Neiman Marcus 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Delivery and processing costs—Delivery and processing costs consist primarily of delivery charges we pay to third party carriers and other costs

related to the fulfillment of customer orders not delivered at the point-of-sale.

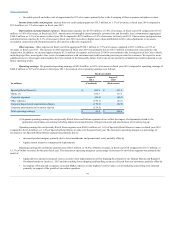

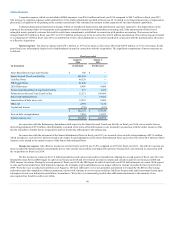

Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale.

Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we earn in connection with the sales of the vendor’s

merchandise. These allowances result in an increase to gross margin when we earn the allowances and they are approved by the vendor. Other allowances we

receive represent reductions to the amounts we pay to acquire the merchandise. These allowances reduce the cost of the acquired merchandise and are

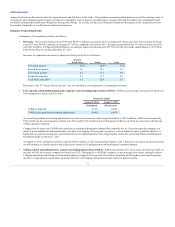

recognized at the time the goods are sold. We received vendor allowances of $93.5 million (including $5.0 million for the Predecessor prior to the

Acquisition) in fiscal year 2014, $90.2 million in fiscal year 2013 and $92.5 million in fiscal year 2012. The amounts of vendor allowances we receive

fluctuate based on the level of markdowns taken and did not have a significant impact on the year-over-year change in gross margin during fiscal years 2014,

2013 or 2012.

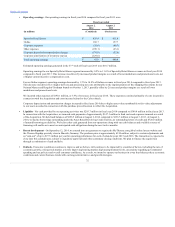

Changes in our COGS as a percentage of revenues can be affected by the following factors:

• our ability to order an appropriate amount of merchandise to match customer demand and the related impact on the level of net markdowns and

promotions costs incurred;

• customer acceptance of and demand for the merchandise we offer in a given season and the related impact of such factors on the level of full-

price sales;

• factors affecting revenues generally, including pricing and promotional strategies, product offerings and actions taken by competitors;

• changes in delivery and processing costs and our ability to pass such costs onto the customer;

• changes in occupancy costs primarily associated with the opening of new stores or distribution facilities; and

• the amount of vendor reimbursements we receive during the fiscal year.

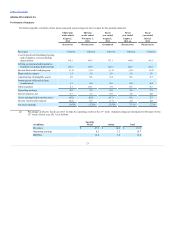

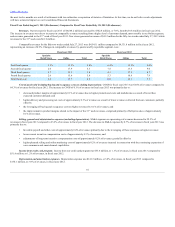

Selling, general and administrative expenses (excluding depreciation). SG&A principally consists of costs related to employee compensation and

benefits in the selling and administrative support areas and advertising and marketing costs. A significant portion of our selling, general and administrative

expenses is variable in nature and is dependent on the revenues we generate.

Advertising costs consist primarily of 1) online marketing costs, 2) advertising costs incurred related to the production of the photographic content

for our websites and 3) costs incurred related to the production, printing and distribution of our print catalogs and other promotional materials mailed to our

customers. We receive advertising allowances from certain of our merchandise vendors. Substantially all the advertising allowances we receive represent

reimbursements of direct, specific and incremental costs that we incur to promote the vendor’s merchandise in connection with our various advertising

programs, primarily catalogs and other print media. Advertising allowances fluctuate based on the level of advertising expenses incurred and are recorded as

a reduction of our advertising costs when earned. Advertising allowances aggregated approximately $51.4 million (including $20.0 million for the

Predecessor prior to the Acquisition) in fiscal year 2014, $55.0 million in fiscal year 2013 and $53.1 million in fiscal year 2012.

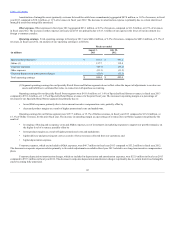

We also receive allowances from certain merchandise vendors in conjunction with compensation programs for employees who sell the vendor’s

merchandise. These allowances are netted against the related compensation expense that we incur. Amounts received from vendors related to compensation

programs were $73.9 million (including $18.5 million for the Predecessor prior to the Acquisition) in fiscal year 2014, $72.2 million in fiscal year 2013 and

$65.1 million in fiscal year 2012.

Changes in our selling, general and administrative expenses are affected primarily by the following factors:

• changes in the number of sales associates primarily due to new store openings and expansion of existing stores, including increased health care

and related benefits expenses;

• changes in expenses incurred in connection with our advertising and marketing programs; and

• changes in expenses related to employee benefits due to general economic conditions such as rising health care costs.

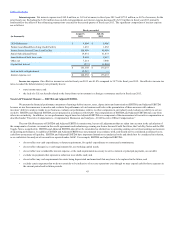

Income from credit card program. We maintain a proprietary credit card program through which credit is extended to customers and have a related

marketing and servicing alliance with affiliates of Capital One. Pursuant to the Program

36