Porsche 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122

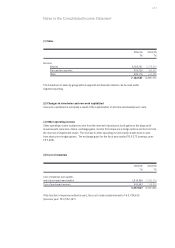

Amendments to IAS 39 “Financial Instruments: Recognition and Measurement” and IFRS 4 “Insurance

Contracts” – financial guarantees and loan commitments:

Following the revision of IAS 39 and IFRS 4, financial guarantees fall under the scope of IAS 39 only.

In the past, financial guarantees had been subject - depending on their structure – either to IAS 39 or to

IFRS 4. The amendments are applicable for fiscal years beginning on or after January 1, 2006.

IFRS 6 “Exploration for and Evaluation of Mineral Resources” and amendments to IFRS 1 and IFRS 6:

These amendments are applicable for the first time for fiscal years beginning on or after January 1,2006.

IFRIC 4 “Determining whether an Arrangement contains a Lease” and IFRIC 5 “Rights to Interests

Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds”:

These interpretations are applicable for the first time for fiscal years beginning on or after

January 1, 2006.

IFRIC 6 “Liabilities arising from Participating in a Specific Market – Waste Electrical and Electronic

Equipment”:

The interpretation is applicable for fiscal years beginning on or after January 1, 2006.

IFRIC 7 “Applying the Restatement Approach under IAS 29 “Financial Reporting in Hyperinflationary

Economies”:

This interpretation is applicable for the first time for fiscal years beginning on or after January 1, 2007.

IFRIC 8 “Scope of IFRS 2”:

The amendments are applicable for the first time for fiscal years beginning on or after May 1, 2006.

IFRIC 9 “Reassessment of Embedded Derivatives”:

The interpretations are applicable for the first time for fiscal years beginning on or after June 1, 2006.

IFRIC 10 “Interim Financial Report and Impairment”:

This interpretation is applicable for the first time for fiscal years beginning on or after November 1, 2006.

These changes to the accounting principles are not expected to have a major effect on future

consolidated financial statements.