Logitech 2005 Annual Report Download - page 86

Download and view the complete annual report

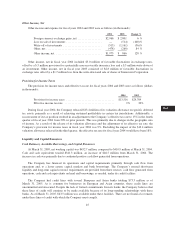

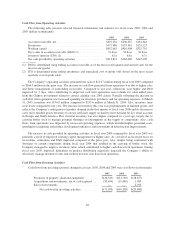

Please find page 86 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash used in financing activities during fiscal year 2003 included treasury stock purchases of $63.8 million.

The Company repurchased 88,000 shares for $3.8 million in open market transactions under a short-term stock

buyback program. In July 2002, the Company announced a program to buyback up to CHF 75 million

(approximately $52 million based on exchange rates at the date of announcement) of Logitech shares in a twelve-

month period. The Company completed this buyback program with the repurchase of 1,509,000 shares for $52.4

million in open market transactions. In February 2003, the Board of Directors authorized an additional

repurchase plan for up to CHF 75 million (approximately $55 million based on exchange rates at the date of

announcement) of the Company’s registered shares over the next twelve months. At March 31, 2003, the

Company had repurchased 238,000 shares under the new plan for $7.6 million in open market transactions.

During fiscal year 2003, the Company realized $15.6 million of proceeds from the sale of shares pursuant to

employee stock purchase and stock option plans.

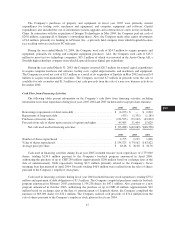

Cash Outlook

The Company’s working capital requirements and capital expenditures could increase to support future

expansion of Logitech operations. Future acquisitions or expansion of the Company’s operations may be

significant and may require the use of cash. The Company is currently constructing a new factory in Suzhou,

China to provide for additional production capacity to meet future demand. The new site is scheduled to be

completed in the summer of 2005, and the Company estimates the total capital investment in the new factory will

be approximately $20 million, of which approximately $10 million has yet to be spent.

On June 8, 2001, Logitech sold CHF 170.0 million ($95.6 million based on exchange rates at the date of

issuance) aggregate principal amount of its 1% convertible bonds, which mature in June 2006. Logitech may

redeem the bonds on notice if the closing price of its registered shares is at least 150% of the conversion price on

20 consecutive trading days, or if 95% of the bonds have been converted. Unless the Company redeems the

bonds early, bondholders may convert their bonds at any time until June 5, 2006 into registered shares of

Logitech at the conversion price of CHF 62.40 ($52.24 based on exchange rates at March 31, 2005) per share.

The Company’s stock price on the SWX Swiss Exchange at March 31, 2005 was CHF 72.75. Based on the

current stock price, the Company anticipates bondholders will convert their bonds into registered shares of

Logitech when the bonds mature in June 2006. If the Company’s stock price should decline and bondholders

choose not to convert, Logitech may seek to refinance some or all of the debt obligation.

In April 2004, the Company announced a new buyback program of up to CHF 250 million (approximately

$200 million based on exchange rates at the date of announcement). The program expires at the Company’s 2006

Annual General Meeting at the latest. At March 31, 2005, the Company had repurchased shares totaling CHF

167.7 million (approximately $134.5 million) under this program. The Company plans to continue repurchasing

shares in fiscal year 2006 under this program.

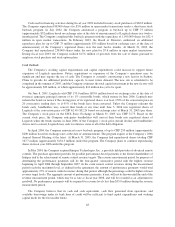

In May 2004, the Company acquired Intrigue Technologies, Inc., a privately held provider of advanced remote

controls. The purchase agreement provides for possible performance-based payments to the former shareholders of

Intrigue tied to the achievement of remote control revenue targets. The revenue measurement period for purposes of

determining the performance payments will be the four-quarter consecutive period with the highest revenue

beginning in April 2006 through September 2007. In the event remote control revenues during the measurement

period reach the maximum level, as defined in the agreement, the amount of performance payments would total

approximately 27% of remote control revenues during that period, although the percentage could be higher at lower

revenue target levels. The aggregate amount of performance payments, if any, will not be known until the end of the

revenue measurement period, which may be as late as fiscal year 2008, and will be recorded as an adjustment to

goodwill. No performance payments will be required for revenue levels less than $55.0 million during the revenue

measurement period.

The Company believes that its cash and cash equivalents, cash flow generated from operations, and

available borrowings under its bank lines of credit will be sufficient to fund capital expenditures and working

capital needs for the foreseeable future.

48