Marks and Spencer 1998 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

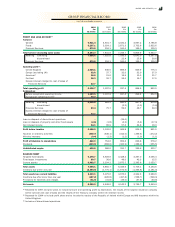

THE GROUP THE COMPANY

1998 1997 1998 1997

£m £m £m £m

73

/8% Guaranteed bonds 1998 –150.0 –Ð

US$ Promissory note 1998 –274.1 –Ð

Medium term notes 108.3 ЖÐ

Amounts owed to Group undertakings –Ж150.0

Other creditors( 1) 78.9 71.7 –Ð

187.2 495.8 –150.0

(1) Other creditors include £57.5m (last year £50.2m) which is shown in the calculation of the GroupÕs net debt and is treated as

financing within the cash flow statement. These amounts are also included in the analysis of borrowings in note 19B.

A INTEREST RATE AND CURRENCY ANALYSIS

After taking into account the various interest rate swaps entered into by the Group, the currency and interest rate ex posure of the

GroupÕs gross borrowings, all of which were at floating rates, was as follows:

THE GROUP

1998 1997

Currency £m £m

Sterling 584.2 457.5

US dollar 492.9 427.9

Other 99.4 86.4

1,176.5 971.8

The sterling borrowings are at interest rates below LIBOR. The US dollar borrowings are at interest rates related to LIBOR. These rates

are for periods ranging from one month to six months.

B MATURITY OF BORROWINGS THE GROUP

1998 1997

£m £m

Repayable within one year:

Bank loans, overdrafts and commercial paper 408.5 488.6

Medium term notes 164.6 Ð

73Ú8% Guaranteed bonds 1998(1) 150.0 Ð

US$ Promissory note 1998( 2) 268.7 Ð

Other creditors 18.9 8.9

1,010.7 497.5

Repayable between one and two years:

73Ú8% Guaranteed bonds 1998 –150.0

US$ Promissory note 1998 –274.1

Other creditors 17.7 8.8

17.7 432.9

Repayable between two and five years:

Medium term notes 108.3 Ð

Other creditors 35.3 37.7

143.6 37.7

Repayable in five years or more:

Other creditors 4.5 3.7

1,176.5 971.8

(1)

£150m was raised in July 1993 by the issue of a Eurobond at an annual interest rate of 73

/8% maturing in 1998. Interest rate swaps were

arranged to provide £150m at floating interest rates below LIBOR. The interest charges on the Eurobond shown in note 4 represent floating

rates.

(2) A US$450m ten-year promissor y note, bearing interest at US$ LIBOR maturing in 1998

.

C BORROWING FACILITIES

At 31 March 1998, the Group had an undrawn committed facility of $50m (last year $50m) linked to its commercial paper programme.

The Group also has a number of undrawn uncommitted facilities available to it. A t 31 March 1998 these amounted to £617.4m

(last year £548.2m).

18 CREDITORS: AMOUNTS FALLING DUE AFTER MORE THAN ONE YEAR

19 ANALYSIS OF BORROWINGS

NO TES TO TH E FIN AN CIAL STATEM EN TS

MA RKS A ND SPENCER p.l.c. 63