Porsche 2005 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

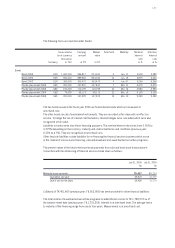

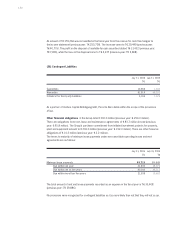

The two bonds issued in the fiscal year 2006 are fixed-interest bonds which are measured at

amortized cost.

The other bonds are also fixed-interest instruments. They are recorded at fair value with an effect on

income. To hedge the risk of interest rate fluctuation, interest hedges were concluded which were also

recognized at fair value.

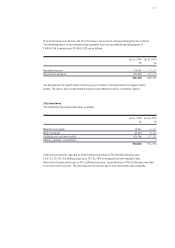

Liabilities to banks serve short-term financing purposes. The nominal interest rate varies from 0.50% to

4.375% depending on the currency, maturity and contractual terms and conditions (previous year:

0.25% to 4.5%). They are recognized at amortized cost.

Other financial liabilities include liabilities for re-financing the financial services business which arose

in the context of non-recourse financing, sale-and-leaseback and asset-backed securities programs.

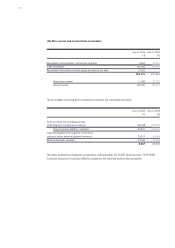

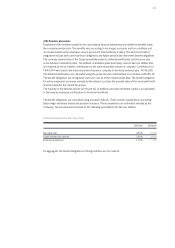

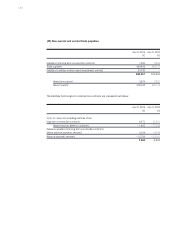

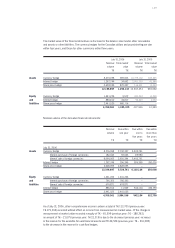

The present values of the future minimum lease payments from sale and lease back transactions in

connection with the refinancing of financial services break down as follows:

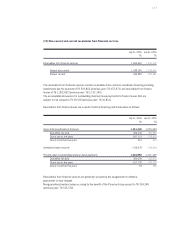

Collateral of T€ 401,465 (previous year: T€ 362,950) has been provided for other financial liabilities.

The total volume of asset-backed securities programs included therein comes to T€ 1,798,533 as of

the balance sheet date (previous year: T€ 1,715,205). Interest is at inter-bank level. The average terms

to maturity of the financing range from one to four years. Measurement is at amortized cost.

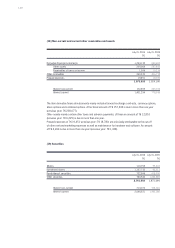

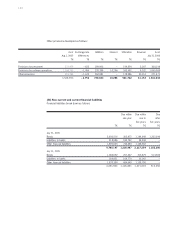

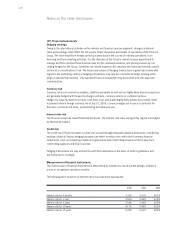

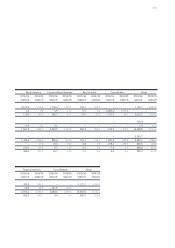

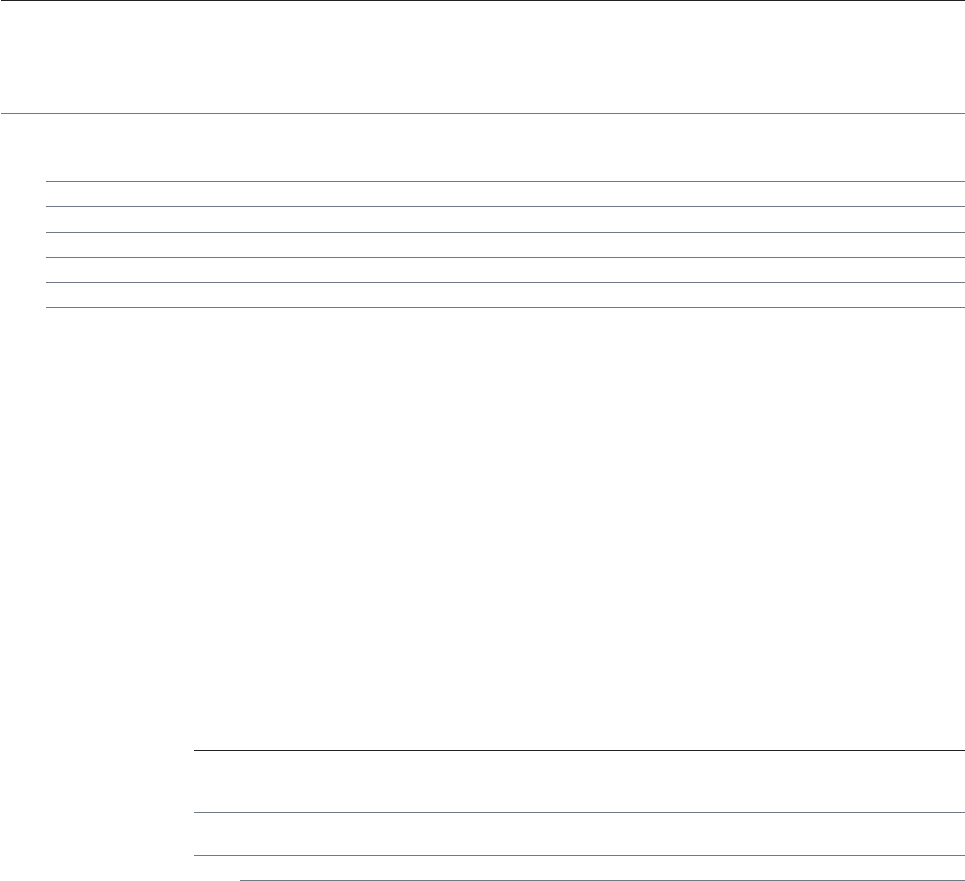

The following items are reported under bonds:

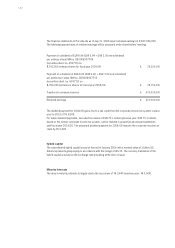

Issue volume Carrying Market Total term Maturity Nominal Effective

local currency amount value interest interest

thousands rate rate

Currency in TLC in T€ in T€ in % in %

Bonds

Bond 2006 EUR 1,000,000 996,817 973,000 5 Jan. 11 3.500 3.580

Bond 2006 EUR 900,000 889,862 843,030 10 Jan. 16 3.875 4.020

Bond 2002 EUR 300,000 303,472 303,472 5 Jun. 07 5.250 5.250

Private placement 2004 USD 200,000 147,831 147,831 7 Mrz. 11 4.470 4.470

Private placement 2004 USD 150,000 110,199 110,199 10 Mrz. 14 4.980 4.980

Private placement 2004 USD 75,000 55,113 55,113 12 Mrz. 16 5.130 5.130

Private placement 2004 USD 200,000 147,222 147,222 15 Mrz. 19 5.330 5.330

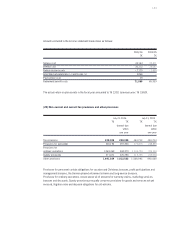

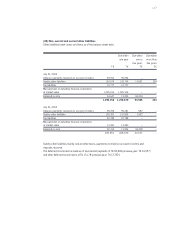

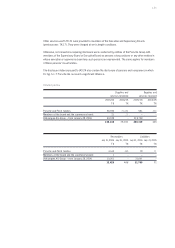

July 31, 2006 July 31,2005

T€ T€

Minimum lease payments 75,427 80,113

Due within one year 39,519 40,099

Due in one to five years 35,908 40,014