Neiman Marcus 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

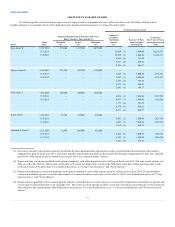

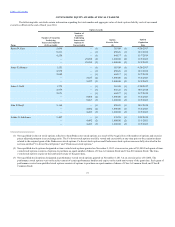

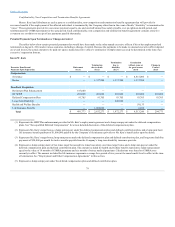

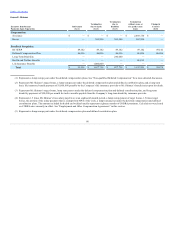

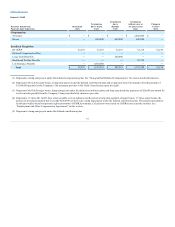

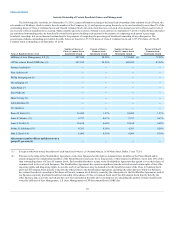

The amounts reported in the table below represent deferrals, distributions and Company matching contributions credited pursuant to the KEDC Plan

and Company contributions credited pursuant to the DC SERP (the Executive Contributions). As a result of the Acquisition, all amounts then held by

participants in the DC SERP and the KEDC were paid out effective October 25, 2013. The aggregate balance at fiscal year-end consists of amounts earned

and contributed since October 26, 2013.

Karen W. Katz

KEDC 205,548

50,650

18,556

2,379,391

93,705

DC SERP —

350,073

11,300

1,241,358

201,068

James E. Skinner

KEDC 70,011

26,292

6,545

806,781

46,096

DC SERP —

135,024

6,592

831,528

49,142

James J. Gold

KEDC —

—

—

—

—

DC SERP —

110,330

6,807

835,632

52,210

John E. Koryl

KEDC —

—

—

—

—

DC SERP —

69,702

393

56,149

18,190

Joshua G. Schulman

KEDC —

—

—

—

—

DC SERP —

—

—

—

—

(1) The amounts reported as Executive Contributions in Last Fiscal Year are also included as Salary in the Summary Compensation Table.

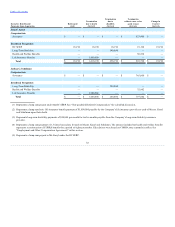

The KEDC Plan allows eligible employees to elect to defer up to 15% of base pay and up to 15% of annual performance bonus each year. Eligible

employees generally are those employees who have completed one year of service with us, have annual base pay of at least $300,000 and are otherwise

designated as eligible by our employee benefits committee; provided, however, that effective January 1, 2008, only those persons who were eligible for the

KEDC as of January 1, 2007 are permitted to continue participating in the KEDC. No new participants will be added. We also credit a matching contribution

each pay period equal to (A) the sum of 1) 100% of the sum of the employee’s KEDC Plan deferrals and the maximum RSP deferral that the employee could

have made under such plan for such pay period, to the extent that such sum does not exceed 2% of the employee’s compensation for such pay period, and 2)

25% of the sum of the employee’s KEDC Plan deferrals and the maximum RSP, as applicable, deferral that the employee could have made under such plan for

such pay period, to the extent that such sum does not exceed the next 4% of the employee’s compensation for such pay period, minus (B) the maximum

possible match the employee could have received under the RSP, as applicable, for such pay period. Such amounts are credited to a bookkeeping account for

the employee and are fully vested with respect to matching contributions made for calendar years prior to 2008. Amounts attributable to matching

contributions, plus interest thereon, for calendar years on and after 2008 are subject to forfeiture in the event the employee is terminated for cause. Accounts

are credited monthly with interest at an annual rate equal to the prime interest rate published in The Wall Street Journal on the last business day of the

preceding calendar quarter. Amounts credited to an employee’s account become payable to the employee upon separation from service, death, unforeseeable

emergency, or change of control of us. In the event of separation of service, payment is made in a lump sum in the calendar quarter following the calendar

quarter in which the separation occurs although if the employee is eligible for retirement upon such separation, payment may be deferred until the following

year or the nine subsequent years, and may be made in a lump sum or in installments over a period of up to ten years, depending upon the distribution form

elected by the employee. There is no separate funding for the amounts payable under the KEDC Plan, rather we make payment from its general assets.

The DC SERP is an unfunded, non-qualified deferred compensation plan under which benefits are paid from our general assets to provide eligible

employees with the opportunity to receive employer contributions on the portion of their eligible compensation that exceeds the IRS Limit. Eligible

employees generally are those employees who have completed one year of service with the Company, who have annual base pay of at least 80% of the IRS

Limit (or were eligible to participate in the SERP Plan as of December 31, 2007 and ceased to be eligible to participate in the SERP Plan as of January 1,

2008), and who are otherwise designated as eligible by our employee benefits committee. We will make transitional and non-transitional credits to the

accounts of eligible participants each pay period. Transitional credits apply only to participants who were eligible to participate in the SERP Plan as of

December 31, 2007 but ceased participating in the SERP Plan as of that date and became a

76