Neiman Marcus 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203

|

|

Table of Contents

Grant Date Fair Value of Stock Options. At the date of grant, the stock option exercise price equals or exceeds the fair market value of Parent's

common stock. Because Parent is privately held and there is no public market for its common stock, the fair market value of Parent's common stock is

determined by our Compensation Committee at the time option grants are awarded (Level 3 determination of fair value). In determining the fair market value

of Parent's common stock, the Compensation Committee considers such factors as any recent transactions involving Parent's common stock, the Company’s

actual and projected financial results, the principal amount of the Company’s indebtedness, valuations of the Company performed by third parties and other

factors it believes are material to the valuation process.

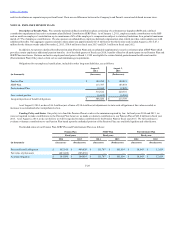

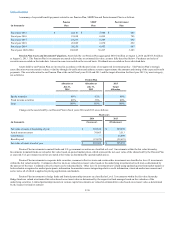

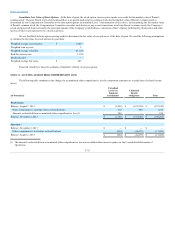

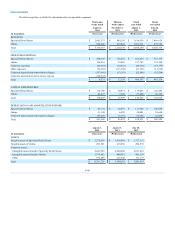

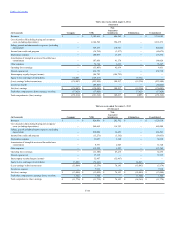

We use the Black-Scholes option-pricing model to determine the fair value of our options as of the date of grant. We used the following assumptions

to estimate the fair value for stock options at grant date:

Weighted average exercise price

$ 1,000

Weighted term in years

5

Weighted average volatility

45.12%

Risk-free interest rate

1.39%

Dividend yield

—

Weighted average fair value

$ 407

Expected volatility is based on estimates of implied volatility of our peer group.

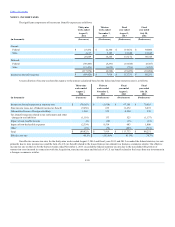

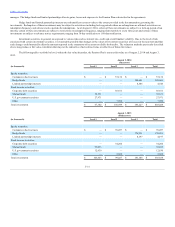

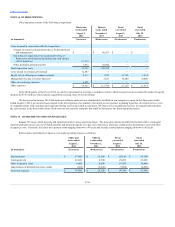

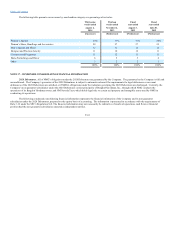

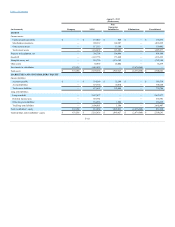

The following table summarizes the changes in accumulated other comprehensive loss by component (amounts are recorded net of related income

taxes):

Balance, August 3, 2013

$ (3,999)

$ (103,530)

$ (107,529)

Other comprehensive earnings before reclassifications

610

490

1,100

Amounts reclassified from accumulated other comprehensive loss (1)

224

—

224

Balance, November 2, 2013

$ (3,165)

$ (103,040)

$ (106,205)

Balance, November 2, 2013

$ —

$ —

$ —

Other comprehensive loss before reclassifications

(954)

(16,475)

(17,429)

Balance, August 2, 2014

$ (954)

$ (16,475)

$ (17,429)

(1) The amounts reclassified from accumulated other comprehensive loss are recorded within interest expense on the Consolidated Statements of

Operations.

F-35