Logitech 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

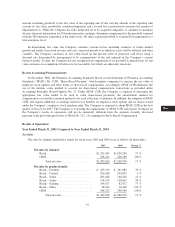

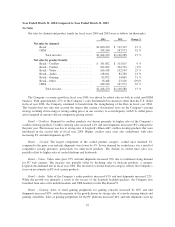

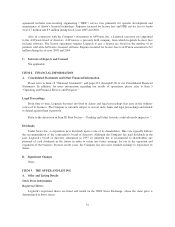

Year Ended March 31, 2004 Compared to Year Ended March 31, 2003

Net Sales

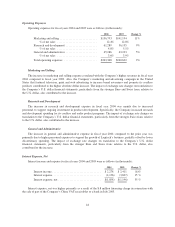

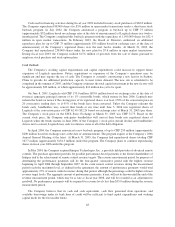

Net sales by channel and product family for fiscal years 2004 and 2003 were as follows (in thousands):

2004 2003 Change %

Net sales by channel:

Retail ................................ $1,020,290 $ 912,315 12 %

OEM ................................ 248,180 187,973 32 %

Total net sales ..................... $1,268,470 $1,100,288 15 %

Net sales by product family:

Retail – Cordless ....................... $ 341,082 $ 313,815 9 %

Retail – Corded ........................ 294,829 304,703 (3)%

Retail – Video ......................... 166,418 132,934 25 %

Retail – Audio ......................... 118,641 82,768 43 %

Retail – Gaming ....................... 82,872 54,869 51%

Retail – Other ......................... 16,448 23,226 (29)%

OEM ................................ 248,180 187,973 32 %

Total net sales ..................... $1,268,470 $1,100,288 15 %

The Company’s revenue growth in fiscal year 2004 was driven by robust sales in both its retail and OEM

business. With approximately 47% of the Company’s sales denominated in currencies other than the U.S. dollar

in fiscal year 2004, the Company continued to benefit from the strengthening of the Euro in fiscal year 2004.

This benefit does not take into account the impact that currency fluctuations have on the Company’s pricing

strategy resulting in lowering or raising selling prices in one currency to avoid disparity with U.S. dollar prices

and to respond to currency-driven competitive pricing actions.

Retail – Cordless. Demand for cordless products was driven primarily by higher sales of the Company’s

cordless desktop products. Cordless desktop sales increased 14% and unit shipments increased 18% compared to

the prior year. The increase was due to strong sales of Logitech’s Bluetooth®cordless desktop products that were

introduced in the second half of fiscal year 2004. Higher cordless mice sales also contributed, with sales

increasing 8% and unit shipments up 25%.

Retail – Corded. The largest component of the corded product category, corded mice declined 5%

compared to the prior year and unit shipments were lower by 4%. Lower demand for corded mice was a result of

competitive pricing pressures, particularly for entry-level products. The decline in corded mice sales was

partially offset by higher sales of corded desktops and keyboards.

Retail – Video. Video sales grew 25% and unit shipments increased 29% due to continued strong demand

for PC web cameras. The increase was partially offset by declining sales of dualcam products, a category

Logitech discontinued late in fiscal year 2004. The decision to exit the dualcam category reflects the Company’s

focus on investments in PC web camera products.

Retail – Audio. Sales of the Company’s audio products increased 43% and unit shipments increased 22%.

While the growth was primarily a result of the success of the Logitech branded speakers, the Company also

benefited from sales of its mobile headsets and USB headsets for the PlayStation®2.

Retail – Gaming. Sales of retail gaming peripherals for gaming consoles increased by 60% and unit

shipments increased 83%, with the majority of the growth driven by strong sales of console steering wheels and

gaming controllers. Sales of gaming peripherals for the PC platform increased 44% and unit shipments were up

42