Neiman Marcus 2013 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

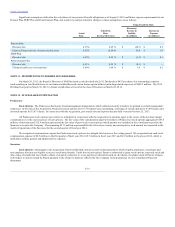

authorities may also impose fines or other remedies against us. We have also incurred other costs associated with this security incident, including legal fees,

investigative fees, costs of communications with customers and credit monitoring services provided to our customers. At this point, we are unable to predict

the developments in, outcome of, and economic and other consequences of pending or future litigation or regulatory investigations related to, and other costs

associated with, this matter. We will continue to evaluate these matters based on subsequent events, new information and future circumstances.

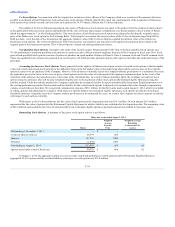

Other. We had no outstanding irrevocable letters of credit relating to purchase commitments and insurance and other liabilities at August 2, 2014.

We had approximately $4.7 million in surety bonds at August 2, 2014 relating primarily to merchandise imports and state sales tax and utility requirements.

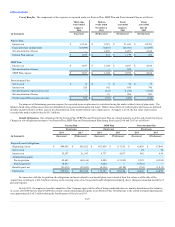

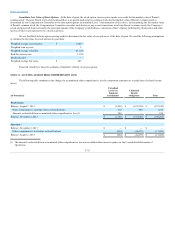

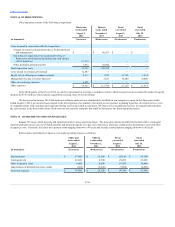

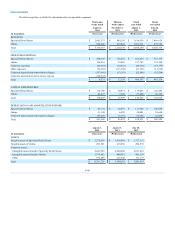

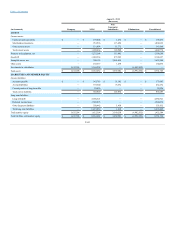

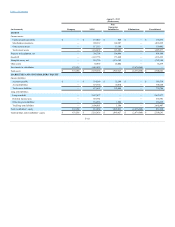

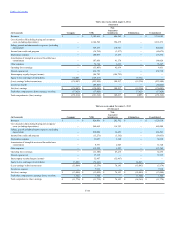

We have identified two reportable segments: Specialty Retail Stores and Online. The Specialty Retail Stores segment aggregates the activities of

our Neiman Marcus and Bergdorf Goodman retail stores, including our Last Call stores. The Online segment conducts online and supplemental print catalog

operations under the Neiman Marcus, Bergdorf Goodman, Last Call and Horchow brand names. Both the Specialty Retail Stores and Online segments derive

their revenues from the sales of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers, precious and fashion jewelry and

decorative home accessories.

Operating earnings for the segments include 1) revenues, 2) cost of sales, 3) direct selling, general and administrative expenses, 4) other direct

operating expenses, 5) income from credit card program and 6) depreciation expense for the respective segment. Items not allocated to our operating

segments include those items not considered by management in measuring the assets and profitability of our segments. These amounts include 1) corporate

expenses including, but not limited to, treasury, investor relations, legal and finance support services and general corporate management, 2) charges related

to the application of purchase accounting including amortization of long-term assets (primarily favorable lease commitments and customer lists) and other

non-cash items, 3) interest expense and 4) other expenses. These items, while often related to the operations of a segment, are not considered by segment

operating management, corporate operating management and the chief operating decision maker in assessing segment operating performance. The

accounting policies of the operating segments are the same as those described in the summary of significant accounting policies (except with respect to

purchase accounting adjustments not allocated to the operating segments).

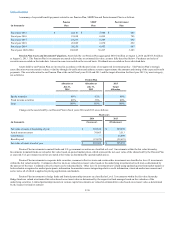

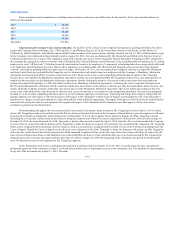

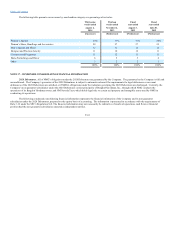

We believe that our customers have allocated a higher portion of their luxury spending to online retailing in recent years and that our customers'

expectations of a seamless shopping experience across our in-store and online channels have increased, and we expect these trends will continue for the

foreseeable future. As a result, we have made investments and redesigned processes to integrate our shopping experience across channels consistent with our

customers' shopping preferences and expectations. In particular, we have invested and continue to invest in technology and systems that further our omni-

channel selling capabilities and in fiscal year 2014, we realigned the merchandising responsibilities for our Neiman Marcus brand into a single team

responsible for inventory procurement for both our store and online channels. With the acceleration of omni-channel retailing and our past and ongoing

investments in omni-channel initiatives, we believe the growth in our total comparable revenues and operating results are the best measures of our ability to

grow our brands. As a result, we are re-evaluating our current segment reporting practices and anticipate that we may begin to report a single "omni-channel"

reporting segment in the future.

F-39