Neiman Marcus 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

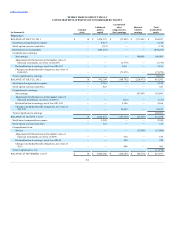

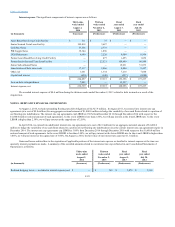

• Level 1 — Unadjusted quoted prices for identical instruments traded in active markets.

• Level 2 — Observable market-based inputs or unobservable inputs corroborated by market data.

• Level 3 — Unobservable inputs reflecting management’s estimates and assumptions.

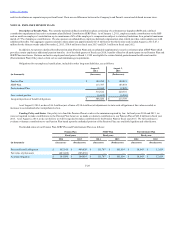

The following table shows the Company’s financial assets that are required to be measured at fair value on a recurring basis in our Consolidated

Balance Sheets:

Other long-term assets:

Interest rate caps

Level 2

$ 1,132

$ 29

The fair value of the interest rate caps are estimated using industry standard valuation models using market-based observable inputs, including

interest rate curves. In addition, the fair value of the interest rate caps includes consideration of the counterparty’s non-performance risk.

The carrying values of cash and cash equivalents, credit card receivables and accounts payable approximate fair value due to their short-term nature.

We determine the fair value of our long-term debt on a non-recurring basis, which results are summarized as follows:

Long-term debt:

Senior Secured Term Loan Facility

Level 2

$ 2,927,912

$ 2,907,797

$ —

$ —

Cash Pay Notes

Level 2

960,000

994,800

—

—

PIK Toggle Notes

Level 2

600,000

633,000

—

—

2028 Debentures

Level 2

122,035

127,500

122,077

125,625

Former Asset-Based Revolving Credit Facility

Level 2

—

—

15,000

15,000

Former Senior Secured Term Loan Facility

Level 2

—

—

2,560,000

2,566,400

We estimated the fair value of long-term debt using prevailing market rates for debt of similar remaining maturities and credit risk for our revolving

and term loan facilities and quoted market prices of the same or similar issues for the Cash Pay Notes, the PIK Toggle Notes and the $125.0 million aggregate

principal amount of 7.125% Debentures due 2028 (the 2028 Debentures and, together with the Cash Pay Notes and the PIK Toggle Notes, the Notes).

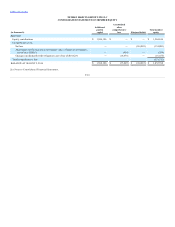

In connection with purchase accounting, we have made estimates of the fair value of our long-lived and intangible assets based upon assumptions

related to the future cash flows, discount rates and asset lives utilizing currently available information, and in some cases, valuation results from independent

valuation specialists (Level 3 determination of fair value). We also measure certain non-financial assets at fair value on a non-recurring basis, primarily long-

lived assets, intangible assets and goodwill, in connection with our periodic evaluations of such assets for potential impairment.

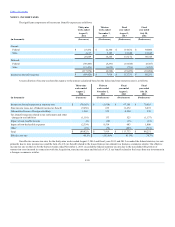

The significant components of our property and equipment, net are as follows:

Land, buildings and improvements $ 1,047,556

$ 1,017,463

Fixtures and equipment 373,033

904,879

Construction in progress 83,395

49,648

1,503,984

1,971,990

Less: accumulated depreciation and amortization 113,718

1,070,146

Property and equipment, net $ 1,390,266

$ 901,844

F-18