Porsche 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

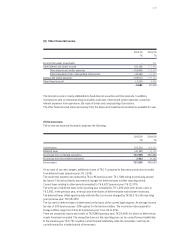

Primary financial instruments

Loans and receivables originated by the entity, held-to-maturity investments and financial

liabilities are measured at amortized cost unless they are associated with hedging instruments.

In particular, these include trade receivables and payables, receivables from financial services, other

receivables and assets, held-to-maturity investments, financial liabilities and other liabilities.

Provided they are financial instruments as defined by IAS 39 and not associated with a hedging instrument,

the liabilities have been disclosed at their fair value or amortized cost. Fair value is recognized if exercising

the fair value option requires the liabilities to be recognized at fair value with an effect on income.

Amortized cost is recognized for all other liabilities as defined by IAS 39.

The liabilities from finance leases which are also disclosed under financial liabilities are recognized at

present value in accordance with IAS 17.

Available-for-sale investments are measured at fair value.

Unrealized gains and losses from subsequent measurement are recognized in equity after considering defer-

red taxes until the investment is disposed of or an objective impairment occurs.

Equity investments disclosed as financial assets and not measured at equity also constitute available-for-sale

investments and are measured at fair value. If no active market is available and fair value cannot reasonably

be expected to be determined, they are measured at cost.

Securities held for trading are also measured at fair value. Gains and losses from subsequent measure-

ment are recognized in the net profit or loss.

Securities which are held to maturity are accounted for at cost. Gains and losses from subsequent mea-

surement are recognized in the net profit or loss.

Financial assets are regularly subjected to an impairment test if there is an indication that the value of the

asset may be permanently impaired. An impairment loss is immediately recorded as an expense. Any loss

previously recorded in equity for available-for-sale investments is then also posted to the income state-

ment. Any increase in value at a later date is accounted for debt instruments by reversal of the impairment

loss with an effect on income.

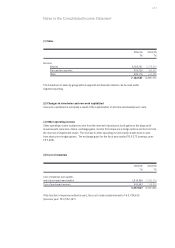

Derivative financial instruments

Derivative financial instruments in the Porsche Group primarily relate to forward exchange contracts and

foreign currency options, interest derivatives and share price hedge options. They are used to hedge

interest and currency risks from existing balance sheet items or highly probable future transactions as well

as to obtain liquidity at short notice. Derivative financial instruments are measured at fair value. Provided

the criteria for hedge accounting are satisfied, they are recognized as a cash flow hedge. As cash flow

hedges, derivative financial instruments are stated at fair value. Changes in value are recorded in other

comprehensive income, taking into account deferred taxes. When the underlying contract is concluded,

they are reclassified from other comprehensive income with an effect on income.