Marks and Spencer 1998 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

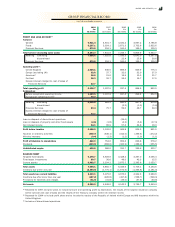

THE GROUP THE COMPANY

1998 1997 1998 1997

£m £m £m £m

ACommitments in respect of proper ties in the course of development 364.2 100.5 357.8 57.2

BDeferred tax ation not provided on the ex cess of capital allowances

over depreciation on tangible fixed assets 202.7 204.2 188.4 191.2

CGuarantees by the Company in respect of the Eurobond,

promissory note, medium term notes and commercial paper issued by subsidiaries –Ð834.3 577.4

DGuarantees made in the ordinary course of business

on behalf of overseas subsidiaries. –Ð86.3 38.1

EMarks & Spencer (Ireland) Limited and its subsidiar y Aprell Limited have availed themselves of the ex emption provided for in S17 of

the Companies (Amendment) A ct 1986 (Ireland) in respect of the documents required to be annex ed to their annual returns.

FIn the opinion of the directors, the revalued properties will be retained for use in the business and the likelihood of any tax ation

liability

arising is remote. A ccordingly the potential deferred taxation in respect of these properties has not been quantified.

GOther material contracts

In the event of a material change in the trading arrangements with certain warehouse operators, the Company has a commitment to

purchase, at market value, fix ed assets which are currently owned and operated by them on the CompanyÕs behalf.

HCommitments under operating leases

At 31 March 1998 annual commitments under operating leases were as follows:

THE GROUP THE COMPANY

Land & Land &

buildings Other buildings Other

£m £m £m £m

Expiring within one year 2.3 1.2 0.6 0.6

Expiring in the second to fifth years inclusive 32.6 7.4 4.8 6.9

Expiring in more than five years 72.7 Ð 40.7 Ð

107.6 8.6 46.1 7.5

The principal foreign ex change rates used in the financial statements are as follows (local currency equivalent of £1):

SA LES AVERAGE RATE PROFIT AVERAGE RATE BA LA NCE SHEET RATE

1998 1997 1998 1997 1998 1997

Republic of Ireland 1.13 0.99 1.13 1.00 1.23 1.03

France 9.82 8.39 9.86 8.40 10.38 9.24

Belgium 60.38 50.99 60.88 51.54 63.88 56.63

Germany 2.92 2.60 2.95 2.47 3.10 2.74

The Netherlands 3.29 2.78 3.31 2.84 3.49 3.08

Spain 247.57 209.49 249.10 210.31 262.93 232.79

United States 1.65 1.60 1.64 1.58 1.67 1.64

Canada 2.32 2.19 2.34 2.20 2.38 2.27

Hong Kong 12.75 12.37 12.71 12.39 12.97 12.72

Japan 203.54 181.06 204.19 182.81 223.31 203.30

There were no material transactions with related parties as defined by FRS8 ÔRelated par ty transactionsÕ.

31 COMMITMENTS AND CONTINGENT LIABILITIES

32 FOREIGN EXCHANGE RATES

33 RELATED PARTY TRANSACTIONS

NO TES TO TH E FIN AN CIAL STATEM EN TS

68