Marks and Spencer 1998 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

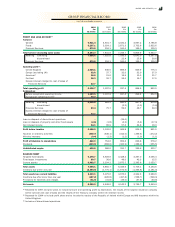

C TANGIBLE FIXED ASSETS AT COST

Gerald Eve, Char tered Sur veyors, valued the CompanyÕs freehold and leasehold properties in the United Kingdom

as at 31 March 1982.

This valuation was on the basis of open market value for ex isting use. At 31 March 1988,

the directors, after consultation with Gerald

Eve, revalued those of the CompanyÕs proper ties which had been valued as at 31 March 1982 (ex cluding subsequent additions and

adjusted

for disposals). The directorsÕ valuation was incorporated into the financial statements at 31 March 1988.

The CompanyÕs freehold interests in investment proper ties have been valued at open market value as at 31 March 1998 by ex ternal

valuers, Gerald Eve, Chartered Sur veyors. The valuation attributed to the CompanyÕs investment interest in the Gyle Shopping Centre is

subject to

the lease to the Company of the Marks & Spencer store at a nominal fix ed rent until 2117 and the occupational leases of the other parts

of the centre. The valuations of the remaining investment proper ties are based on the apportionment of larger valuations to ex clude the

owner occupied Marks & Spencer store, ex cept for one property which was valued at the stage of its development reached by 31 March

1998.

If the CompanyÕs land and buildings had not been valued as set out above their net book value would have been:

1998 1997

£m £m

At valuation at 31 March 1975(1) 334.6 335.4

At cost 2,151.5 1,725.2

At 31 March 2,486.1 2,060.6

Accumulated depreciation 93.1 87.5

Net book value at 31 March 2,393.0 1,973.1

(1) The Company also valued its land and buildings in 1955 and in 1964. In the opinion of the directors unreasonable ex pense would be

incurred in obtaining the original costs of the assets valued in those years and in 1975.

D FIXTURES, FITTINGS AND EQUIPMENT

The Company does not maintain detailed records of cost and depreciation for fix tures, fittings and equipment. The accumulated cost

and depreciation figures represent reasonable estimates of the sums involved.

A INVESTMENTS THE GROUP THE COMPANY

Shares in Loans to

Joint Other Group Group Joint

venture

(1)(2)

investments

(3)

Total undertakings

(4)

undertakings venture

(1)

Total

£m £m £m £m £m £m £m

At 1 A pril 1997 21.0 15.6 36.6 314.7 39.5 17.4 371.6

Additions 0.4 30.7 31.1 ÐÐÐ –

Share of joint ventureÕs property revaluation 2.0 Ð 2.0 ÐÐÐ –

Repayment of loan Ð Ð –Ð (10.0) Ð (10.0)

At 31 March 1998 23.4 46.3 69.7 314.7 29.5 17.4 361.6

(1)

The joint venture represents a 50% interest in Hedge End Park Ltd, a property investment company. The par tner in the joint venture is

J Sainsbur y plc.

(2) The GroupÕs investment in the joint venture includes £11.3m (last year £11.3m) of loans and accumulated reser ves of £6.0m

(last year £3.6m).

(3) Other investments comprise listed securities held by a subsidiar y. The difference between their book value and market value is

negligible.

(4) Shares in Group undertakings of £314.7m (last year £314.7m) are stated after cumulative amounts written off of £543.6m

(last year £543.6m).

11 TANGIBLE FIXED ASSETS continued

12 FIXED ASSET INVESTMENTS

NO TES TO TH E FIN AN CIAL STATEM EN TS

60