Neiman Marcus 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

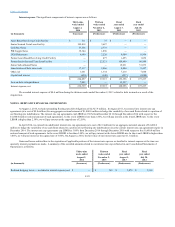

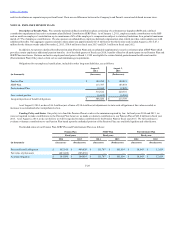

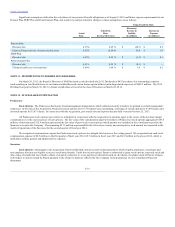

Interest expense. The significant components of interest expense are as follows:

Asset-Based Revolving Credit Facility

$ 311

$ 75

$ —

$ —

Senior Secured Term Loan Facility

102,818

3,687

—

—

Cash Pay Notes

57,556

2,773

—

—

PIK Toggle Notes

39,344

1,896

—

—

2028 Debentures

6,680

2,226

9,004

8,906

Former Asset-Based Revolving Credit Facility

—

477

1,453

1,052

Former Senior Secured Term Loan Facility

—

22,521

108,489

98,989

Senior Subordinated Notes

—

—

19,031

51,873

Amortization of debt issue costs

17,117

2,466

8,404

8,457

Other, net

1,661

1,334

7,214

7,040

Capitalized interest

(630)

(140)

(237)

(1,080)

$ 224,857

$ 37,315

$ 153,358

$ 175,237

Loss on debt extinguishment

7,882

—

15,597

—

Interest expense, net

$ 232,739

$ 37,315

$ 168,955

$ 175,237

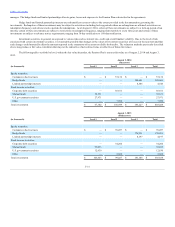

We recorded interest expense of $8.4 million during the thirteen weeks ended November 2, 2013 related to debt incurred as a result of the

Acquisition.

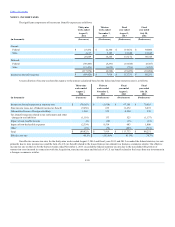

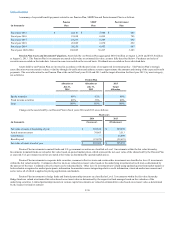

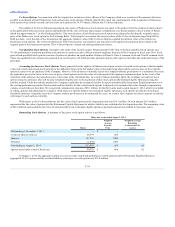

At August 2, 2014, we had outstanding floating rate debt obligations of $2,927.9 million. In August 2011, we entered into interest rate cap

agreements (at a cost of $5.8 million) for an aggregate notional amount of $1,000.0 million to hedge the variability of our cash flows related to a portion of

our floating rate indebtedness. The interest rate cap agreements cap LIBOR at 2.50% from December 2012 through December 2014 with respect to the

$1,000.0 million notional amount of such agreements. In the event LIBOR is less than 2.50%, we will pay interest at the lower LIBOR rate. In the event

LIBOR is higher than 2.50%, we will pay interest at the capped rate of 2.50%.

In April 2014, we entered into additional interest rate cap agreements (at a cost of $2.0 million) for an aggregate notional amount of $1,400.0

million to hedge the variability of our cash flows related to a portion of our floating rate indebtedness once the current interest rate cap agreements expire in

December 2014. The interest rate cap agreements cap LIBOR at 3.00% from December 2014 through December 2016 with respect to the $1,400.0 million

notional amount of such agreements. In the event LIBOR is less than 3.00%, we will pay interest at the lower LIBOR rate. In the event LIBOR is higher than

3.00%, we will pay interest at the capped rate of 3.00%. On August 2, 2014, the fair value of our interest rate caps was $1.1 million.

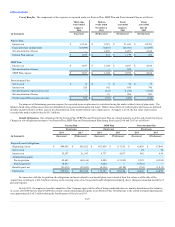

Gains and losses realized due to the expiration of applicable portions of the interest rate caps are reclassified to interest expense at the time our

quarterly interest payments are made. A summary of the recorded amounts related to our interest rate caps reflected in our Consolidated Statements of

Operations is as follows:

Realized hedging losses — included in interest expense, net

$ —

$ 369

$ 3,475

$ 3,318

F-25