Neiman Marcus 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

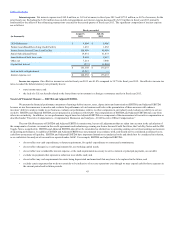

• favorable payroll and other costs of approximately 0.2% of revenues primarily due to the leveraging of these expenses on higher revenues.

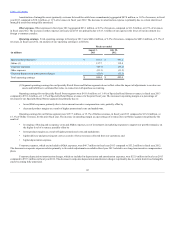

Income from credit card program. Income from our credit card program was $55.3 million, or 1.1% of revenues, in fiscal year 2014 compared to

$53.4 million, or 1.1% of revenues, in fiscal year 2013.

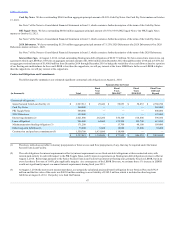

Depreciation and amortization expenses. Depreciation expense was $147.6 million, or 3.0% of revenues, in fiscal year 2014 compared to $141.5

million, or 3.0% of revenues, in fiscal year 2013. Amortization of intangible assets (primarily customer lists and favorable lease commitments) aggregated

$160.3 million, or 3.3% of revenues, in fiscal year 2014 compared to $47.4 million, or 1.0% of revenues, in fiscal year 2013. The increases in depreciation

and amortization expenses by 2.3% of revenues in fiscal year 2014 were due to higher asset values attributable to fair value adjustments to our assets

recorded in connection with the purchase price allocation to reflect the Acquisition.

Other expenses. Other expenses in fiscal year 2014 aggregated $190.1 million, or 3.9% of revenues, compared to $23.1 million, or 0.5% of

revenues, in fiscal year 2013. The increase in other expenses in fiscal year 2014 was primarily due to $162.7 million in transaction costs related to the

Acquisition. In addition, we incurred approximately $12.6 million of expenses in fiscal year 2014 for costs related to the investigation of the Cyber-Attack,

including legal fees, investigative fees, costs of communications with customers and credit monitoring services provided to customers. We expect to incur

additional costs to investigate and remediate the Cyber-Attack in the foreseeable future. Such costs are not currently estimable but could be material to our

future operating results.

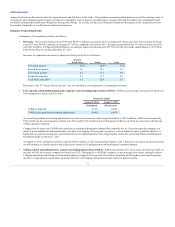

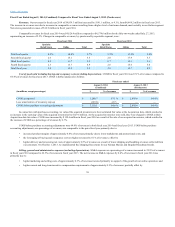

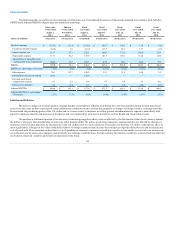

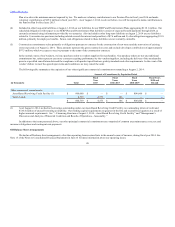

Operating earnings. We generated operating earnings of $41.0 million, or 0.8% of revenues, in fiscal year 2014 compared to operating earnings of

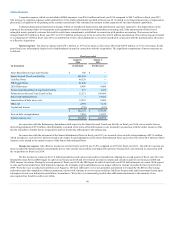

$446.4 million, or 9.6% of revenues, in fiscal year 2013. An analysis of our operating earnings is as follows:

Specialty Retail Stores (1)

$ 426.9

$ 411.4

Online (1)

160.7

157.7

Corporate expenses

(56.0)

(46.7)

Other expenses

(190.1)

(23.1)

Corporate depreciation/amortization charges

(170.9)

(52.9)

Corporate amortization of inventory step-up

(129.6)

—

Total operating earnings

$ 41.0

$ 446.4

(1) Segment operating earnings for our Specialty Retail Stores and Online segments do not reflect the impact of adjustments related to the

application of purchase accounting including depreciation/amortization of long-term assets and amortization of inventory step-up.

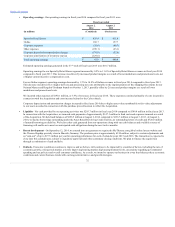

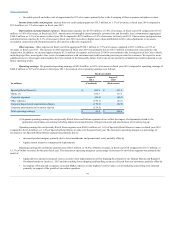

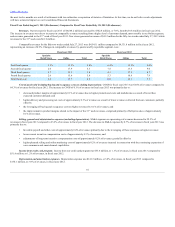

Operating earnings for our Specialty Retail Stores segment were $426.9 million, or 11.6% of Specialty Retail Stores revenues, in fiscal year 2014

compared to $411.4 million, or 11.4% of Specialty Retail Stores revenues, for the prior fiscal year. The increase in operating margin as a percentage of

revenues for our Specialty Retail Stores segment was primarily due to:

• increased product margins primarily due to lower markdowns and promotional costs; partially offset by

• higher current incentive compensation requirements.

Operating earnings for our Online segment were $160.7 million, or 14.0% of Online revenues, in fiscal year 2014 compared to $157.7 million, or

15.3% of Online revenues, for the prior fiscal year. The decrease in operating margin as a percentage of revenues for our Online segment was primarily the

result of:

• higher delivery and processing net costs as a result of our implementation of free shipping/free returns for our Neiman Marcus and Bergdorf

Goodman brands on October 1, 2013 and the resulting lower shipping and handling revenues collected from our customers; partially offset by

• leveraging of buying and occupancy costs and SG&A expenses on the higher level of revenues, net of marketing and selling costs incurred

primarily in support of the growth of our online operation.

39