Neiman Marcus 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

consideration of all relevant facts, circumstances and available information. If we believe it is more likely than not that our position will be sustained, we

recognize the benefit we believe is cumulatively greater than 50% likely to be realized.

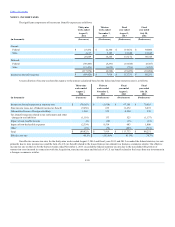

Recent Accounting Pronouncements. In May 2014, the Financial Accounting Standards Board (FASB) issued guidance to clarify the principles for

recognizing revenue and to develop a common revenue standard for GAAP and International Financial Reporting Standards. The standard outlines a single

comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes the most current revenue recognition

guidance. This guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2016, which is effective for us as of

the first quarter of fiscal year 2018 using one of two retrospective application methods. We are currently evaluating the application method and the impact of

adopting this new accounting guidance on our Consolidated Financial Statements.

We do not expect that any other recently issued accounting pronouncements will have a material impact on our financial statements.

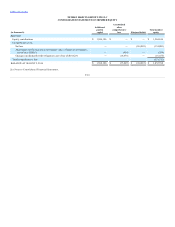

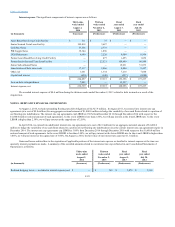

The Acquisition was completed on October 25, 2013 and was financed by:

• borrowings of $75.0 million under our senior secured asset-based revolving credit facility (Asset-Based Revolving Credit Facility);

• borrowings of $2,950.0 million under our senior secured term loan facility (Senior Secured Term Loan Facility and, together with the Asset-

Based Revolving Credit Facility, the Senior Secured Credit Facilities);

• issuance of $960.0 million aggregate principal amount of 8.00% senior cash pay notes due 2021 (Cash Pay Notes);

• issuance of $600.0 million aggregate principal amount of 8.75%/9.50% senior PIK toggle notes due 2021 (PIK Toggle Notes); and

• $1,583.3 million of equity investments from Parent funded by direct and indirect equity investments from the Sponsors, certain co-investors and

management.

The Acquisition occurred simultaneously with:

• the closing of the financing transactions and equity investments described previously;

• the termination of our former $700.0 million senior secured asset-based revolving credit facility (Former Asset-Based Revolving Credit

Facility); and

• the termination of our former $2,560.0 million senior secured term loan facility (Former Senior Secured Term Loan Facility and, together with

the Former Asset-Based Revolving Credit Facility, the Former Senior Secured Credit Facilities).

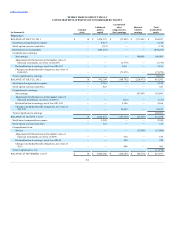

We have accounted for the Acquisition in accordance with the provisions of FASB Accounting Standards Codification Topic 805, Business

Combinations, whereby the purchase price paid to effect the Acquisition has been allocated to state the acquired assets and liabilities at fair value. The

Acquisition and the allocation of the purchase price have been recorded for accounting purposes as of November 2, 2013, the end of our first quarter of fiscal

year 2014.

In connection with the purchase price allocation, we have made estimates of the fair values of our long-lived and intangible assets based upon

assumptions related to the future cash flows, discount rates and asset lives utilizing currently available information, and in some cases, valuation results from

independent valuation specialists. As of August 2, 2014, we have recorded purchase accounting adjustments to increase the carrying value of our property

and equipment and inventory, to revalue intangible assets for our tradenames, customer lists and favorable lease commitments and to revalue our long-term

benefit plan obligations, among other things.

F-16