Logitech 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

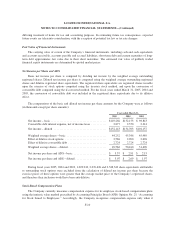

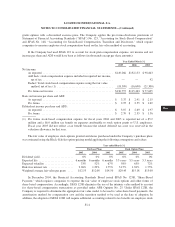

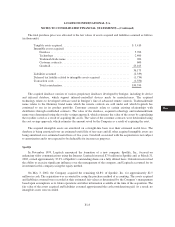

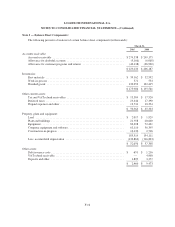

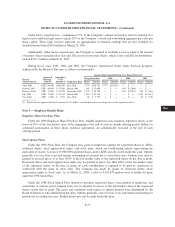

The total purchase price was allocated to the fair values of assets acquired and liabilities assumed as follows

(in thousands):

Tangible assets acquired ............................................... $ 3,410

Intangible assets acquired:

Database ....................................................... 5,700

Technology ..................................................... 2,400

Trademark/trade name ............................................ 900

Customer contracts ............................................... 600

Goodwill ....................................................... 23,163

36,173

Liabilities assumed ................................................... (2,339)

Deferred tax liability related to intangible assets acquired .................... (1,734)

Transaction costs .................................................... (1,550)

Total consideration ............................................... $30,550

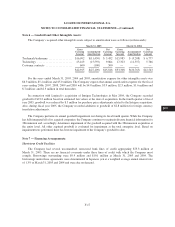

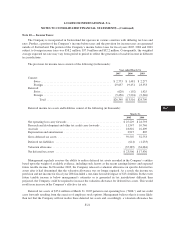

The acquired database consists of various proprietary databases developed by Intrigue, including its device

and infrared database, which support infrared-controlled devices made by manufacturers. The acquired

technology relates to developed software used in Intrigue’s line of advanced remote controls. Trademark/trade

name relates to the Harmony brand name which the remote controls are sold under and which Logitech has

continued to use in its product portfolio. Customer contracts relate to certain existing relationships with

distributors through established contracts. The value of the database, acquired technology and trademark/trade

name were determined using the royalty savings approach, which estimates the value of the assets by capitalizing

the royalties saved as a result of acquiring the assets. The value of the customer contracts were determined using

the cost savings approach, which estimates the amount saved by the Company as a result of acquiring the asset.

The acquired intangible assets are amortized on a straight-line basis over their estimated useful lives. The

database is being amortized over an estimated useful life of ten years and all other acquired intangible assets are

being amortized over estimated useful lives of five years. Goodwill associated with the acquisition is not subject

to amortization and is not expected to be deductible for income tax purposes.

Spotlife

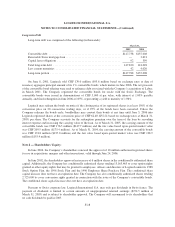

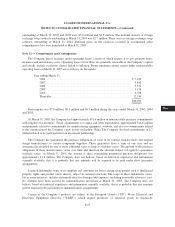

In November 1999, Logitech announced the formation of a new company, Spotlife, Inc., focused on

enhancing video communications using the Internet. Logitech invested $7.0 million in Spotlife and, at March 31,

2002, owned approximately 35.2% of Spotlife’s outstanding shares on a fully diluted basis. Outside investors had

the ability to exercise significant influence over the management of the company, and Logitech accounted for its

investment in this company using the equity method.

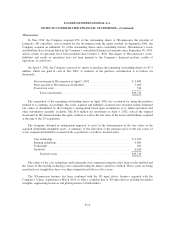

On May 3, 2002, the Company acquired the remaining 64.8% of Spotlife, Inc. for approximately $2.5

million in cash. The acquisition was accounted for using the purchase method of accounting. The assets acquired

and liabilities assumed were recorded at their estimated fair values as determined by the Company’s management

based upon assumptions as to future operations and other information available at the time of the acquisition. The

fair value of the assets acquired and liabilities assumed approximated the cash consideration paid. As a result, no

intangible assets were recorded.

F-13

CG

20-F

LISA