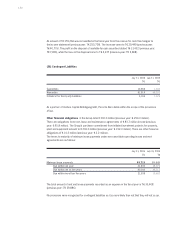

As of July 31, 2006, other comprehensive income contains a total of T€ 113,705 (previous year:

T€ 179,304) recorded without effect on income from measurement at market value. Of the change in

measurement at market value recorded in equity of T€ – 65,599 (previous year: T€ – 188,763),

an amount of T€ – 21,075 (previous year: T€ 21,319) is due to the decrease (previous year: increase)

in the reserve for the available-for-sale financial assets and T€ 44,524 (previous year: T€ – 210,082)

to the decrease in the reserve for cash flow hedges.

The market value of the financial derivatives is disclosed in the balance sheet under other receivables

and assets or other liabilities. The currency hedges for the Canadian dollars and pound sterling are due

within four years, and those for other currencies within three years.

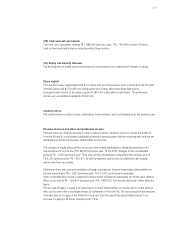

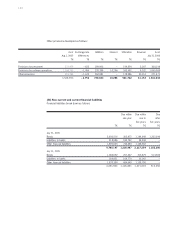

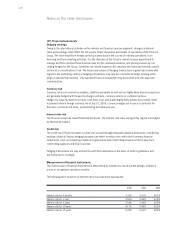

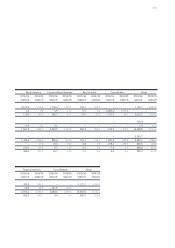

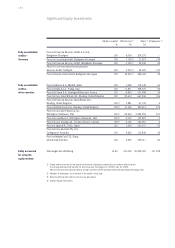

Nominal volume of the derivative financial instruments:

July 31, 2006 July 31, 2005

Nominal Total market Nominal Total market

volume value volume value

T€ T€ T€ T€

Currency hedge 8,276,098 389,003 10,729,102 645,645

Interest hedge 1,292,744 34,692 2,001,750 41,944

Share price hedge 2,628,055 870,437 116,501 11,093

12,196,897 1,294,132 12,847,353 698,682

Currency hedge 1,441,224 9,572 341,293 11,298

Interest hedge 886,812 34,817 96,623 2,092

Share price hedge 2,441,025 980,716 – –

4,769,061 1,025,105 437,916 13,390

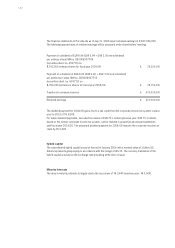

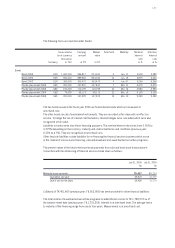

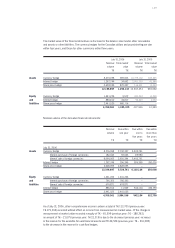

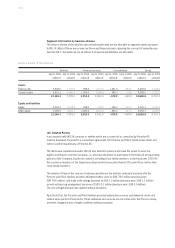

Nominal Due within Due within Due within

volume one year one to more than

five years five years

T€ T€ T€ T€

July 31, 2006

Currency hedge 8,276,098 2,742,357 5,533,741 –

thereof purchase of foreign currencies 182,043 92,063 89,980 –

thereof sale of foreign currencies 8,094,055 2,650,294 5,443,761 –

Interest hedge 1,292,744 356,349 586,395 350,000

Share price hedge 2,628,055 2,628,055 – –

12,196,897 5,726,761 6,120,136 350,000

Currency hedge 1,441,224 1,441,224 – –

thereof purchase of foreign currencies 766,353 766,353 – –

thereof sale of foreign currencies 674,871 674,871 – –

Interest hedge 886,812 11,949 542,104 332,759

Share price hedge 2,441,025 2,441,025 – –

4,769,061 3,894,198 542,104 332,759

Assets

Equity

and

liabilities

Assets

Equity

and

liabilities