Marks and Spencer 1998 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

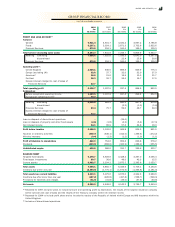

THE GROUP THE COMPANY

£m £m

At 1 A pril 1997 31.8 27.9

Utilised during the year (0.6) Ð

Exchange differences (0.2) Ð

At 31 March 1998 31.0 27.9

The provision utilised during the year mainly represents ex penditure related to discontinued Canadian operations.

The provisions at 31 March 1998 include £27.8m for post-retirement health benefits (see note 9B) and £3.2m for discontinued

Canadian operations.

THE GROUP THE COMPANY

1998 1997 1998 1997

£m £m £m £m

Deferred tax provision arising on short-term timing differences 50.4 43.9 47.6 41.0

Deferred tax asset arising on post-retirement health benefits (8.6) (9.2) (8.6) (9.2)

41.8 34.7 39.0 31.8

Recoverable A CT offset against deferred tax provision (see note 13) (41.8) (34.7) (39.0) (31.8)

–ЖÐ

The movement in deferred tax comprises:

At 1 A pril 34.7 24.0 31.8 21.7

Charged to the profit and loss account (see note 5) 7.4 11.0 7.2 10.1

Exchange differences (0.3) (0.3) –Ð

At 31 March 41.8 34.7 39.0 31.8

Deferred tax is not provided in respect of liabilities which might arise on the distribution of unappropriated profits of overseas subsidiaries.

Deferred tax not provided on the ex cess of capital allowances over depreciation on tangible fix ed assets is shown in note 31B.

The GroupÕs borrowings and net assets (ex cluding borrowings) by currency at 31 March were as follows:

THE GROUP

1998 1997

Net assets Net assets

by currency Gross Net by currency Gross Net

of operations(1) debt(2) investments of operations(1) debt( 2) investments

Currency £m £m £m £m £m £m

Sterling assets/ liabilities 5,360.4 (584.2) 4,776.2 4,673.4 (457.5) 4,215.9

Matched assets/ liabilities(3)

US dollar 468.9 (492.9) (24.0) 397.3 (427.9) (30.6)

Other 413.0 (99.4) 313.6 430.4 (86.4) 344.0

Sterling plus total matched assets/liabilities 6,242.3 (1,176.5) 5,065.8 5,501.1 (971.8) 4,529.3

(1) Net assets by currency of operations ex clude gross debt and are shown after taking into account the effect of swaps and foreign

ex change contracts.

(2) The amounts shown above for gross borrowings are after taking into account the effect of any currency swaps and forward foreign

ex change contracts.

(3) Matched assets and liabilities are those that generate no gain or loss in the profit and loss account, either because they are

denominated in the same currency as the Group operation to which they belong, or because they qualify under SSA P20 as a

foreign currency borrowing providing a hedge against a foreign equity investment.

(4) There were no significant unmatched foreign currency assets or liabilities.

20 PROVISIONS FOR LIABILITIES AND CHARGES

21 DEFERRED TAXATION

22 CURRENCY ANALYSIS OF NET ASSETS

NO TES TO TH E FIN AN CIAL STATEM EN TS

64