Neiman Marcus 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

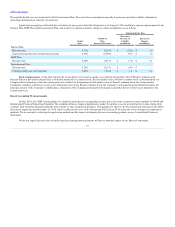

Plan and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available information,

including information provided by our actuaries.

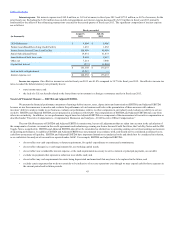

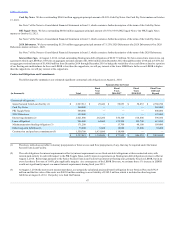

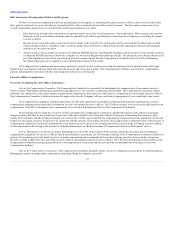

Significant assumptions utilized in the calculation of our projected benefit obligations as of August 2, 2014 and future expense requirements for our

Pension Plan, SERP Plan and Postretirement Plan, and sensitivity analysis related to changes in these assumptions, are as follows:

Pension Plan:

Discount rate

4.35%

0.25 %

$ (20.3)

$ 0.5

Expected long-term rate of return on plan assets

6.50%

(0.50)%

N/A

$ 1.9

SERP Plan:

Discount rate

4.20%

0.25 %

$ (3.2)

$ 0.1

Postretirement Plan:

Discount rate

4.25%

0.25 %

$ (0.3)

$ —

Ultimate health care cost trend rate

5.00%

1.00 %

$ 1.4

$ 0.1

Stock Compensation. At the date of grant, the stock option exercise price equals or exceeds the fair market value of Parent's common stock.

Because Parent is privately held and there is no public market for its common stock, the fair market value of Parent's common stock is determined by our

Compensation Committee at the time option grants are awarded. In determining the fair market value of Parent's common stock, the Compensation

Committee considers such factors as any recent transactions involving Parent's common stock, the Company’s actual and projected financial results, the

principal amount of the Company’s indebtedness, valuations of the Company performed by third parties and other factors it believes are material to the

valuation process.

In May 2014, the FASB issued guidance to clarify the principles for recognizing revenue and to develop a common revenue standard for GAAP and

International Financial Reporting Standards. The standard outlines a single comprehensive model for entities to use in accounting for revenue arising from

contracts with customers and supersedes the most current revenue recognition guidance. This guidance is effective for fiscal years and interim periods within

those years beginning after December 15, 2016, which is effective for us as of the first quarter of fiscal year 2018 using one of two retrospective application

methods. We are currently evaluating the application method and the impact of adopting this new accounting guidance on our Consolidated Financial

Statements.

We do not expect that any other recently issued accounting pronouncements will have a material impact on our financial statements.

53