Marks and Spencer 1998 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

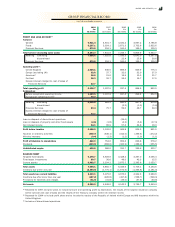

THE GROUP THE COMPANY

1998 1997 1998 1997

£m £m £m £m

Called up share capital (see note 25) 715.6 709.2 715.6 709.2

Share premium account:

At 1 A pril 259.8 221.4 259.8 221.4

Shares issued relating to scrip dividends (2.4) (1.3) (2.4) (1.3)

Shares issued under the CompanyÕs share schemes 68.3 39.7 68.3 39.7

At 31 March 325.7 259.8 325.7 259.8

Revaluation reserve:

At 1 A pril 456.3 449.8 461.9 458.4

Surplus on revaluation of investment proper ties 47.8 7.0 47.8 7.0

Share of joint ventureÕs movement in revaluation reserve 2.0 3.0 –Ð

Realised during the year –(3.5) –(3.5)

At 31 March 506.1 456.3 509.7 461.9

Profit and loss account reserve:

At 1 A pril 3,104.0 2,744.5 2,788.6 2,483.5

Realised revaluation reserve –3.5 –3.5

Amounts added back in respect of scrip dividends (see note 7) 52.1 24.3 52.1 24.3

Amounts deducted in respect of shares issued to the QUEST (see note 25) (23.4) Ð(23.4) Ð

Undistributed surplus for the year 419.8 386.0 315.1 277.3

Exchange differences on foreign currency translation (34.1) (54.3) –Ð

At 31 March 3,518.4 3,104.0 3,132.4 2,788.6

Shareholders’ funds at 31 March – all equity 5,065.8 4,529.3 4,683.4 4,219.5

Cumulative goodwill of £453.3m (last year £453.3m) arising on the acquisition of US, Canadian and Spanish subsidiaries has been

written off against the profit and loss account reser ve.

THE GROUP

1998 1997

£m £m

Profit attributable to shareholders 828.9 754.6

Dividends (409.1) (368.6)

419.8 386.0

Other recognised gains and losses relating to the year 15.7 (44.3)

New share capital subscribed 72.3 43.7

Amounts deducted from profit and loss account reserve in respect

of shares issued to the QUEST (23.4) Ð

Amounts added back to profit and loss account reser ve in respect of scrip dividends 52.1 24.3

Net additions to shareholders’ funds 536.5 409.7

ShareholdersÕ funds at 1 A pril 4,529.3 4,119.6

Shareholders’ funds at 31 March 5,065.8 4,529.3

THE GROUP

1998 1997

£m £m

Operating profit 1,116.7 1,037.9

Depreciation 166.5 162.8

Increase in stocks (61.9) (36.8)

Increase in customer advances (264.1) (323.8)

Increase in other debtors (44.0) (27.7)

Increase in creditors 44.0 84.7

Net cash inflow from operating activities 957.2 897.1

27 RECONCILIATION OF MOVEMENTS IN GROUP SHAREHOLDERS’ FUNDS

28 RECONCILIATION OF OPERATING PROFIT TO NET CASH INFLOW FROM OPERATING ACTIVITIES

26 SHAREHOLDERS’ FUNDS

NO TES TO TH E FIN AN CIAL STATEM EN TS

66