Neiman Marcus 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

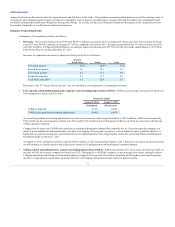

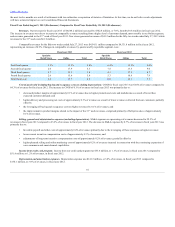

Corporate expenses, which are included in SG&A expenses, were $56.0 million in fiscal year 2014 compared to $46.7 million in fiscal year 2013.

The increase in corporate expenses relates primarily to 1) favorable adjustments recorded in fiscal year 2013 related to our long-term incentive compensation

plans and 2) a higher level of spending in the current year related to the continued investment in and expansion of our omni-channel capabilities.

Corporate depreciation/amortization charges, which are included in depreciation and amortization expenses, represent 1) the depreciation on the

step-up in the carrying values of our property and equipment recorded in connection with purchase accounting and 2) the amortization of finite-lived

intangible assets, primarily customer lists and favorable lease commitments, established in connection with purchase accounting. The increase in these

charges from $52.9 million in fiscal year 2013 to $170.9 million in fiscal year 2014, as well as the $129.6 million amortization of inventory step-up recorded

as a component of COGS in fiscal year 2014, are attributable to fair value adjustments to our assets recorded in connection with the purchase price allocation

to reflect the Acquisition.

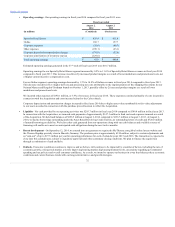

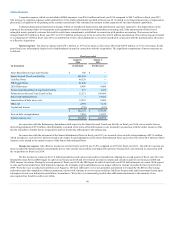

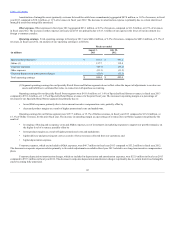

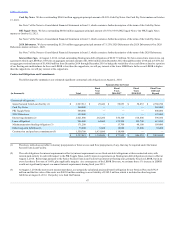

Interest expense. Net interest expense was $270.1 million, or 5.6% of revenues, in fiscal year 2014 and $169.0 million, or 3.6% of revenues, for the

prior fiscal year, reflecting the higher level of indebtedness incurred in connection with the Acquisition. The significant components of interest expense are

as follows:

Asset-Based Revolving Credit Facility

$ 386

$ —

Senior Secured Term Loan Facility

106,505

—

Cash Pay Notes

60,329

—

PIK Toggle Notes

41,240

—

2028 Debentures

8,906

9,004

Former Asset-Based Revolving Credit Facility

477

1,453

Former Senior Secured Term Loan Facility

22,521

108,489

Senior Subordinated Notes

—

19,031

Amortization of debt issue costs

19,583

8,404

Other, net

2,995

7,214

Capitalized interest

(770)

(237)

$ 262,172

$ 153,358

Loss on debt extinguishment

7,882

15,597

Interest expense, net

$ 270,054

$ 168,955

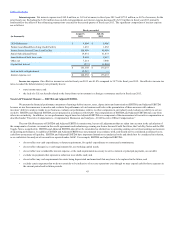

In connection with the Refinancing Amendment with respect to the Senior Secured Term Loan Facility in fiscal year 2014, we incurred a loss on

debt extinguishment of $7.9 million, which primarily consisted of the write-off of debt issuance costs incurred in connection with the initial issuance of the

facility allocable to lenders that no longer participate in the facility subsequent to the refinancing.

In connection with the retirement of the Senior Subordinated Notes in fiscal year 2013, we incurred a loss on debt extinguishment of $15.6 million,

which included 1) costs of $10.7 million related to the tender for and redemption of the Senior Subordinated Notes and 2) the write-off of $4.9 million of debt

issuance costs related to the initial issuance of the Senior Subordinated Notes.

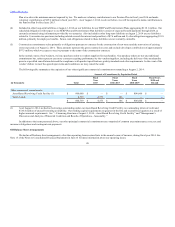

Income tax expense. Our effective income tax rate for fiscal year 2014 was 35.8% compared to 41.0% for fiscal year 2013. Our effective income tax

rates exceeded the federal statutory rate primarily due to state income taxes and the non-deductible portion of transaction costs incurred in connection with

the Acquisition in fiscal year 2014.

We file income tax returns in the U.S. federal jurisdiction and various state and local jurisdictions. During the second quarter of fiscal year 2013, the

Internal Revenue Service (IRS) began its audit of our fiscal year 2010 and 2011 federal income tax returns and closed its audit of our fiscal year 2008 and

2009 income tax returns. During the second quarter of fiscal year 2014, the IRS began its audit of our fiscal year 2012 federal income tax return. With respect

to state and local jurisdictions, with limited exceptions, the Company and its subsidiaries are no longer subject to income tax audits for fiscal years before

2009. We believe our recorded tax liabilities as of August 2, 2014 are sufficient to cover any potential assessments to be made by the IRS or other taxing

authorities upon the completion of their examinations and we will continue to review our recorded tax liabilities for potential audit assessments based upon

subsequent events, new information and future circumstances. We believe it is reasonably possible that additional adjustments in the amounts of our

unrecognized tax benefits could occur within

40