Porsche 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.139

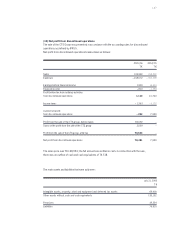

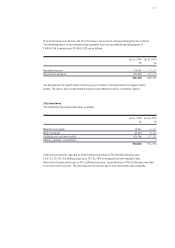

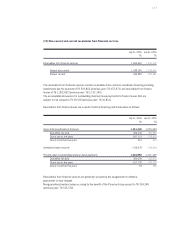

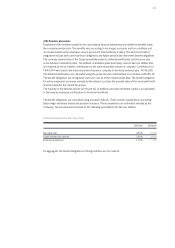

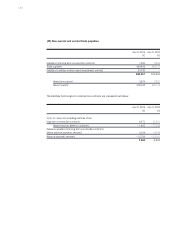

(20) Cash and cash equivalents

Cash and cash equivalents totaling T€ 1,988,550 (previous year: T€ 1,754,930) consist of checks,

cash on hand and bank balances maturing within three months.

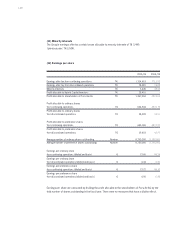

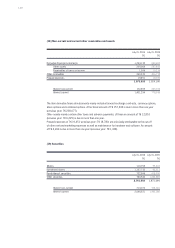

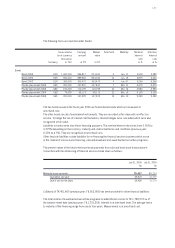

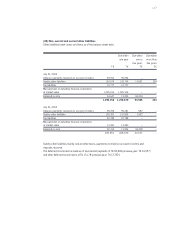

(21) Equity and minority interests

The development of equity and minority interests is presented in the statement of changes in equity.

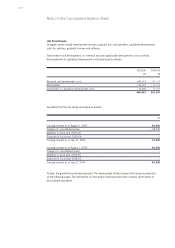

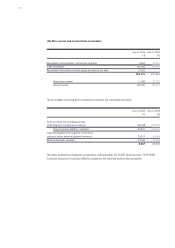

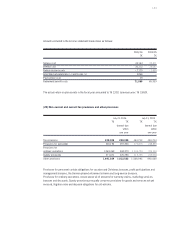

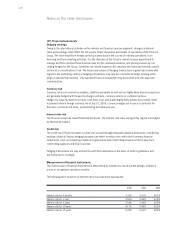

Share capital

Porsche AG’s share capital totals EUR 45.5 million and, as in the previous year, is divided into 8,750,000

ordinary shares and 8,750,000 non-voting preference shares which have been fully paid in.

A proportionate amount of the share capital of EUR 2.60 is allocable to each share. The preference

shares carry an additional dividend of EUR 0.06.

Capital reserve

The capital reserve contains solely contributions from premiums and is unchanged since the previous year.

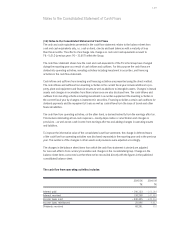

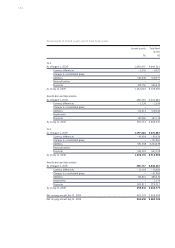

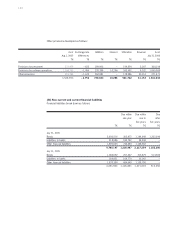

Revenue reserves and other comprehensive income

Revenue reserves relate exclusively to other revenue reserves. Revenue reserves include the profits of

Porsche AG and its consolidated subsidiaries earned in previous years and the reporting year and not yet

distributed as well as transactions without effect on income.

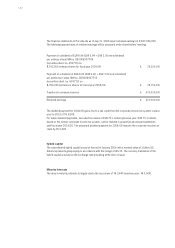

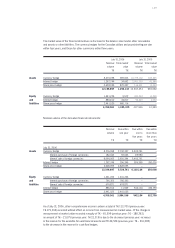

The changes in equity without effect on income were mainly attributable to dividend payments to the

shareholders of Porsche AG of T€ 86,975 (previous year: T€ 69,475), changes to the consolidated

group of T€ – 1,815 (previous year: T€ 0) and currency fluctuations compared to the previous year of

T€ 4,321 (previous year: T€ – 30,197), as well as expenses and income recorded directly in equity

and income from associates.

Differences from the currency translation of foreign subsidiaries’ financial statements without effect on

income amounting to T€ – 1,821 (previous year: T€ 10,532) are disclosed separately.

Other comprehensive income contains the measurement of financial instruments at market value without

effect on income of T€ – 126,907 (previous year: T€ – 188,763). The amount disclosed is after deferred

taxes.

The pro rata changes in equity from associates recorded without effect on income are recorded without

effect on income in the consolidated financial statements of Porsche AG. The total amount of the amounts

recorded directly in equity in the 2005/06 fiscal year from the use of the equity method leads to an

increase in equity by T€ 6,161 (previous year: T€ 0).