Logitech 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company is through December 2007. Logitech also contracts with various distribution services throughout the

world for additional warehouses in which the Company stores inventory.

Logitech believes that the Company’s manufacturing and distribution facilities are adequate for its ongoing

needs and continues to evaluate the need for additional facilities to meet anticipated future requirements.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

This Annual Report on Form 20-F to shareholders contains forward-looking statements that involve risks

and uncertainties. The Company’s actual results could differ materially from those anticipated in these

statements as a result of certain factors, including those set forth above in Item 3D “Risk Factors,” and below in

Item 11 “Quantitative and Qualitative Disclosure about Market Risk.”

Overview

Logitech is a leading global technology company and earns revenues and profits from the sale of personal

peripherals that serve as the primary physical interface between people and their personal computers and other

digital platforms. The Company offers a broad range of products including cordless and corded input and

pointing devices such as mice, trackballs, and keyboards; interactive gaming devices for entertainment such as

joysticks, gamepads, and racing systems; web cameras; speakers, headsets and microphones; 3D controllers and

advanced remote controls. The Company sells its products through two primary channels, original equipment

manufacturers (“OEMs”) and a network of distributors and resellers (“retail”).

The Company’s markets are extremely competitive. Some of our competitors are well established with

substantial market share, others are less established and compete at lower price points. These markets are

characterized by aggressive pricing practices, rapidly changing technology and evolving customer demands.

Logitech has historically targeted peripherals for the PC platform. While the Company is focused on

strengthening its market leadership in the PC market, it has also expanded into peripherals for other platforms,

including video game consoles, mobile phones, home entertainment systems and most recently, mobile

entertainment systems.

Over the last few years, Logitech has laid a foundation for long-term growth, expanding and improving its

supply chain operations, investing in product development and marketing, delivering innovative new products

and pursuing new market opportunities beyond the PC platform. During this time, the Company has significantly

broadened its product offerings and the markets in which it sells them. Although most of this expansion has been

organic, the Company’s business has also grown as a result of a limited number of acquisitions that have

expanded the Company’s business into new product categories. Most recently, the Company expanded its

offerings to include advanced remote controls through its acquisition of Intrigue Technologies, Inc. in May 2004.

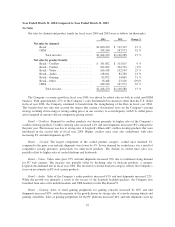

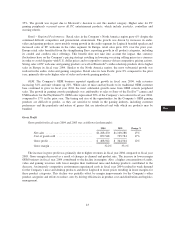

The Company has also continued to grow revenues and profits year over year. In fiscal year 2005, revenues grew

17% to $1.5 billion and net income increased 13% to $149.3 million. In fiscal year 2004, the Company reported

15% growth in revenues and 34% increase in net income over the prior year.

The Company’s focus in fiscal year 2006 is to continue building on this foundation. Logitech believes the

investments made in fiscal year 2005 will allow the Company to sustain strong growth in the new fiscal year and

beyond. The Company expects operating expense growth in fiscal year 2006 to occur at the same rate or at a

slower rate than the growth in gross profit. Logitech remains committed to investments in product research and

development and recognizes that such investments are critical to facilitating innovation of new and improved

products and technologies. Logitech believes that the market penetration for its products is particularly low in

developing markets such as Latin America, Eastern Europe and China. The Company intends to capitalize on

growth opportunities in these regions, by securing new channel partners, strengthening relationships with

existing partners, and investing in product and marketing initiatives. Further, Logitech is making investments to

upgrade business applications and information technology. These investments are focused on positioning

33

CG

20-F

LISA