Logitech 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For purposes of the Treaty and the Internal Revenue Code of 1986, as amended (the “Code”), United States

holders of ADSs are treated as the owners of the registered shares corresponding to such ADSs. Accordingly, the

Swiss tax consequences discussed below also generally apply to United States holders of registered shares.

Swiss Taxation

Gain on Sale

Under Swiss law, a holder of registered shares or ADSs who (i) is a non-resident of Switzerland, (ii) during the

taxable year has not engaged in a trade or business through a permanent establishment within Switzerland and (iii)

is not subject to taxation by Switzerland for any other reason, will be exempted from any Swiss federal, cantonal or

municipal income or other tax on gains realized during the year on the sale of registered shares or ADSs.

Stamp, Issue and Other Taxes

Switzerland generally does not impose stamp, registration or similar taxes on the sale of registered shares or

ADSs by a holder thereof unless such sale or transfer occurs through or with a Swiss securities dealer (as defined

in the Swiss Stamp Duty Law).

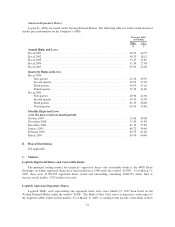

Withholding Tax

Under Swiss law, any dividends paid in respect of registered shares will be subject to the Swiss Anticipatory

Tax at the rate of 35%, and the Company will be required to withhold tax at this rate from any dividends paid to a

holder of registered shares. Such dividend payments may qualify for refund of the Swiss Anticipatory Tax by

reason of the provisions of a double tax treaty between Switzerland and the country of residence or incorporation

of a holder, and in such cases such holder will be entitled to claim a refund of all or a portion of such tax in

accordance with such treaty.

The Swiss-U.S. tax treaty provides for a mechanism whereby a United States resident or United States

corporations can generally seek a refund of the Swiss Anticipatory Tax paid on dividends in respect of registered

shares, to the extent such withholding exceeds 15%.

F. Dividends and Paying Agents

Not applicable.

G. Statement by Experts

Not applicable.

H. Documents on Display

Whenever a reference is made in this Form 20-F to any contract, agreement or other document, the reference

may not be complete and you should refer to the copy of that contract, agreement or other document filed as an

exhibit to one of our previous SEC filings. We file annual and special reports and other information with the

SEC. You may read and copy all or any portion of this Form 20-F and any other document we file with the SEC

at the SEC’s public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information about the public reference room. Such material may also be obtained at

the Internet site the SEC maintains at www.sec.gov.

I. Subsidiary Information

Not applicable.

57

CG

20-F

LISA