Logitech 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

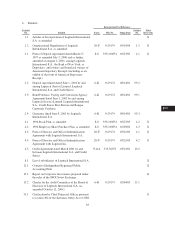

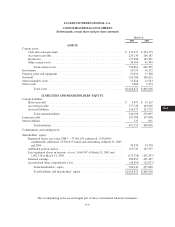

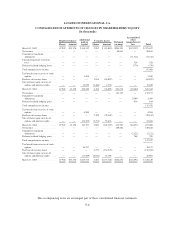

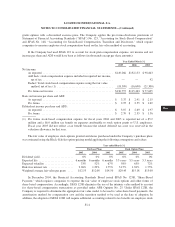

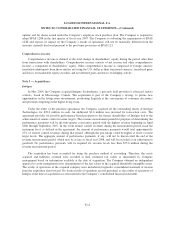

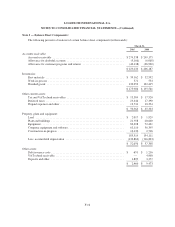

LOGITECH INTERNATIONAL S.A.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In thousands)

Registered shares Additional

paid-in

capital

Treasury shares Retained

earnings

Accumulated

other

comprehensive

loss TotalShares Amount Shares Amount

March 31, 2002 ................ 47,902 $33,370 $134,312 2,082 $ (15,819) $204,391 $(33,237) $ 323,017

Netincome .................... — — — — — 98,843 — 98,843

Cumulative translation

adjustment .................. — — — — — — (11,312) (11,312)

Unrealized gain net of income

taxes ....................... — — — — — — 328 328

Deferred realized hedging losses . . . — — — — — — (779) (779)

Totalcomprehensiveincome ...... 87,080

Tax benefit from exercise of stock

options ..................... — — 3,658 — — — — 3,658

Purchase of treasury shares ....... — — — 1,836 (63,822) — — (63,822)

Sale of shares upon exercise of

optionsandpurchaserights ..... — — 12,879 (1,464) 2,750 — — 15,629

March 31, 2003 ................ 47,902 33,370 150,849 2,454 (76,891) 303,234 (45,000) 365,562

Netincome .................... — — — — — 132,153 — 132,153

Cumulative translation

adjustment .................. — — — — — — 2,009 2,009

Deferred realized hedging gains .... — — — — — — 914 914

Totalcomprehensiveincome ...... 135,076

Tax benefit from exercise of stock

options ..................... — — 4,200 — — — — 4,200

Purchase of treasury shares ....... — — — 2,199 (79,162) — — (79,162)

Sale of shares upon exercise of

optionsandpurchaserights ..... — — (22,252) (1,751) 53,656 — — 31,404

March 31, 2004 ................ 47,902 33,370 132,797 2,902 (102,397) 435,387 (42,077) 457,080

Netincome .................... — — — — — 149,266 — 149,266

Cumulative translation

adjustment .................. — — — — — — (2,522) (2,522)

Deferred realized hedging gains .... — — — — — — 708 708

Totalcomprehensiveincome ...... 147,452

Tax benefit from exercise of stock

options ..................... — — 10,157 — — — — 10,157

Purchase of treasury shares ....... — — — 2,775 (134,525) — — (134,525)

Sale of shares upon exercise of

optionsandpurchaserights ..... — — (17,209) (2,016) 63,194 — — 45,985

March 31, 2005 ................ 47,902 $33,370 $125,745 3,661 $(173,728) $584,653 $(43,891) $ 526,149

The accompanying notes are an integral part of these consolidated financial statements.

F-6