Marks and Spencer 1998 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1998 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

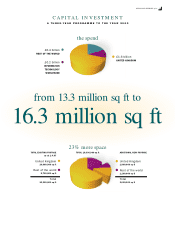

added more than 80,000 sq ft of selling space. There

was also substantial footage expansion in our

franchise businesses. In the coming year nearly half

a million square feet of retail selling space will be

added worldwide, including four new stores in

Germany and two in Spain.

Sales in our stores in H ong Kong were

severely affected by the economic situation, as were

those of all our franchise operations in the Far East.

While slowing down our investment plans, we

remain confident in the long-term future of the

region. Brooks Brothers, which already has 66

shops in Japan, opened two franchise stores in

Hong Kong in partnership with Dickson Concepts.

While trading conditions in N orth America

remained very competitive, Brooks Brothers (US)

produced further growth in sales and profits ahead

of the sector; Brooks Brothers (Japan) was affected

by the local economic situation. Kings Super

Markets recorded another year of sales progress,

although profits were affected by pre-opening and

other non-trading costs. In M arks & Spencer

Canada, our new chief executive officer is

implementing strategies to take the business

forward in this difficult market. We are

investigating the possibility of opening retail outlets

in Latin America.

The Group is investing heavily in the

infrastructure of the business. We are in the process

of rolling out a new generation of tills across the

chain at a cost of some £100 million. The new

equipment is quicker, quieter and easier to operate.

It will allow us to accept payment in a range of

currencies, including the euro. By the year 2000, we

will have replaced about 11,000 tills at the end of

their economic life, across our stores in the UK and

continental Europe. We have taken appropriate

steps to avoid the problems associated with the

so-called “ millennium bug” .

I would like to thank staff throughout the

Group for their enthusiasm and hard work during

the year. Their loyalty and commitment is our most

valuable asset. We encourage all members of the

company to develop as individuals to enable them,

1993 1994 1995 1996 1997 1998

5 YEAR GROWTH

£5,949.7m £6,543.7m £6,809.9m £7,233.7m £7,841.9m £8,243.3m

UP 39%

GROUP TURNOVER

1993 1994 1995 1996 1997 1998

5 YEAR GROWTH

£736.5m £851.5m £924.3m £965.8m £1,102.0m £1,168.0m

UP 59%

GROUP PROFIT BEFORE TAX

1993 1994 1995 1996 1997 1998

5 YEAR GROWTH

18.0p 20.9p 22.4p 23.3p 26.7p 29.1p

UP 62%

EARNINGS PER SHARE

1993 1994 1995 1996 1997 1998

5 YEAR GROWTH

8.1p 9.2p 10.3p 11.4p 13.0p 14.3p

UP 77%

DIVIDENDS PER SHARE

43 DEPARTMENTAL STORES

ALLOW US TO OFFER A MORE COMPLETE

SHOPPING SERVICE THAN EVER BEFORE

CHAIRMAN’S STATEMENT CONTINUED

4