Porsche 2005 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

142

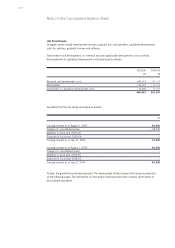

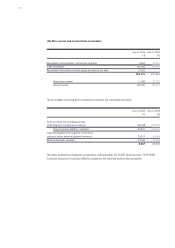

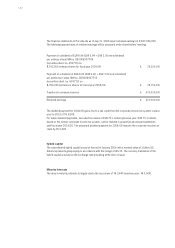

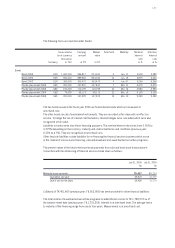

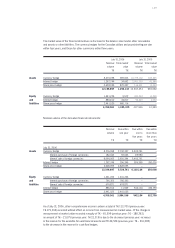

The carrying amount posted to the balance sheet for pension provisions and similar obligations

developed as follows compared to the previous year:

2005/06 2004/05

T€ T€

Carrying amounts as of August 1, 2005 and August 1, 2004 596,264 550,817

Changes in consolidated group – 6,842 –

Retirement benefit costs 71,085 49,303

Benefit payments made – 17,331 – 16,193

Contributions to funds 1,213 44

Employee contributions to company pension plan 14,354 12,293

Carrying amounts as of July 31, 2006 and July 31, 2005 658,743 596,264

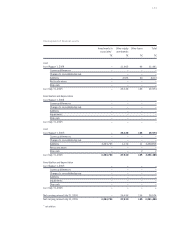

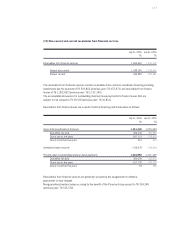

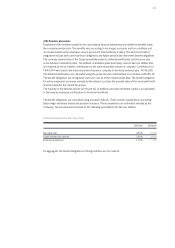

July 31, 2006 July 31, 2005

T€ T€

Present value of benefit obligations financed by provisions 709,664 719,183

Present value of funded benefit obligations 49,004 44,131

Projected benefit obligations 758,668 763,314

Fair value of plan assets – 37,309 – 32,476

Net obligations 721,359 730,838

Unrecognised actuarial gains (+) and losses (–) – 63,572 – 134,574

Unrecognised past service costs 956 –

Carrying amount as of July 31, 2006 and July 31, 2005 658,743 596,264

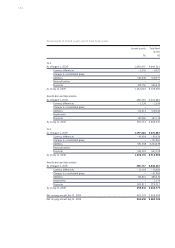

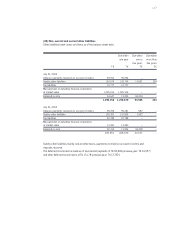

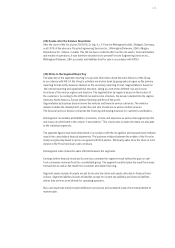

The company uses the ten percent corridor rule to measure the pension provisions and determine the

pension expenses. Actuarial gains and losses are not taken into account provided they do not exceed

ten percent of the commitment or ten percent of the fair value of the existing plan assets.

The amount in excess of the corridor is distributed over the average residual service period of the active

workforce and recorded in the profit and loss. Due to unrecognized actuarial losses, the pension provisions

shown on the face of the balance sheet are lower than the present value of the pension commitment.

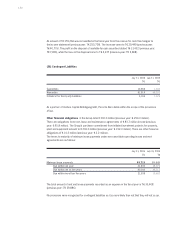

The net benefit obligations are as follows: