Logitech 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A.

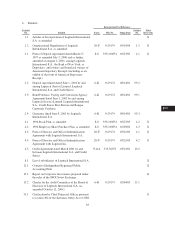

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

• delivery has occurred and title and risk of loss transfer to the customer;

• the price of the product is fixed or determinable; and

• collectibility of the receivable is reasonably assured.

Revenues from sales to distributors and authorized resellers are subject to terms allowing price protection,

certain rights of return and allowances for customer marketing programs. Reserves for price protection are

recorded when the price protection program is approved. Estimated future returns and customer marketing

programs are provided for upon revenue recognition. Future returns are estimated, and periodically adjusted,

based on historical and anticipated rates of returns, distributor inventory levels and other factors, and recorded as

a reduction of revenue. The costs of customer marketing programs are contractual in nature and are estimated and

periodically adjusted based on levels of customer product purchases.

Advertising Costs

Advertising costs are expensed as incurred and amounted to $125.1 million, $82.1 million and $76.9 million

in fiscal years 2005, 2004 and 2003. Advertising costs are recorded as either a marketing and selling expense or a

deduction from revenue. Advertising costs reimbursed by the Company to a customer must have an identifiable

benefit and an estimable fair value in order to be classified as an operating expense. If these criteria are not met,

the cost is classified as a deduction from revenue.

Cash Equivalents

The Company considers all highly liquid instruments purchased with an original maturity of three months or

less to be cash equivalents.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist

principally of cash and cash equivalents and accounts receivable. The Company maintains cash and cash

equivalents with various financial institutions to limit exposure with any one financial institution.

The Company sells to large OEMs, distributors and high volume resellers and, as a result, maintains

individually significant receivable balances with such customers. As of March 31, 2005, three customers

represented 14%, 12% and 11% of total accounts receivable. As of March 31, 2004, one customer represented

16% and another customer represented 11% of total accounts receivable. The Company’s OEM customers tend

to be well-capitalized, multi-national companies, while retail customers may be less well-capitalized. The

Company manages its accounts receivable credit risk through ongoing credit evaluation of its customers’

financial condition and by purchasing credit insurance on U.S. and European retail accounts receivable. The

Company generally does not require collateral from its customers.

Accounts Receivable

Accounts receivable are reported net of allowances for doubtful accounts. The allowances are based on the

Company’s regular assessment of the credit worthiness and financial condition of specific customers, as well as

its historical experience with bad debts, receivables aging, current economic trends and the financial condition of

its distribution channels.

F-8