Neiman Marcus 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

secure the 2028 Debentures or other secured public debt obligations without requiring the preparation and filing of separate financial statements of such

subsidiary in accordance with applicable SEC rules. As a result, the collateral under the Senior Secured Term Loan Facility will include shares of capital

stock or other securities of subsidiaries of the Company or any subsidiary guarantor only to the extent that the applicable value of such securities (on a

subsidiary-by-subsidiary basis) is less than 20% of the aggregate principal amount of the 2028 Debentures or other secured public debt obligations of the

Company.

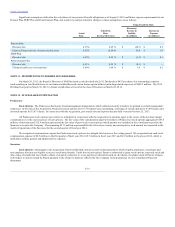

The credit agreement governing the Senior Secured Term Loan Facility contains a number of negative covenants and covenants related to the

security arrangements for the Senior Secured Term Loan Facility. The credit agreement also contains customary affirmative covenants and events of default,

including a cross-default provision in respect of any other indebtedness that has an aggregate principal amount exceeding $50.0 million.

Cash Pay Notes. In connection with the Acquisition, we incurred indebtedness in the form of $960.0 million aggregate principal amount of 8.00%

senior Cash Pay Notes. Interest on the Cash Pay Notes is payable semi-annually in arrears on each April 15 and October 15. The Cash Pay Notes were

assumed by us as a result of the Acquisition and are guaranteed by the same entities that guarantee the Senior Secured Term Loan Facility. The Cash Pay

Notes are unsecured and the guarantees are full and unconditional. Our Cash Pay Notes mature on October 15, 2021.

We may redeem the Cash Pay Notes, in whole or in part, at any time prior to October 15, 2016, at a price equal to 100% of the principal amount of

the Cash Pay Notes redeemed plus accrued and unpaid interest up to the redemption date plus the applicable premium. In addition, we may redeem up to 40%

in the aggregate principal amount of the Cash Pay Notes with the net proceeds of certain equity offerings at any time and from time to time on or before

October 15, 2016 at a redemption price equal to 108.00% of the face amount thereof, plus accrued and unpaid interest up to the date of redemption, so long

as at least 50% of the original aggregate principal amount of the Cash Pay Notes remain outstanding after such redemption. On and after October 15, 2016,

we may redeem the Cash Pay Notes, in whole or in part, at the redemption price set forth in the Cash Pay Notes indenture.

The Cash Pay Notes include certain restrictive covenants that limit our ability to, among other things: (i) incur additional debt or issue certain

preferred stock, (ii) pay dividends, redeem stock or make other distributions, (iii) make other restricted payments or investments, (iv) create liens on assets, (v)

transfer or sell assets, (vi) create restrictions on payment of dividends or other amounts by us to our restricted subsidiaries, (vii) engage in mergers or

consolidations, (viii) engage in certain transactions with affiliates and (ix) designate our subsidiaries as unrestricted subsidiaries. The Cash Pay Notes also

contain a cross-acceleration provision in respect of other indebtedness that has an aggregate principal amount exceeding $50.0 million.

PIK Toggle Notes. In connection with the Acquisition, we incurred indebtedness in the form of $600.0 million aggregate principal amount of our

8.75%/9.50% senior PIK Toggle Notes. The PIK Toggle Notes were assumed by us as a result of the Acquisition and are guaranteed by the same entities that

guarantee the Senior Secured Term Loan Facility. The PIK Toggle Notes are unsecured and the guarantees are full and unconditional. Our PIK Toggle Notes

mature on October 15, 2021.

Interest on the PIK Toggle Notes is payable semi-annually in arrears on each April 15 and October 15. Interest on the PIK Toggle Notes will be paid

entirely in cash for the first two interest payments and thereafter may be paid (i) entirely in cash (Cash Interest), (ii) entirely by increasing the principal

amount of the PIK Toggle Notes by the relevant interest (PIK Interest), or (iii) 50% in Cash Interest and 50% in PIK Interest, subject to certain restrictions on

the timing and number of elections of PIK Interest or partial PIK Interest payments. Cash Interest on the PIK Toggle Notes accrues at a rate of 8.75% per

annum. PIK Interest on the PIK Toggle Notes accrues at a rate of 9.50% per annum.

We may redeem the PIK Toggle Notes, in whole or in part, at any time prior to October 15, 2016, at a price equal to 100% of the principal amount of

the PIK Toggle Notes redeemed plus accrued and unpaid interest up to the redemption date plus the applicable premium. In addition, we may redeem up to

40% in the aggregate principal amount of the PIK Toggle Notes with the net proceeds of certain equity offerings at any time and from time to time on or

before October 15, 2016 at a redemption price equal to 108.75% of the face amount thereof, plus accrued and unpaid interest up to the date of redemption, so

long as at least 50% of the original aggregate principal amount of the PIK Toggle Notes remain outstanding after such redemption. On and after October 15,

2016, we may redeem the PIK Toggle Notes, in whole or in part, at the redemption price set forth in the PIK Toggle Notes indenture.

The PIK Toggle Notes include certain restrictive covenants that limit our ability to, among other things: (i) incur additional debt or issue certain

preferred stock, (ii) pay dividends, redeem stock or make other distributions, (iii) make other restricted payments or investments, (iv) create liens on assets, (v)

transfer or sell assets, (vi) create restrictions on payment of dividends or other amounts by us to our restricted subsidiaries, (vii) engage in mergers or

consolidations, (viii) engage in

F-23