Porsche 2005 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166

|

|

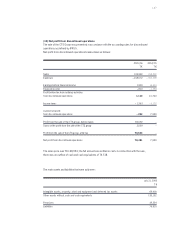

126

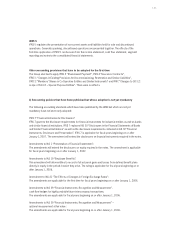

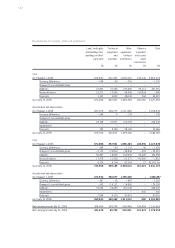

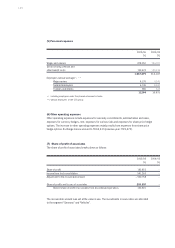

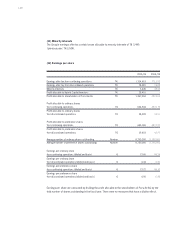

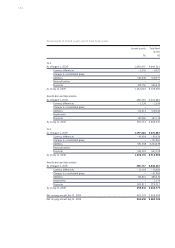

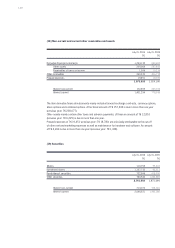

2005/06 2004/05

T€ T€

Expected income tax expense 822,900 482,820

Tax rate related differences – 30,381 – 28,066

Difference in tax base – 85,632 4,090

Recognition and measurement of deferred tax assets 768 967

Taxes relating to other periods 9,896 – 961

Other differences – 551 150

Reported income tax expense 717,000 459,000

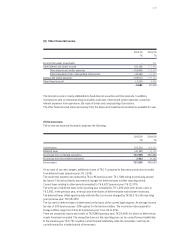

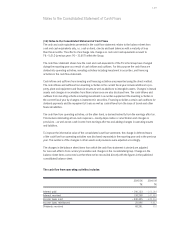

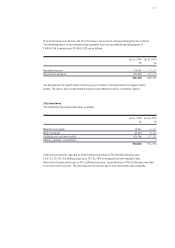

Deferred tax assets Deferred tax liabilities

July 31, 2006 July 31, 2005 July 31, 2006 July 31, 2005

T€ T€ T€ T€

Intangible assets, property, plant and

equipment, leased assets and financial assets 232,796 218,683 430,723 284,343

Other assets 300,821 150,655 387,423 340,564

Unused tax losses and

tax credits 444 785 – –

Provisions 255,652 252,897 642 –

Liabilities 194,082 13,639 205,520 7,337

Subtotal 983,795 636,659 1,024,308 632,244

Offsetting – 842,544 – 451,895 – 842,544 – 451,895

Balance pursuant to consolidated balance sheet 141,251 184,764 181,764 180,349

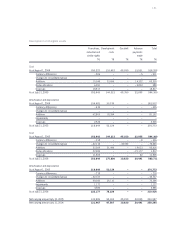

The deferred tax assets and liabilities break down by balance sheet item as follows.

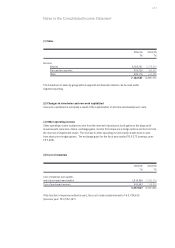

In addition, deferred tax assets of a total of T€ 3,443 (previous year: T€ 1,126) were recognized on

unused tax losses and of T€ 244 (previous year: T€ 14) on unused tax credits. No deferred taxes were

recorded on accumulated profits at subsidiaries of T€ 18,614 (previous year: T€ 30,336), as these profits

are to be used for the expansion of business activities at the different locations.

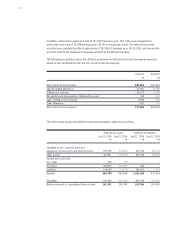

The following reconciliation shows the differences between the theoretical income tax expense expected

based on the calculated tax rate and the current income tax expense: